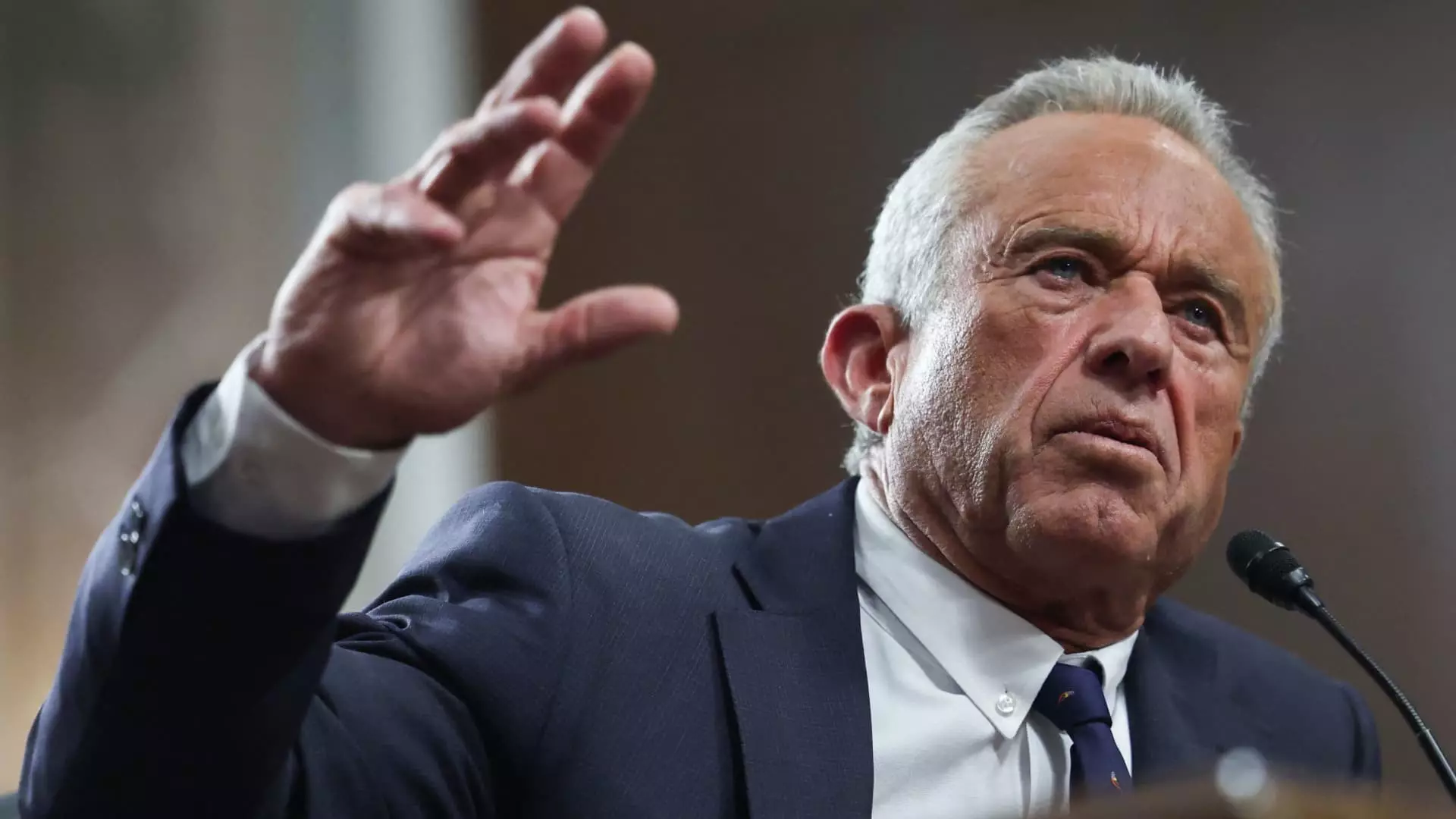

In 2024, Americans faced an unprecedented challenge as credit card balances surged to an alarming $1.17 trillion. This shocking figure sheds light on a broader financial trend affecting a wide demographic, including those traditionally perceived as financially secure. The case of Robert F. Kennedy, Jr.—high-profile nominee for health and human services under the Trump administration—has illuminated how even the affluent are not exempt from the pitfalls of credit card debt. Recent financial disclosures indicate that he holds between $610,000 and $1.2 million in credit card debt, with steep interest rates ranging from 23.24% to 23.49%. This revelation has raised eyebrows among financial experts and consumers alike.

Experts assert that the levels of debt observed in Kennedy’s case are not simply the result of reckless spending but a symptom of a more extensive economic issue exacerbated by inflation. As Matt Schulz, chief credit analyst at LendingTree, aptly puts it, many Americans now see credit cards as a go-to emergency fund amid rising prices and decreasing financial flexibility. In economic scenarios where financial wiggle room tightens, consumers may heavily rely on credit to cope with daily expenses and unexpected emergencies, a trend that is troubling.

Credit card debt at this scale is not only cumbersome but also financially devastating. Financial analysts emphasize the importance of repaying these high-interest loans promptly to avoid astronomical interest payments. For instance, if Kennedy were to allocate $50,000 monthly toward a debt of $610,000, he would take roughly 15 months to clear it, accruing around $93,000 in interest. Conversely, tackling the upper limit of his debt would take over two years and incur an eye-watering $434,000 in interest. Such calculations starkly illustrate the real costs of carrying high balances.

This situation presents an essential lesson for all consumers—regardless of their income level. The average credit card debt per borrower reached $6,380 in late 2024, a considerable figure that coupled with a rising average interest rate of 20.13%, highlights the urgency for effective debt management strategies. Experts recommend that individuals prioritize paying down high-interest debts over other financial commitments, like investing. Ted Rossman of Bankrate highlights that paying down credit card debt is effectively a guaranteed return on investment, especially when interest rates soar.

Moreover, the average unsecured debt—excluding fixed assets like homes or cars—rose significantly, reaching $29,364 in early 2024. Such figures further signify a trend where consumers are increasingly accumulating debt, propelled by life circumstances and economic pressures that leave little alternative but to rely on credit.

Interestingly, data suggests that higher-income individuals are just as susceptible to prolonged debt as their lower-income counterparts. Research indicates that nearly 59% of borrowers earning over $100,000 have been in credit card debt for at least one year, with significant portions struggling for much longer. This surprising trend demonstrates how ease of access to higher credit limits can lead individuals, irrespective of income, into precarious financial situations.

For many affluent consumers, the allure of premium credit cards often adds complexity to their financial decisions. Cards like the American Express Centurion require hefty fees but promise stylish perks like exclusive dining reservations and premium travel privileges. Yet, financial experts argue that credit may not always be the best borrowing method for wealthier individuals, who might find other avenues to finance large purchases, such as lines of credit that do not demand ongoing fees but still offer financial flexibility when significant costs arise.

The landscape of America’s credit card debt underscores the immediate need for increased financial literacy. As evident in the circumstances surrounding high earners and their struggles, many consumers mismanage their resources and take on more debt than they can reasonably handle. Preventative education surrounding debt, spending habits, and the ramifications of interest rates could empower consumers to make wiser financial choices.

As this issue continues to escalate, it is imperative for financial institutions, policymakers, and advisors to foster dialogue aimed at improving the understanding of credit as a tool rather than a crutch. Raising awareness around responsible financial practices could ultimately transform the prevailing debt culture and pave the way for a healthier economic future for all.

With rising inflation and a volatile economic environment, maintaining a proactive approach to debt management is essential. Whether wealthy or not, Americans must prioritize a financial strategy that curbs credit card reliance and promotes long-term financial stability.