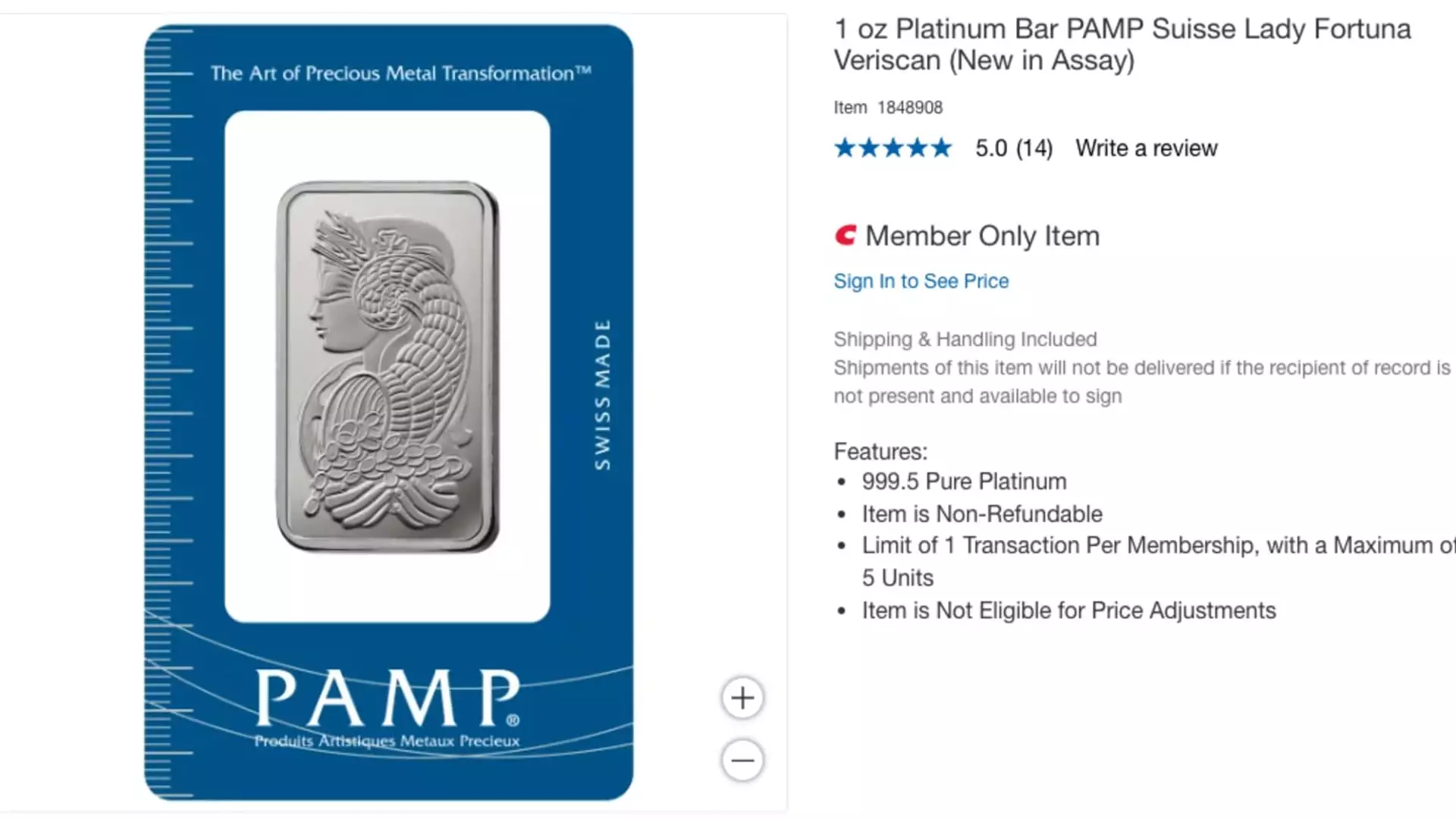

Costco, the popular membership-based wholesaler, is strategically increasing its presence in the lucrative precious metals sector. Recently announced additions include Swiss-made 1-ounce platinum bars, now available for $1,089.99 on their website. This latest move comes on the heels of their previous success with gold bars and silver coins, indicating Costco’s commitment to diversifying its product offerings in high-value markets. However, it’s essential to recognize that these platinum bars are not available for delivery to consumers in certain regions, including Louisiana, Nevada, and Puerto Rico, which could limit their market reach.

To purchase these platinum bars, customers must hold a valid Costco membership, which ranges in cost from $65 to $130 annually. For many, this membership represents a commitment to quality shopping and bulk purchasing, yet for others, it may serve as a potential barrier to entry. The necessity of a membership could encourage some individuals to invest more cautiously, while others might view it as an opportunity to gain access to exclusive products. Costco’s strategy hinges on fostering a sense of belonging and loyalty among its members, which may ultimately strengthen the company’s position in the precious metals market.

The interest in precious metals has boomed since Costco debuted its gold bars in August 2023. Reports indicated that stock would vanish within hours of being listed online—a testament to the rising demand for tangible assets amid economic uncertainty. Analysts have estimated that Costco has been moving approximately $200 million worth of gold bars each month, which not only underscores consumer confidence in precious metals but also highlights the company’s adeptness at recognizing and capitalizing on trending investment opportunities.

Richard Galanti, the former chief financial officer of Costco, noted the rapid turnover of their gold bars, signaling a robust interest in collectible and investment-grade items. This swift sell-out trend provides insight into broader consumer behavior, with individuals increasingly viewing precious metals as a hedge against inflation and market instability.

While gold has shown remarkable growth—soaring over 40% within the last year—platinum presents a more complex picture. Over the last 12 months, platinum has seen a modest increase of approximately 15%. However, following a peak earlier in 2024 at over $1,100, its value has declined by more than 8%. This volatility presents challenges and opportunities for investors looking to diversify their portfolios. Costco’s foray into platinum may attract seasoned investors who recognize its potential merits and risks, offering a new avenue for engagement within the wholesale setting.

Costco’s entrance into the precious metals market reflects a calculated response to evolving consumer preferences and economic trends. By offering both gold and platinum, the company positions itself as more than just a wholesaler of everyday goods; it becomes a critical player in the investment landscape. As consumers increasingly seek safe havens for their wealth, Costco’s strategy may well set a new standard in retail investment, making precious metals more accessible to the average investor while enhancing the brand’s overall value proposition.