MongoDB has recently announced impressive fiscal second-quarter earnings, causing a significant increase in their share value. The company exceeded LSEG consensus expectations in both earnings per share and revenue. With earnings per share coming in at 70 cents adjusted versus the expected 49 cents, and revenue totaling $478.1 million compared to the anticipated $464.1 million, MongoDB demonstrated strong performance in the market. The company reported a 13% year-over-year revenue growth in the quarter ended July 31, with a net loss of $54.5 million or 74 cents per share, an increase from $37.6 million or 53 cents per share from the same period a year ago.

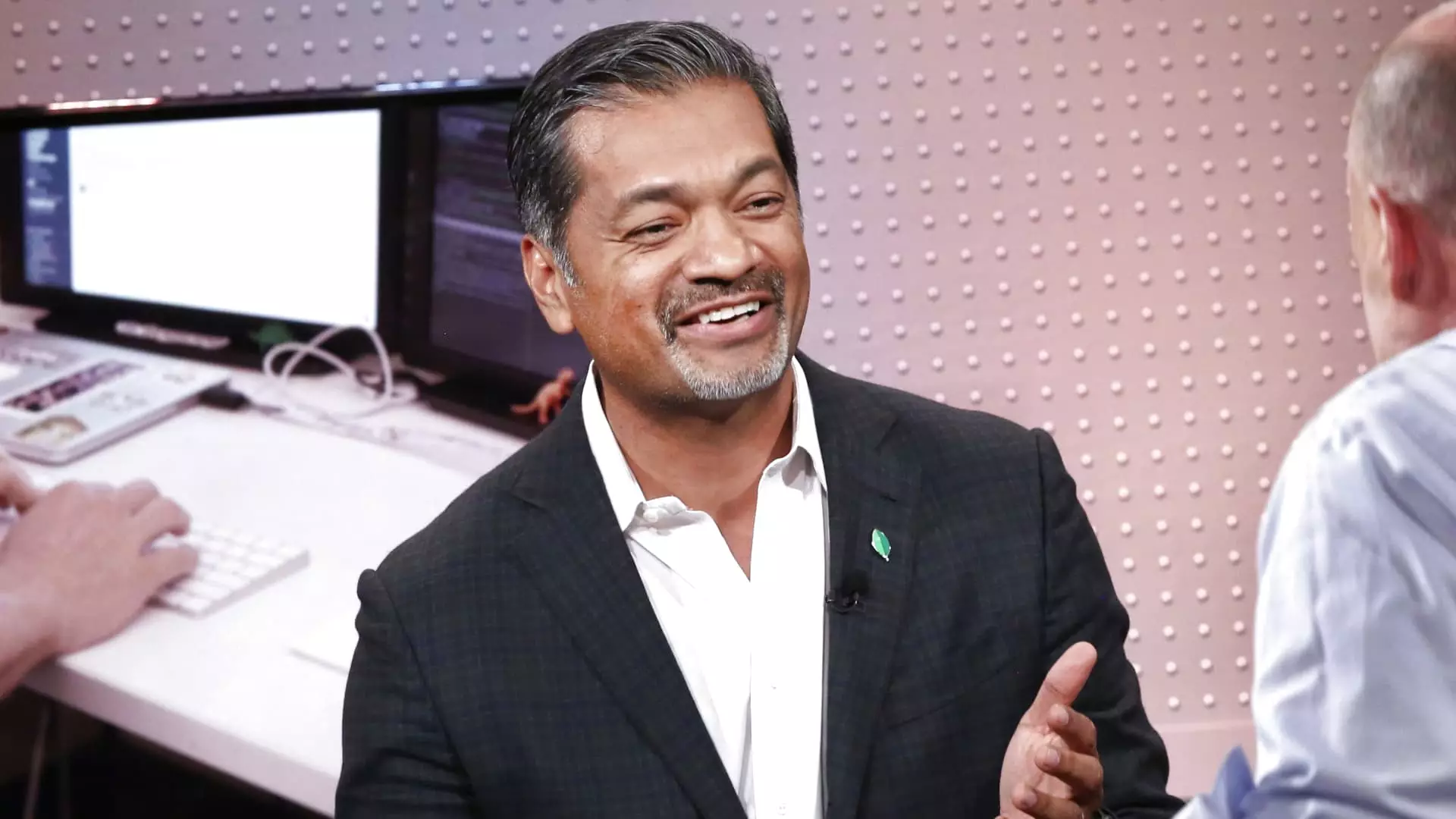

CEO Dev Ittycheria expressed confidence in MongoDB’s position to assist customers in integrating generative AI into their operations and modernizing their legacy application architecture. He highlighted the success of the company’s Atlas cloud database service, which exceeded consumption expectations. Ittycheria also addressed concerns regarding the impact of economic conditions on client consumption growth, stating that MongoDB continued to secure new business without significant hindrance from the macro environment. This resilience to external factors sets MongoDB apart from other software vendors, as noted by Ittycheria.

The contrasting fortunes of MongoDB and Elastic, a search software maker, were evident during their respective fiscal calls. While MongoDB reported positive growth and outlook, Elastic experienced a decline in client commitments, leading to a downturn in its stock value. Ittycheria discussed the opportunity to assist companies in migrating from Elastic products, underscoring MongoDB’s competitive advantage in the market.

Looking ahead, MongoDB provided an optimistic guidance for the fiscal third quarter, with adjusted earnings expected to range between 65 to 68 cents per share and revenue projected to be $493.0 million to $497.0 million. The company also revised its fiscal 2025 forecast, anticipating adjusted earnings of $2.33 to $2.47 per share and revenue of $1.92 billion to $1.93 billion. These projections represent a significant increase from previous estimates and demonstrate MongoDB’s confidence in future growth prospects.

MongoDB’s recent financial performance and forward-looking statements paint a promising picture for the company’s growth trajectory. Despite challenges in the market, MongoDB’s ability to adapt to changing conditions and capitalize on emerging trends positions it as a key player in the database software industry. Investors and analysts will be closely monitoring MongoDB’s progress as it continues to navigate the evolving landscape of technology and innovation.