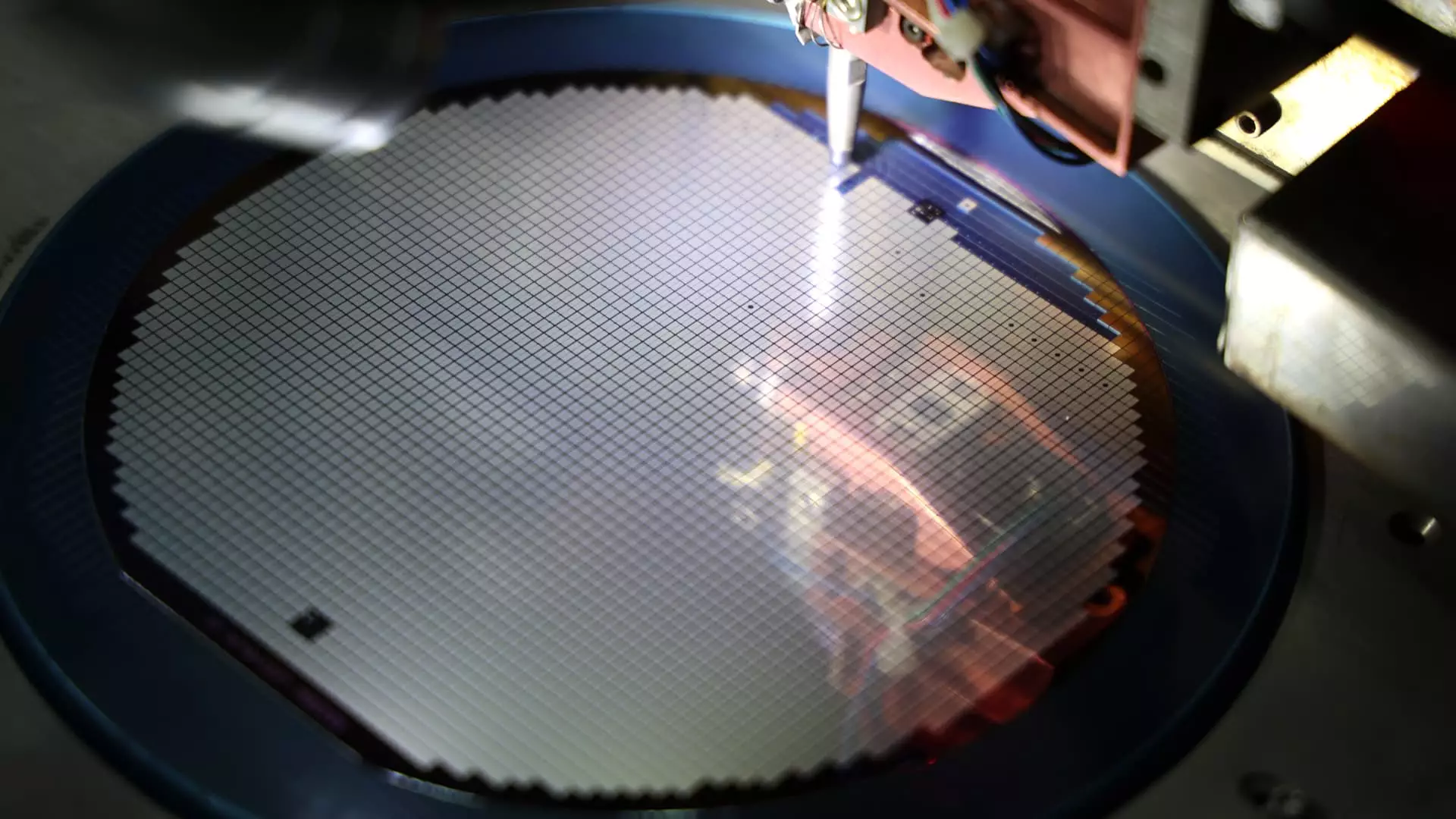

In a recent report by Bank of America analysts, it was revealed that four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue since late 2022. This surge in revenue is attributed to China’s accelerated purchase of semiconductor manufacturing equipment following the U.S.’s tighter export restrictions imposed in October 2022.

The report highlighted that the companies’ China revenue more than doubled from 17% of their total revenue in the fourth quarter of 2022 to 41% in the first quarter of 2024. With technology, especially semiconductor manufacturing, being at the forefront of trade tensions between the U.S. and China, there is a heightened risk of further escalation in tensions affecting the industry.

The U.S. initiated sweeping export controls on sales of advanced semiconductors and related manufacturing equipment to China in October 2022, leading to a shift in market dynamics. Recent reports have indicated that the Biden administration is considering broader restrictions on semiconductor equipment exports to China, which could have implications for non-U.S. companies operating in the sector.

On a parallel front, Beijing has been actively pursuing initiatives to enhance its technological self-sufficiency, as evidenced by the reaffirmation of this goal at a key policy meeting. This push towards self-reliance is driving China to invest heavily in semiconductor manufacturing capabilities, thus contributing to the increased revenue of global semiconductor equipment manufacturers in the region.

Despite the ongoing trade tensions and regulatory developments, the VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, the market has remained relatively resilient. While the ETF has experienced fluctuations in the past week, it has still retained gains of nearly 46% for the year so far, indicating strong investor confidence in the semiconductor industry’s growth prospects.

The rise of China’s semiconductor equipment revenue reflects the evolving dynamics of the global semiconductor market, driven by geopolitical factors, regulatory changes, and strategic initiatives by key players. As the industry continues to navigate through uncertain waters, stakeholders need to closely monitor developments and adapt their strategies to capitalize on emerging opportunities.