As we embark on a new trading year, the financial landscape is alive with fervor reminiscent of previous speculative booms. The first trading session of 2025 has unveiled soaring prices for cryptocurrency-linked stocks, notable market movements influenced by online personalities, and renewed interest in diverse sectors. This article delves into the intricate dynamics driving this dramatic upturn in the financial markets, creating an intriguing picture of investor sentiment and potential future trends.

One of the most striking aspects of the market’s recent activity is the resurgence of cryptocurrencies, with Bitcoin reclaiming the $96,000 mark, stirring excitement among investors. Companies like Microstrategy, which has capitalized on Bitcoin’s ascent, witnessed a staggering price increase of over 360% throughout 2024, culminating in a 3% increase on the first trading day of the year. This rekindling of interest in crypto stocks has positively influenced exchanges and associated firms, such as Coinbase and Robinhood, illustrating the interconnected nature of modern financial ecosystems.

Moreover, the emergence of lesser-known tokens, such as the quirky “fartcoin,” which recently experienced a breathtaking 45% spike to achieve a market valuation of $1.38 billion, showcases the unpredictable and often whimsical nature of the current meme-influenced trading environment. This phenomenon not only amplifies speculation but also reflects wider cultural trends that capture the collective imagination of traders.

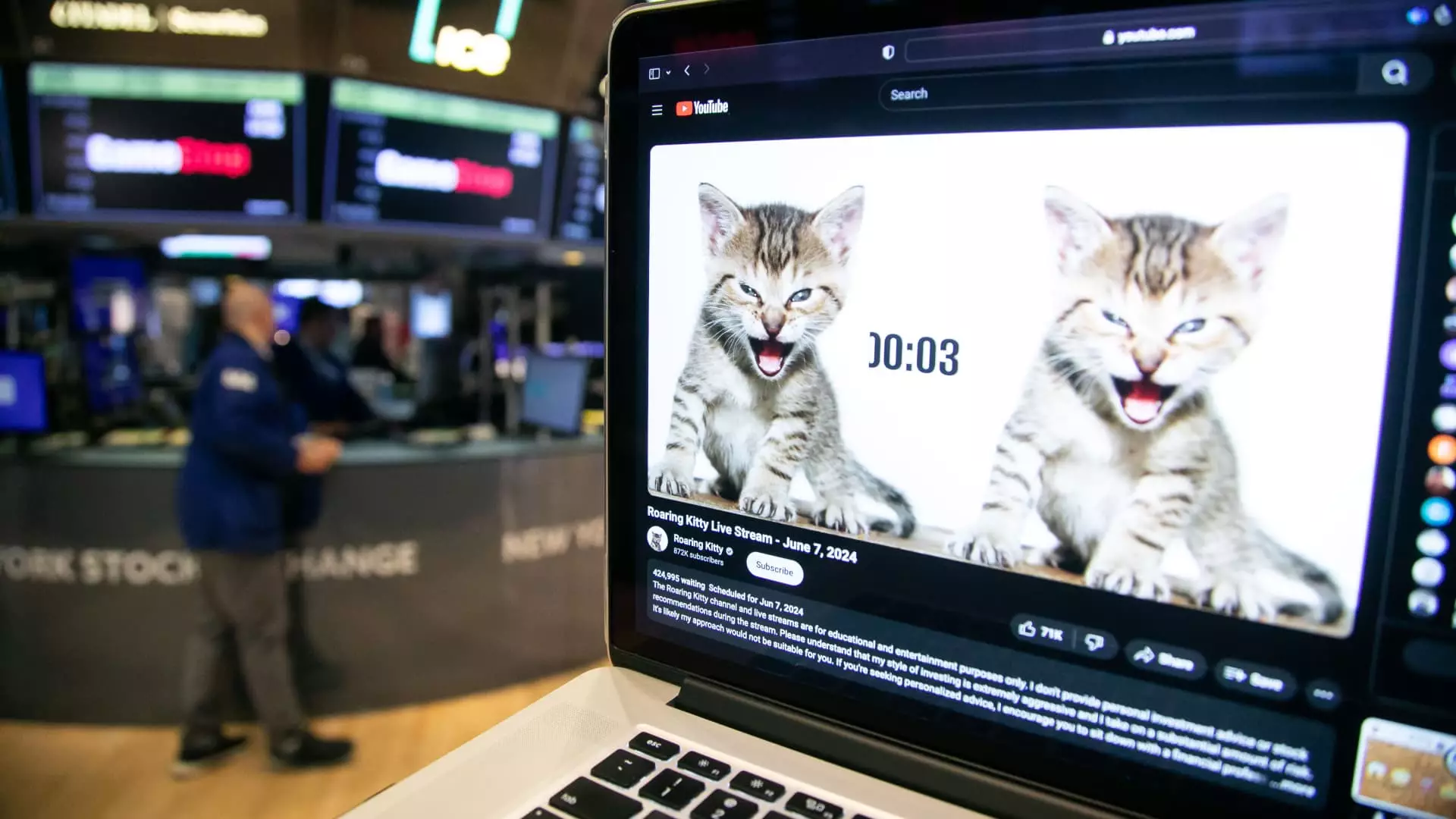

In what might be considered the age of digital influence, social media platforms continue to shape trading dynamics significantly. Notably, the notorious figure “Roaring Kitty,” also known as Keith Gill, has already made waves in the market this year with an enigmatic post referencing Rick James. The implications of such communications can send shockwaves through trading volumes, prompting retail investors to react en masse. Stocks related to his past favorites, such as Unity Software and GameStop, notably surged, illustrating the potent intersection of social influence and market speculation.

This social media impact echoes past trends, where the whims of digital communities have steered the trajectory of otherwise stable stocks. The environment today suggests an increasing reliance on these informal communication channels, where speculation can flourish without the constraints of traditional financial analysis.

While cryptocurrencies and meme stocks grab headlines, sectors such as semiconductors remain pivotal in propelling market gains. Companies like Broadcom and Nvidia have consistently demonstrated resilience, underscoring the importance of technology in today’s economy. With the artificial intelligence sector experiencing a slight deceleration towards the end of last year, the semiconductor industry continues to thrive, highlighting the crucial role of technological advancement in market stability and growth.

Additionally, other sectors are not to be dismissed, as demonstrated by Topgolf Callaway Brands experiencing an 8.5% hike following an investment bank’s upgrade. Such movements highlight how perceptions of value can shift quickly in the stock market, particularly when investors feel certain stocks are undervalued or poised for growth based on broader economic indicators.

As market participants navigate this landscape of heightened speculation, the broader economic implications of recent trends cannot be overlooked. The shift in focus toward financial deregulation reinforces the optimism among many investors regarding potential growth. Chief Investment Officer Lisa Shalett of Morgan Stanley highlights the notion that an incoming administration’s push for deregulation may stimulate what she calls “animal spirits,” potentially propelling various sectors forward.

However, it is crucial to remain vigilant as speculation alone does not guarantee lasting growth. As investors are reminded of previous cycles of exuberance, caution may play a role in moderating expectations. The interplay of regulatory policies, inflationary risks, and global supply chain disruptions will undoubtedly influence market movements in the coming months.

The dawn of 2025 signifies a fascinating chapter in trading history, driven by a complex tapestry of cryptocurrencies, social media influence, sector performance, and speculative practices. As participants in this market, understanding these dynamics will be essential for navigating the uncertainties ahead, arguably making 2025 a year ripe with opportunities and challenges alike.