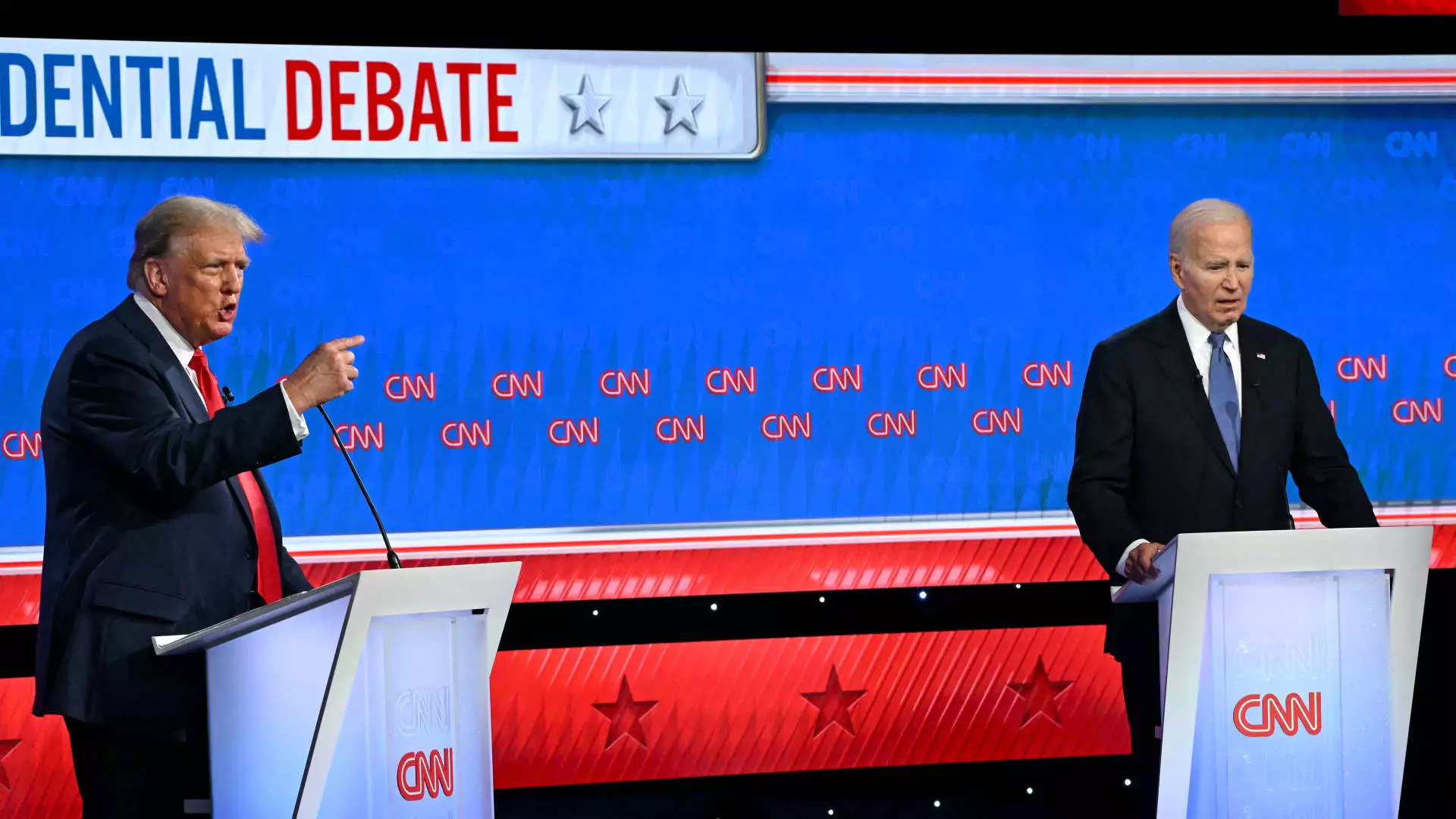

With the upcoming presidential election between President Joe Biden and former President Donald Trump, many investors are feeling nervous about what the outcome could mean for their money. A survey conducted by investment company Betterment found that 57% of investors are feeling anxious about the election, with 40% expecting to change their investments based on the outcome. This anxiety is prevalent across all demographic cohorts, including Generation Z, millennials, Generation X, and baby boomers.

Financial experts, however, advise against making investment decisions based on political reasons as markets tend to react to economic factors that politicians have no control over. Despite the contentious nature of election years, experts recommend maintaining a diversified portfolio and focusing on saving more rather than making decisions based on political outcomes.

Certified financial planner Cathy Curtis emphasized that the economy continues to thrive regardless of whether a Democrat or Republican is in office. She cautions against placing big bets against one candidate over another as it is not a sound investment strategy. Curtis notes that the market has been stable, with the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average continuously breaking records in 2024. Clients have expressed confidence in the overall market this year, indicating a positive outlook despite political uncertainties.

Clients visiting financial advisors have expressed concerns about the potential outcome of the election, particularly the idea of Trump winning. This anxiety is attributed to a rise in polarization among the population. However, experts like Cathy Curtis encourage clients not to make rash decisions with their investments in response to these feelings. By presenting clients with facts and encouraging informed decision-making, Curtis has been able to calm anxious investors.

Dan Egan, vice president of behavioral finance and investing at Betterment, has observed a trend of investors blending their political opinions with their portfolios. Investors are increasingly altering their investments based on their beliefs about how the winning candidate will impact the economy or stock market. Despite this shift in investor behavior, historical data shows that presidential elections have not significantly impacted the stock market.

An analysis conducted by J.P. Morgan Private Bank dating back to 1928 revealed that the S&P 500 has returned an average of 7.5% in presidential election years, compared to 8% in nonelection years on average. Egan emphasizes that regardless of the political party in power, the stock market tends to perform well on average. The checks and balances in place, such as the Federal Reserve, prevent drastic impacts on the economy based on presidential policies.

When considering the potential impact of the election on their portfolios, 29% of investors surveyed by Betterment indicated that they planned to increase holdings in savings accounts. This strategy can be beneficial given the current high rates on savings accounts and other low-risk investments. However, experts caution against keeping too much cash on the sidelines and out of the market.

Financial advisors like Cathy Curtis recommend holding larger cash reserves to take advantage of favorable rates but also stress the importance of staying invested in the market. By striking a balance between cash reserves and market investments, investors can mitigate risks and capitalize on potential opportunities.

While the upcoming presidential election may provoke anxiety among investors, it is essential to base investment decisions on economic factors rather than political outcomes. By maintaining a diversified portfolio, saving more, and staying informed, investors can navigate the uncertainties surrounding the election with confidence and make sound financial decisions.