In the competitive landscape of digital advertising and online gaming, few stories shine as brightly as that of AppLovin, a company experiencing meteoric growth. After posting significant earnings that exceeded market expectations, AppLovin’s stock surged a remarkable 45% in one day, elevating its market valuation to over $80 billion. With a staggering 515% increase this year alone, AppLovin outperforms even the most established tech rivals, setting a high bar for the industry.

Outstanding Financial Performance

AppLovin’s third-quarter results reveal a striking 39% increase in revenue, reaching $1.2 billion—easily surpassing the anticipated $1.13 billion. This growth trend isn’t just limited to revenue; the company reported earnings per share of $1.25, far above the consensus estimate of 92 cents. Predictions for the fourth quarter are equally bright, with revenue projections between $1.24 billion and $1.26 billion, indicating a continued upward trajectory. The company’s ability to outperform even optimistic estimates reflects not only robust demand for its products but also an effective strategy that capitalizes on emerging technologies.

A significant driver behind AppLovin’s success is its advanced AI-driven advertising platform, AXON. With improvements introduced in the 2.0 version released last year, the platform allows for precise ad targeting, optimized specifically for mobile gaming applications. This leap in technology has incrementally bolstered revenues from their software platform, achieving an impressive 66% increase to $835 million this past quarter. Given the accelerating convergence of AI technologies with advertising, it is clear that AppLovin is positioning itself firmly at the forefront of this dynamic sector.

Beyond revenue growth, AppLovin’s profitability has captured market attention. The company reported net income soaring 300% to $434.4 million or $1.25 a share, showcasing its robust EBITDA conversion rates. This profitability is crucial as it solidifies investor confidence and supports the upward momentum of its stock. Analysts from Wedbush noted AppLovin’s exceptional revenue growth and recommended its stock while increasing their target price from $170 to $270—an indication of strong market sentiment.

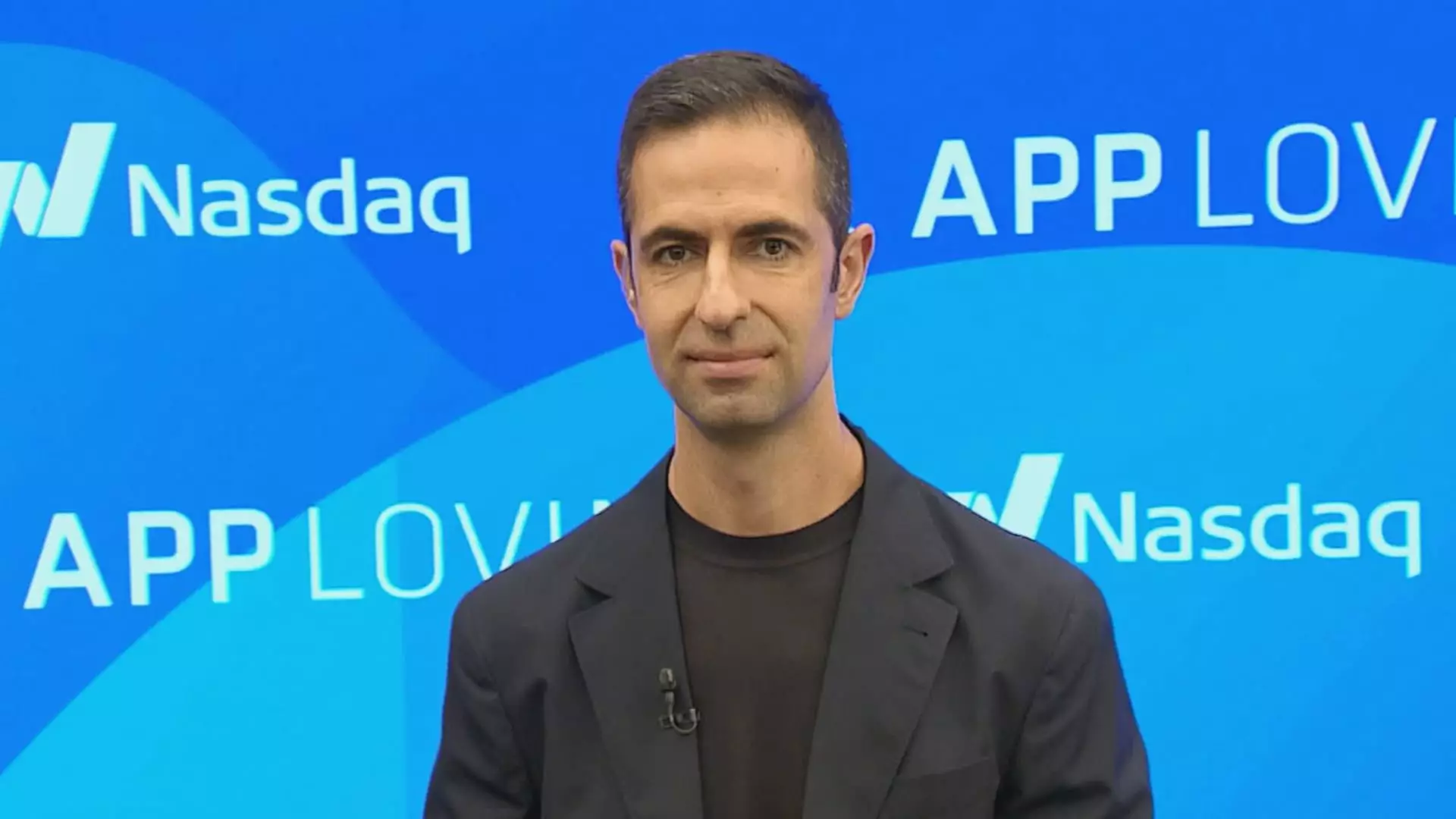

CEO Adam Foroughi also shed light on AppLovin’s pilot e-commerce project during an earnings call. Allowing businesses to utilize targeted ads within games, this initiative highlights an innovative expansion strategy that could further enhance revenue streams. Foroughi’s enthusiasm for this product underscores its potential to redefine blended advertising in gaming, serving as an additional catalyst for growth.

As AppLovin navigates an evolving market characterized by rapid technological advancements and changing consumer behaviors, its successful melding of gaming and advertising positions it uniquely for sustained growth. The string of promising financial results and the strategic direction underpinned by AI-enhanced functionalities place AppLovin as a formidable player in the tech arena. Investors and analysts alike will be closely monitoring AppLovin’s advancements in the coming quarters, as the company works to maintain its upward momentum and define the future of digital advertising.