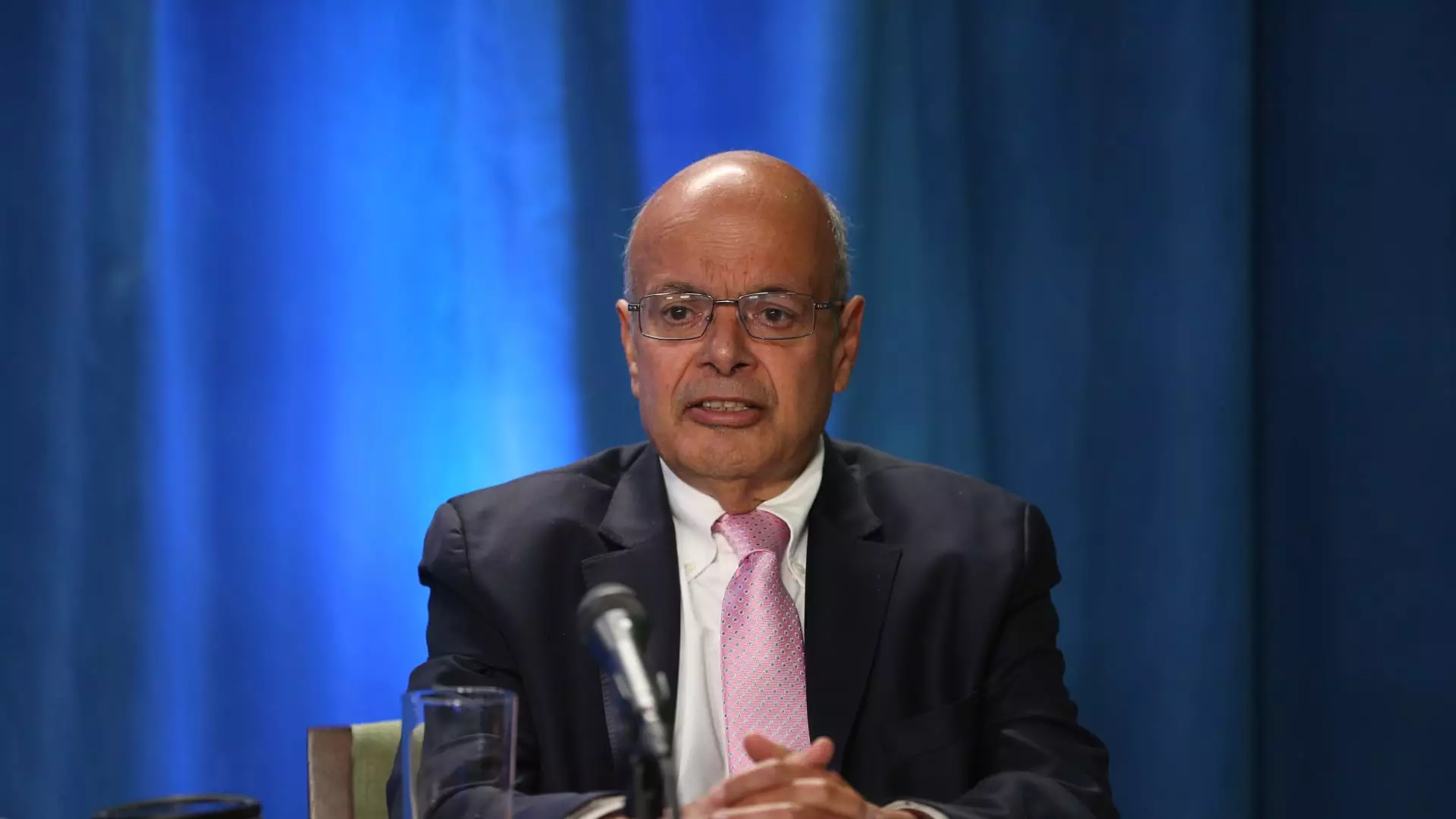

In a surprising turn of events, Ajit Jain, the esteemed vice chairman of Berkshire Hathaway’s insurance operations, sold a significant portion of his shares in the conglomerate. A regulatory filing unveiled that Jain divested about 55% of his total stake, equating to 200 Class A shares, for a whopping $139 million. This sale marks a pivotal moment in Jain’s relationship with Berkshire, particularly noteworthy as he has been a key figure in the organization since 1986. His decision sparks curiosity and speculation regarding the underlying motivations, especially given the current state of the market and Berkshire Hathaway’s recent performance.

Jain’s sale of his Class A shares came at an average price of $695,418 each, with the transaction occurring right when Berkshire’s stock price had recently seen a substantial increase, surpassing $700,000 per share. Such strategic timing prompts analysts to consider whether Jain perceives the stock as overvalued at this stage. Financial experts like David Kass, a finance professor, interpret Jain’s move as a possible indication that he believes Berkshire’s stock has reached its peak valuation. This perspective aligns with a broader sentiment among investors, who are increasingly cautious about the sustainability of high valuations in the current economic landscape.

In addition to Jain’s significant reduction of holdings, the timing coincides with a noticeable slowdown in Berkshire’s stock buyback activity. The company’s repurchases dropped dramatically from $2 billion in previous quarters to a mere $345 million in the second quarter. Such a stark deviation raises further questions about Berkshire’s confidence in its current stock price, suggesting that even its proverbial ‘great company’ may be reassessing its financial strategies and the valuation of its stock.

Ajit Jain’s role in Berkshire Hathaway cannot be understated; he has been instrumental in guiding the company through crucial transitions, particularly in insurance. Jain’s leadership helped to penetrate and win the reinsurance market, adding substantial value to the conglomerate. Under his stewardship, Berkshire’s Geico insurance division also underwent a transformative turnaround, solidifying its heavyweight position in the auto insurance sector. Warren Buffett, the revered CEO, has repeatedly praised Jain for his contributions, even stating in 2017 that Jain could be a suitable successor to him.

However, despite the competence and respect Jain commands within Berkshire, he has consistently expressed disinterest in leading the organization. This sentiment was reiterated by Buffett, who clarified that there is no rivalry between Jain and Greg Abel, the latter being the designated successor. This dynamic raises interesting implications; Jain’s recent stock sale may not be driven by personal ambitions or opportunistic investments, but rather a calculated assessment of the market landscape.

The question of why Jain opted to sell a substantial fraction of his shares raises intrigue about future prospects for both the company and the broader market. Analysts suggest that the sale could serve as a bellwether for potential trends within Berkshire Hathaway. If shareholders observe that one of the company’s top executives perceives the stock as aligned with intrinsic value rather than deploying capital for stock buybacks, they may also begin to reevaluate their own positions.

Moreover, given the state of global markets, where valuations can swing dramatically due to economic indicators, changes in bipartisan policy, or shifts in consumer behavior, Jain’s decision might resonate beyond Berkshire’s borders. Investors across different sectors may take insight from Jain’s actions, adopting a more measured and cautious approach when it comes to equity sales, holdings, and acquisitions.

Ajit Jain’s recent sell-off of shares signifies more than a mere divestment; it prompts a complex discussion about corporate valuation, market confidence, and internal strategy at one of the most prominent conglomerates in the world. While the motivations behind Jain’s actions remain somewhat ambiguous, they undeniably reflect thoughtful consideration within a rapidly shifting financial environment. As observers await the next developments, one can only speculate about the broader implications this may hold for Berkshire Hathaway and its stakeholders, highlighting the intricate relationship between executives’ decisions and market dynamics.