The recent pause on major parts of the Saving on a Valuable Education (SAVE) plan has left millions of student loan borrowers disappointed and confused about the future of their repayments. One such borrower, Cody Gude, was eagerly awaiting a drop in his monthly payment from $200 to $100, which would have provided him with some financial relief. However, the temporary halt on the new repayment plan by two federal judges has thrown a wrench into his plans and left him questioning whether he will actually see the reduction in his payment. The confusion and uncertainty among borrowers like Gude highlight the challenges they face in navigating the complex world of student loan repayment.

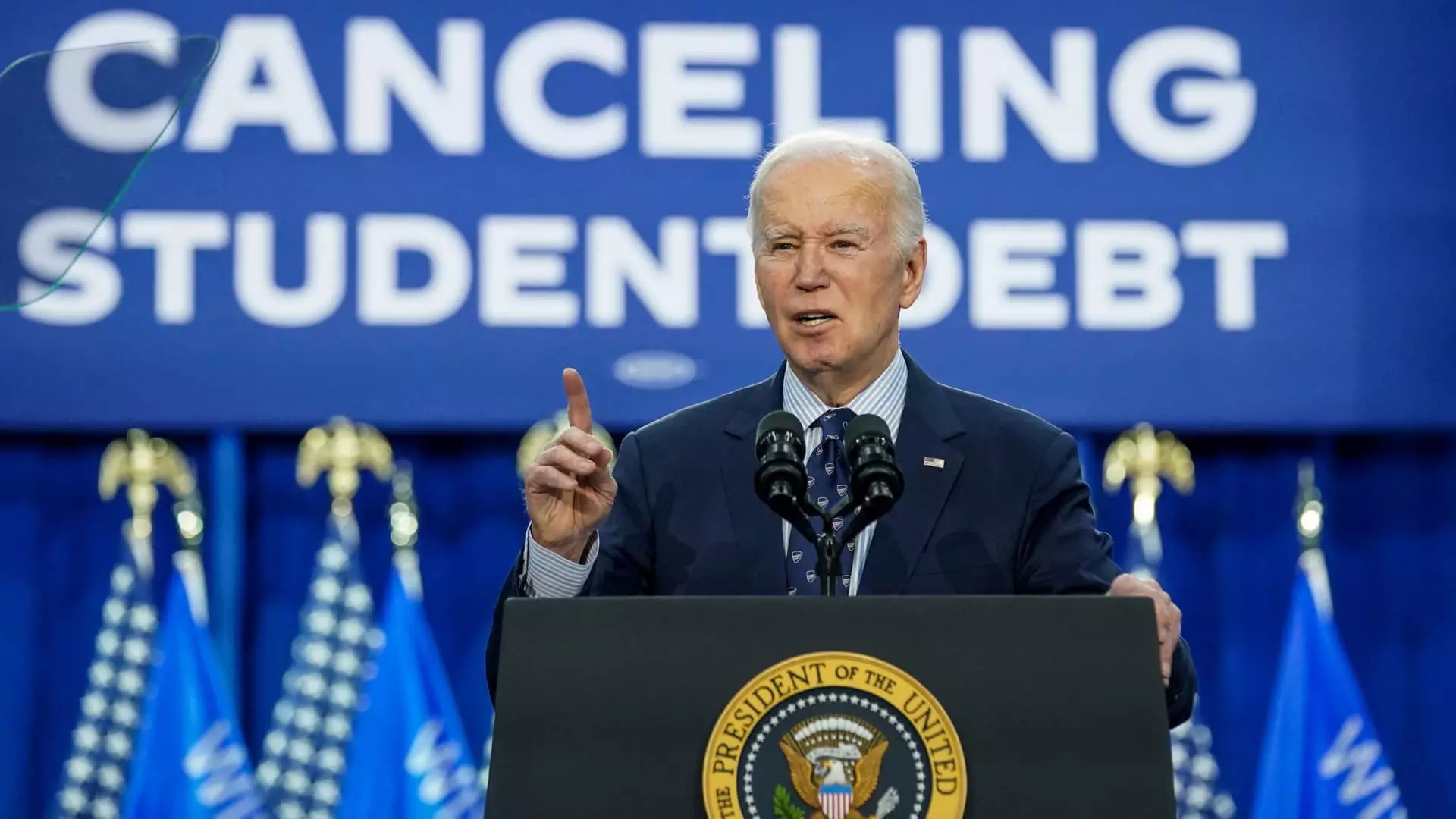

President Joe Biden rolled out the SAVE plan last summer, touting it as the most affordable student loan plan ever. The plan aimed to provide relief to borrowers by reducing the amount they needed to pay each month based on their discretionary income. Under the plan, borrowers were required to pay just 5% of their discretionary income, down from the previous 10% requirement. This more generous repayment plan was expected to benefit millions of borrowers who were struggling to make ends meet. However, the recent legal challenges and injunctions have put the future of the SAVE plan in jeopardy, leaving borrowers in a state of uncertainty.

The pause on the SAVE plan comes as a result of lawsuits filed by Republican-led states, including Florida, Arkansas, and Missouri, challenging the Biden administration’s authority to implement the new repayment plan. The federal judges in Kansas and Missouri raised concerns about the cost of the SAVE plan, which is estimated to reach $475 billion over the next decade, compared to the $15.4 billion cost of the previous plan it replaced. These legal challenges have raised questions about the potential overreach of the Biden administration and its attempts to provide relief to student loan borrowers through executive action.

The uncertainty surrounding the future of the SAVE plan has left borrowers in a state of limbo. While some have already benefited from lower monthly bills under the plan, the recent injunctions have raised concerns about whether these reductions will be reversed in the future. Borrowers like Gude are left wondering whether they will see the relief they were promised or if they will be forced to continue making higher monthly payments. The legal battle surrounding the SAVE plan is expected to drag on for months, with the potential for the cases to reach the Supreme Court, further prolonging the uncertainty for borrowers.

The halt on major parts of the SAVE plan has left student loan borrowers in a state of confusion and uncertainty about the future of their repayments. The legal challenges and injunctions have cast doubt on the Biden administration’s ability to provide relief to borrowers through executive action. While some borrowers have already benefited from the lower monthly payments under the plan, the ongoing legal battles have raised concerns about the long-term sustainability of the SAVE plan. As borrowers await a resolution to the legal challenges, they are left grappling with the financial burden of student loan debt and the uncertainty of what the future may hold for their repayment plans.