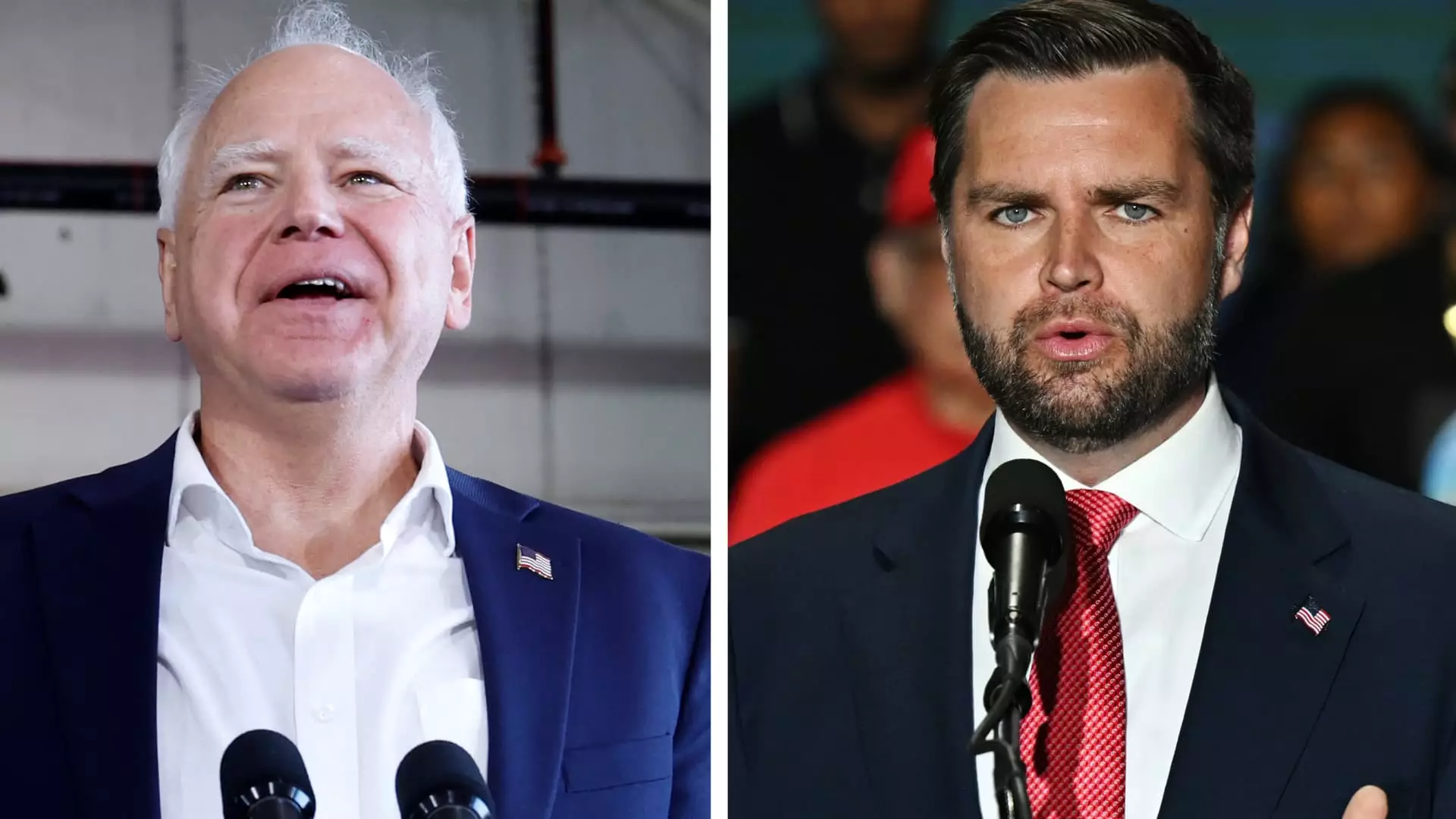

With the upcoming election less than 90 days away, Vice President Kamala Harris has chosen her running mate, Minnesota Gov. Tim Walz, while former President Donald Trump has selected Sen. JD Vance of Ohio. As the candidates unveil their personal finance policies, voters are watching closely to see how these policies will impact their wallets. Both sets of candidates are engaging in class warfare, attempting to portray the opposition as disconnected from the middle-class Americans they aim to represent.

Affordable housing is a critical issue for many Americans, and both Walz and Vance have addressed this topic. Walz signed housing legislation in May 2023 that included $200 million in down payment assistance, $200 million for housing infrastructure, and $40 million for workforce housing. Observers predict that Walz will advocate for demand-side approaches to housing, which aim to improve housing quality or reduce monthly housing costs for individual households. On the other hand, Vance has also emphasized the importance of affordable housing. He has spoken out against institutional ownership of rental homes and Chinese buyers for U.S. real estate, positioning himself as an advocate for tackling poverty through addressing housing affordability.

With trillions of tax breaks enacted by Trump set to expire after 2025, including the child tax credit dropping from $2,000 to $1,000 per child, the future of this policy is uncertain. Minnesota recently enacted a refundable state-level child tax credit, describing it as a “signature accomplishment.” However, a permanent federal child tax credit expansion may face challenges due to a divided Congress and concerns over the federal budget deficit. Vance has expressed support for the child tax credit and positioned himself as a pro-family candidate, but Senate Republicans blocked a federal child tax credit expansion recently.

Vance has been vocal against student loan forgiveness policies, arguing that forgiving student debt benefits the rich and college-educated while neglecting the working class. However, he has supported legislation that would excuse parents from student loans taken on for a child who became permanently disabled. Critics, such as Jane Fox of the Legal Aid Society Attorneys union, have called out Vance’s stance as hypocritical, emphasizing that student debt forgiveness is a working-class issue. In contrast, Walz, a former school teacher, has advocated for programs to alleviate student debt burdens. He signed a student loan forgiveness program for nurses into law in Minnesota and initiated a free tuition program for low-income students.

As the election approaches, the personal finance policies of the candidates will play a significant role in shaping the economic landscape under a Harris or Trump presidency. From affordable housing initiatives to child tax credit expansions and student loan forgiveness programs, voters will need to consider how these policies align with their financial interests. The contrast in approaches between Walz and Vance highlights the ongoing debate over economic inequality and the role of government intervention in shaping financial outcomes for middle-class Americans.