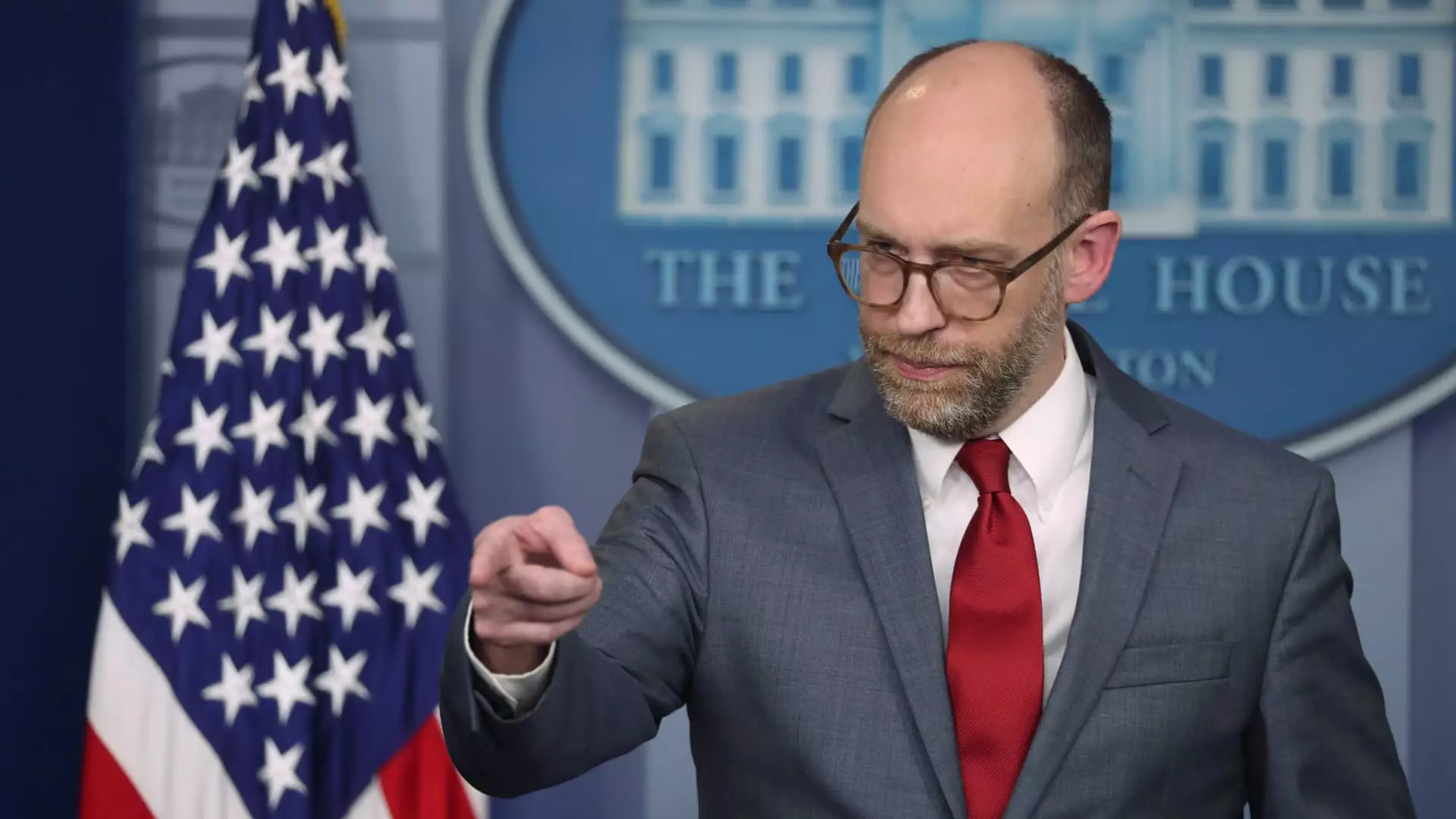

In an unexpected move, the Consumer Financial Protection Bureau (CFPB) has redirected its operational strategies, instructing employees to conduct their work remotely as its Washington, D.C. headquarters remains shuttered until February 14. This directive, communicated by Chief Operating Officer Adam Martinez, follows a prior message from acting director Russell Vought that essentially halted the agency’s oversight and regulatory functions—key roles that are vital in ensuring consumer protection in financial services.

The urgency of this management shift exposes deeper issues regarding the stability of the CFPB and raises questions about the agency’s direction under new leadership. With the suspension of most regular activities, the primary concern for employees and stakeholders is the potential for protracted dormancy within an organization initially established to protect consumers from financial malfeasance.

The environment at the CFPB is reportedly tense, as it faces external meddling from operatives connected to Elon Musk’s DOGE. These individuals, allegedly granted access to internal data, have reportedly been involved in sensitive areas, such as employee performance reviews. This intrusion raises serious questions about confidentiality and the integrity of the agency. Coupled with Musk’s previous public critique—calling for the dissolution of the CFPB on social media—the future stability and effectiveness of the CFPB are in jeopardy.

With Vought’s orders to suspend nearly all agency activities and a freeze on fresh funding, there’s an undeniably chilling effect on morale among CFPB employees. The concern now extends beyond mere operations—questions of job security loom large, as many employees speculate they could face administrative leave or even layoffs. This anxiety highlights a precarious situation, especially given that a significant portion of CFPB jobs are non-mandatory and thus vulnerable in this turbulent time.

The CFPB, established following the financial crisis of 2008, was designed to safeguard consumers against predatory practices by financial institutions. The very essence of its mission—to prevent exploitation—has historically attracted skepticism from banks and financial trade groups that perceive it as punitive. These institutions have challenged the CFPB’s regulatory reach through legal actions, defining the agency as a potential threat to their business models.

Should mass layoffs occur at the CFPB, not only would the livelihoods of roughly 1,700 employees be at stake, but the implications for consumer advocacy could be substantial. A reduction in agency personnel could impede initiatives aimed at enforcing regulations on credit card and overdraft fees. Furthermore, the proposed rule to eliminate approximately $49 billion in medical debt from credit reports of millions stands in jeopardy. The significance of these consumer protections cannot be overstated—they represent tangible financial relief for American families, especially in a post-pandemic economy where economic strains continue to persist.

The historical context of the CFPB’s creation represents a commitment to consumer rights, a commitment now challenged by the current political landscape. With Vought, who also plays a pivotal role in reshaping federal governance through Project 2025, taking charge at the CFPB, the direction of the agency may veer toward a more industry-friendly norm that undermines its foundational goals. His public statements regarding funding cuts indicate a withdrawal of resources necessary for the agency’s sustained function, casting doubts on whether consumer interests will remain prioritized.

Furthermore, the public’s trust in regulatory agencies is already fragile, and this upheaval risks exacerbating that tension. The CFPB’s ability to act as a watchdog is paramount, especially in an economic environment where consumers are vulnerable against institutional power.

The current disturbances within the CFPB largely pivot around the threats to its operations and mission amidst rising new leadership. As the agency faces a pivotal juncture, the outcomes will heavily influence the financial landscape and consumer protections moving forward. Stakeholders, advocates, and the public alike must remain vigilant, ensuring that the CFPB does not lose sight of its original purpose amid external pressures and internal upheaval. Now more than ever, the call for robust consumer protection has never been so critical, as the ramifications of these changes will echo for years to come.