Philadelphia Federal Reserve President Patrick Harker gave a clear indication that an interest rate cut is on the horizon for September. Harker emphasized the necessity of initiating a process to bring rates down and suggested that the Fed should proceed with caution and transparency in its decision-making approach.

The markets have already priced in a high probability of a quarter percentage point decrease in interest rates, with some even speculating a 50 basis point reduction. Despite market expectations, Harker expressed uncertainty about the exact magnitude of the rate cut, stating that he needs to analyze more data before reaching a definitive conclusion.

The Federal Reserve has maintained a benchmark overnight borrowing rate since July 2023 to combat inflation concerns. However, recent data and economic indicators have prompted policymakers to consider easing monetary policy to address potential weaknesses in the labor market. Harker emphasized the importance of making policy decisions based on empirical data rather than political pressures.

Harker underscored the independence of the Federal Reserve and its commitment to making decisions based on economic data and analysis. As a proud technocrat, he emphasized the importance of maintaining a data-driven approach to monetary policy, especially in the midst of upcoming presidential elections.

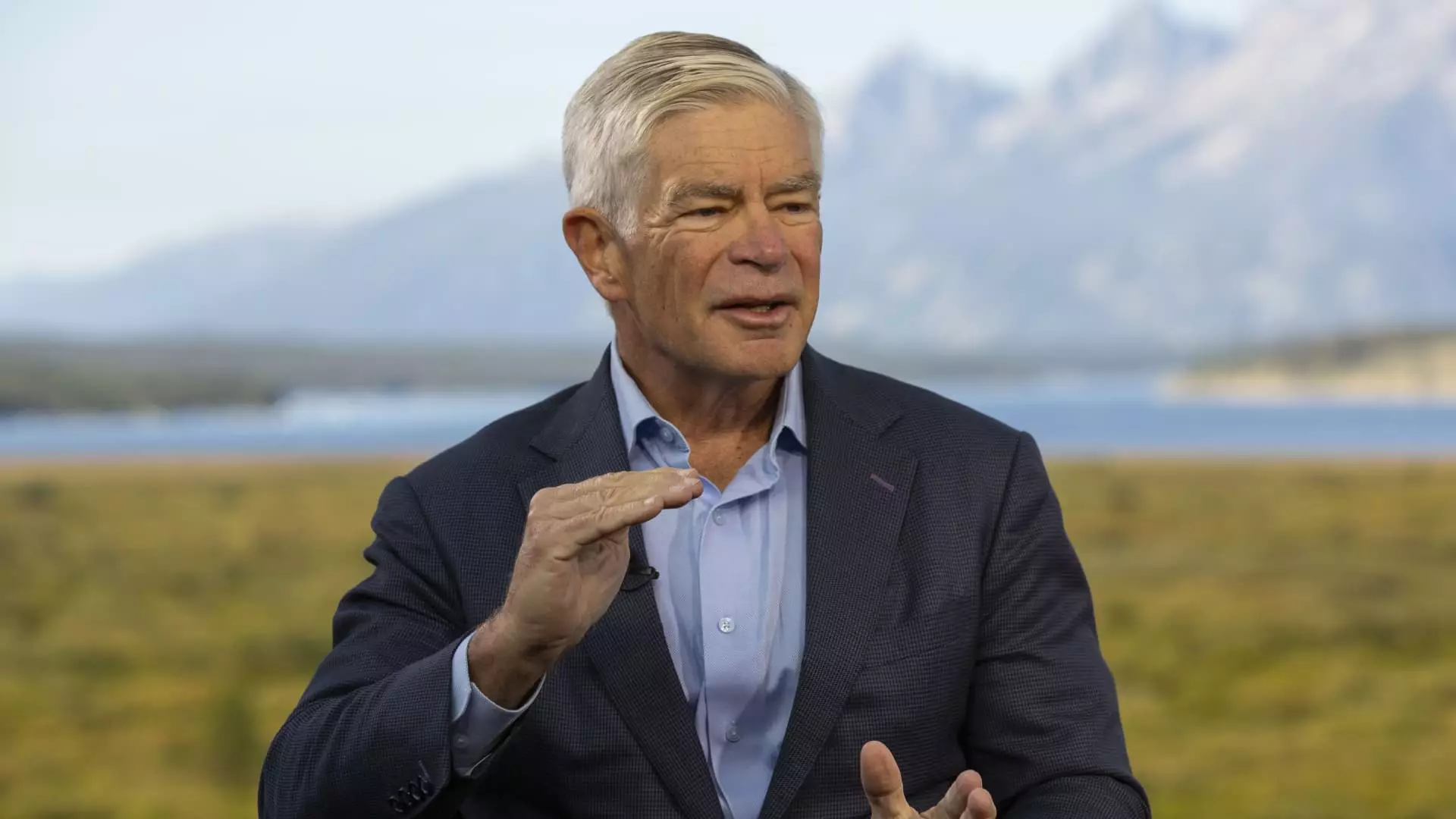

Kansas City Fed President Jeffrey Schmid provided a nuanced perspective on the future of monetary policy, acknowledging the impact of rising unemployment rates on economic trends. Schmid highlighted the importance of scrutinizing the labor market dynamics and adjusting policy measures accordingly.

While acknowledging the cooling of the labor market in recent months, Schmid expressed optimism about the resilience of banks under the prevailing high-rate environment. He emphasized the need to closely monitor the labor market trends in comparison to historical unemployment rates to inform future policy decisions.

Both Harker and Schmid, as nonvoter members of the Federal Open Market Committee, play integral roles in shaping discussions and providing valuable insights on monetary policy decisions. While Harker is set to vote in 2026, Schmid will have an opportunity to influence policy direction in the upcoming year.

The statements made by Patrick Harker and Jeffrey Schmid highlight the nuanced considerations and data-driven approach taken by the Federal Reserve in shaping monetary policy decisions. As global economic conditions continue to evolve, the Fed’s commitment to transparency, independence, and empirical analysis will be essential in guiding future policy actions.