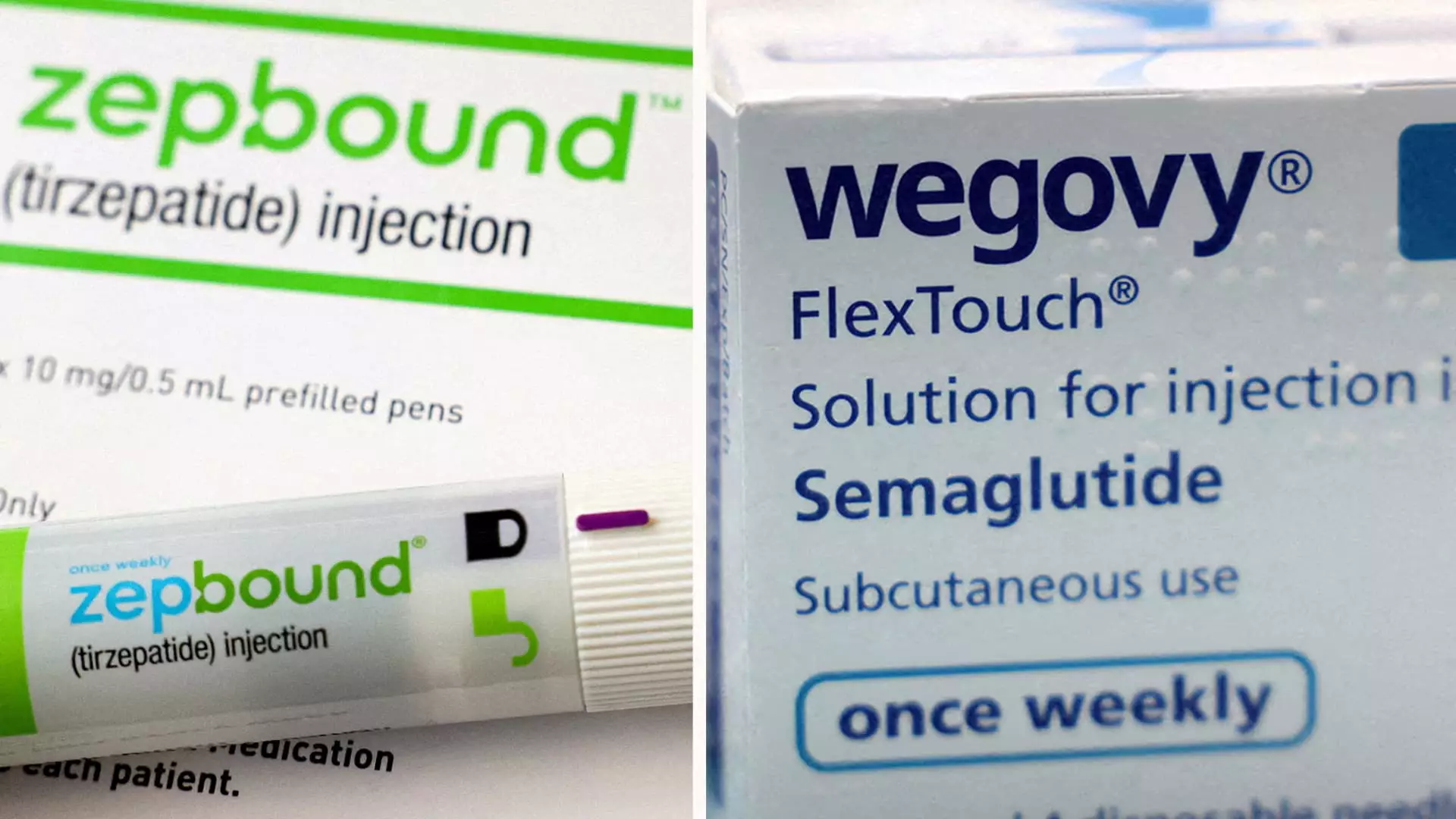

Obesity has become a significant health concern globally, leading to a rise in the demand for effective weight-loss medications. With the obesity treatment market projected to be valued at approximately $150 billion annually by the early 2030s, pharmaceutical companies are aggressively competing to capture a portion of this lucrative market. Recently, Eli Lilly’s Zepbound has garnered attention for outperforming its primary competitor, Novo Nordisk’s Wegovy, in clinical trials. This analysis delves into the clinical results, the implications for treatment options, and the market dynamics of these groundbreaking drugs.

Eli Lilly announced that Zepbound appears to facilitate greater weight loss than Wegovy according to the results of a recent head-to-head clinical trial. The study reported that participants using Zepbound lost an average of 20.2% of their body weight, translating to around 50 pounds, over the course of 72 weeks. In comparison, patients treated with Wegovy experienced a comparatively modest weight loss of approximately 13.7%, or about 33 pounds, during the same period.

Moreover, the trial indicated that Zepbound offers a remarkable 47% higher relative weight reduction compared to Wegovy. More than 31% of participants taking Zepbound lost at least 25% of their body weight, compared to a mere 16% for those on Wegovy. Such findings solidify Zepbound’s position as a powerful contender in the obesity treatment arena, illuminating the potential for transformative patient outcomes.

Understanding the Mechanisms of Action

The mechanisms through which Zepbound and Wegovy operate differ, possibly contributing to the disparities in their efficacy. Zepbound modulates appetite and regulates blood sugar levels by stimulating the release of two critical gut hormones—gastric inhibitory peptide (GIP) and glucagon-like peptide-1 (GLP-1). Wegovy, on the other hand, targets only GLP-1. This distinction may provide Zepbound an additional advantage in managing weight by influencing how the body metabolizes sugar and fat.

The success of Zepbound could be pivotal for Eli Lilly, especially as Novo Nordisk’s Wegovy has already established itself in the market, launching two years prior to Zepbound’s approval in late 2023. Analysts predict a fierce competition in the coming years, with projections indicating that Zepbound could generate an astounding $27.2 billion in annual sales by 2030, outpacing Wegovy’s anticipated $18.7 billion. This potential shift dominates discussions among investors and market analysts alike, as the battle for dominance in the weight-loss drug market heats up.

Patient Access and Insurance Challenges

Despite the promising advancements in weight-loss treatments, challenges remain regarding patient access. A significant factor hindering widespread acceptance of these medications involves inconsistent insurance coverage for weight-loss therapies in the United States. The exorbitant out-of-pocket costs—approximately $1,000 per month for both Zepbound and Wegovy—pose significant barriers for many prospective patients. These affordability issues must be addressed to ensure that effective treatments reach those who need them most.

The implications of Zepbound’s recent clinical trial results are profound, potentially heralding a new era in obesity treatments. As healthcare providers and patients seek more effective options for weight loss, medications like Zepbound, which demonstrates superior efficacy, could become the preferred choices in clinical practice. While both Zepbound and Wegovy show promise, ongoing studies and post-market evaluations will be crucial in refining treatment paradigms and ensuring long-term success in the fight against obesity. Companies like Eli Lilly and Novo Nordisk are not simply competing for market share; they are at the forefront of a much-needed healthcare revolution aimed at addressing the obesity epidemic that affects millions of individuals worldwide.