Super Micro Computer Inc., a prominent player in the server manufacturing industry, is currently experiencing a significant downturn. On Wednesday, the company’s shares fell by a staggering 22%, marking the lowest point since May of the previous year. This decline can be attributed to the company’s disappointing unaudited financial results and the alarming absence of a coherent strategy to maintain its listing on the Nasdaq exchange. By early afternoon, shares plummeted to $21.55, resulting in an 82% decrease from their peak value in March, casting a shadow over approximately $57 billion in market capitalization.

Compounding the situation is the departure of Ernst & Young, Super Micro’s auditor, which is now the second accounting firm to withdraw in just under two years. Such instability raises suspicions about the company’s internal controls and governance, as the firm faces serious allegations of accounting irregularities. Notably, accusations have emerged regarding the shipment of sensitive technology to sanctioned nations, which could potentially lead to violations of international export controls.

Super Micro has not submitted any audited financial statements since May, putting it at considerable risk for delisting from the Nasdaq if it fails to provide the required reports to the Securities and Exchange Commission by the mid-November deadline. In a recent announcement regarding preliminary results for the first fiscal quarter, the company has indicated an unclear timeline for the filing of its annual financials, which further exacerbates concerns among investors and analysts.

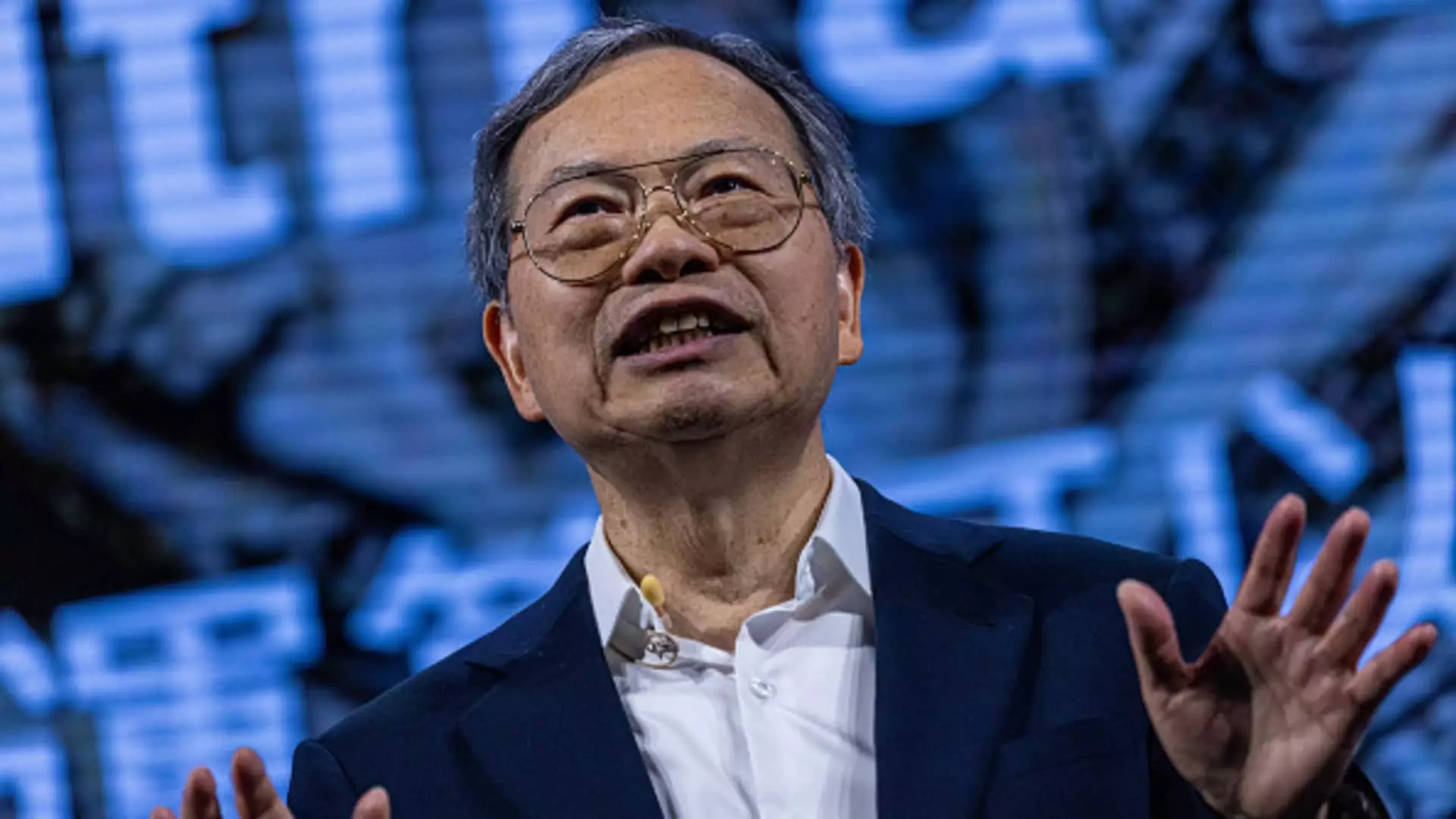

During a conference call with analysts, CEO Charles Liang refrained from delving into details surrounding Ernst & Young’s resignation and corporate governance inadequacies, leaving many questions unanswered. Liang did assure stakeholders that efforts are underway to secure a new auditor while emphasizing the company’s commitment to rectifying its financial reporting delays “with urgency.”

In light of these developments, various analysts have reacted cautiously. Mizuho, for instance, has suspended its coverage of Super Micro shares due to a lack of comprehensive financial disclosures. Meanwhile, Wedbush’s analysts have described the company’s situation as one that raises “more questions than answers,” indicating that management appears preoccupied with renegotiating its auditing situation and resolving its financial reporting issues.

Despite these setbacks, there remains a flicker of optimism regarding Super Micro’s sales performance in the second half of the fiscal year. The company reported net sales between $5.9 billion and $6 billion for the quarter ending September 30, a figure beneath the $6.45 billion forecast from analysts but reflecting an impressive 181% annual growth. This growth can be largely attributed to the heightened demand for servers equipped with Nvidia processors tailored for artificial intelligence applications.

Super Micro’s stock saw an extraordinary climb last year, with shares surging 246% amid a general upswing in the technology sector. The company reached its highest valuation of $118.81 in March after being added to the S&P 500 index, largely driven by robust demand for AI solutions. Following the recent announcements, questions loom regarding the supply chain for Nvidia’s latest GPU, Blackwell. During the call, Liang expressed enthusiasm about the strong demand but lamented a shortfall in chip availability, aggravating concerns regarding ongoing production capabilities.

As analysts sought clarification on whether the company had adjusted its plans for Blackwell-based servers, CFO David Weigand reassured them of Super Micro’s strong relationship with Nvidia. He maintained that ongoing projects remain intact, and Nvidia confirmed that no alterations to the allocation of their chips had been made.

Looking ahead, Super Micro’s projections for the upcoming December quarter appear to be underwhelming, with revenue estimates ranging from $5.5 billion to $6.1 billion, falling short of the consensus forecast of $6.86 billion. Moreover, projected earnings per share of 56 to 65 cents do not meet the expected EPS of 83 cents from analysts.

In response to the concerns raised by Ernst & Young, Super Micro’s board of directors has instituted a special committee to investigate these issues, which reportedly found no evidence of fraud or misconduct from management over a three-month investigation. However, the implications of the ongoing challenges could reshape the company’s trajectory and investor confidence significantly.

While Super Micro navigates through turbulent financial waters, the combination of accountability issues, market fluctuations, and supply chain factors complicates any recovery efforts. Stakeholders remain watchful for substantial developments in transparency and corporate governance that could restore confidence in this struggling tech firm.