In recent years, family offices — private investment firms representing the interests of affluent families — have emerged as significant players in the world of startup investments. This shift signifies a broader transformation within high-net-worth individuals and families, who are moving towards direct investments in private ventures rather than relying solely on traditional investment funds. According to insights from Fintrx, over 150 startup investments were made by the top ten family offices in 2024, spanning a diverse array of sectors, from biotechnology to blockchain technology. This trend raises questions about the implications for both the family offices themselves and the industries they are investing in.

Among the most notable family offices leading this charge is Maelstrom, based in Hong Kong. Founded by Arthur Hayes, renowned for co-founding the crypto exchange BitMEX, Maelstrom has made an impressive 22 investments this year, primarily focusing on blockchain technologies. The firm’s strategy underscores a commitment to navigating the complexities of emerging fintech solutions, which speaks to the broader potential of cryptocurrencies and decentralized finance as vital aspects of our economic future.

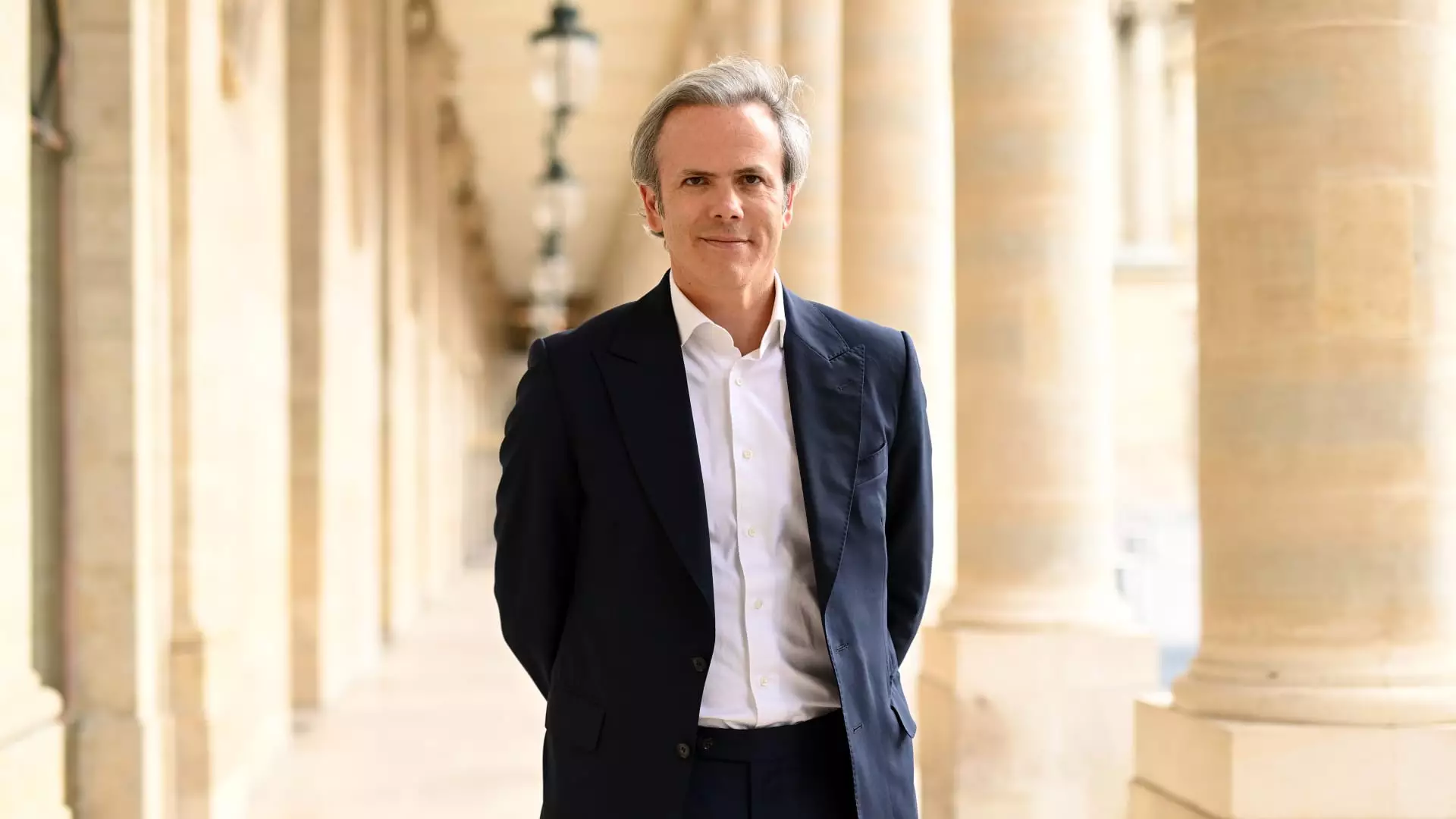

In the second spot, Motier Ventures emerged as a formidable contender. Founded by Guillaume Houzé, a member of the prominent French retail dynasty, Motier’s portfolio also reflects concentrated investments in burgeoning fields like artificial intelligence (AI) and blockchain. Among their notable investments, the funding rounds for significant players such as Mistral and Holistic AI not only highlight Motier’s strategic depth but also indicate a growing belief in the transformative power of AI technologies across various sectors.

Several other family offices have also made headway in innovative investments. Hillspire, created by former Google CEO Eric Schmidt, is another strong player that has deliberately shifted towards AI initiatives this year. This trend suggests that these influential entities see the vast potential within technology-driven solutions, making an investment strategy that emphasizes innovation rather than traditional sectors like real estate more appealing.

Interestingly, the dominance of family offices in startup investing is not limited to tech sectors; they have increasingly diversified their portfolios into health technology, financial services, and even creative industries. For instance, the involvement of Thiel Capital in niche markets, such as fertility services and unconventional gaming ventures, showcases the flexibility and openness of family offices regarding investment approaches. This flexibility allows them to respond to market demands and emerging trends with much agility compared to traditional investment firms.

One aspect not often discussed in the media is how family offices utilize their investments as experimental platforms or “idea labs.” Many family offices are likely to approach startup investing with the intent of understanding new technologies and market dynamics, which they can apply across their broader business interests. As evidenced by Hillspire’s investments in AI alongside energy companies, learning from leading-edge technology applications could also lead to strategic advantages in areas like energy management and efficiency.

However, this transition to direct startup investing does not come without risks. The challenges of navigating private markets can lead to financial pitfalls, especially for family offices lacking in-depth expertise. Changes in economic conditions, market corrections, and a stark decline in potential exits have resulted in rising anxieties among these entities. The insight from experts like Nico Mizrahi underlines the importance of discipline and caution among family offices, particularly in crafting strategic partnerships that effectively leverage market knowledge and experience while avoiding overzealous risks.

As we move forward, the dramatic ascent of family offices in startup investments is set to continue. Trends indicate that a considerable portion of startup funding in the coming years will come from these private entities. Research suggests that over 78% of surveyed family offices aim to increase their investments in AI, underscoring a collective belief that innovation will drive future growth.

Family offices are not just adapting; they are revolutionizing the landscape of startup investments. With their blend of wealth, flexibility, and strategic positioning, they are shaping the trajectory of emerging technologies and industries. By treating investments as a means of exploration and innovation, family offices will likely strengthen their influence in both the investment arena and the broader economic ecosystem in the years to come.