On Wednesday, the U.S. stock market saw a positive turnaround after a three-day losing streak. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all made significant gains, with the S&P 500 climbing 1.5%, the Dow Jones up 1%, and the Nasdaq jumping 1.9%. Jim Cramer acknowledged the previous day’s decline, attributing it to a “one-day glitch” fueled by concerns such as the unwinding of the “yen carry trade” and U.S. recession worries following a disappointing jobs report.

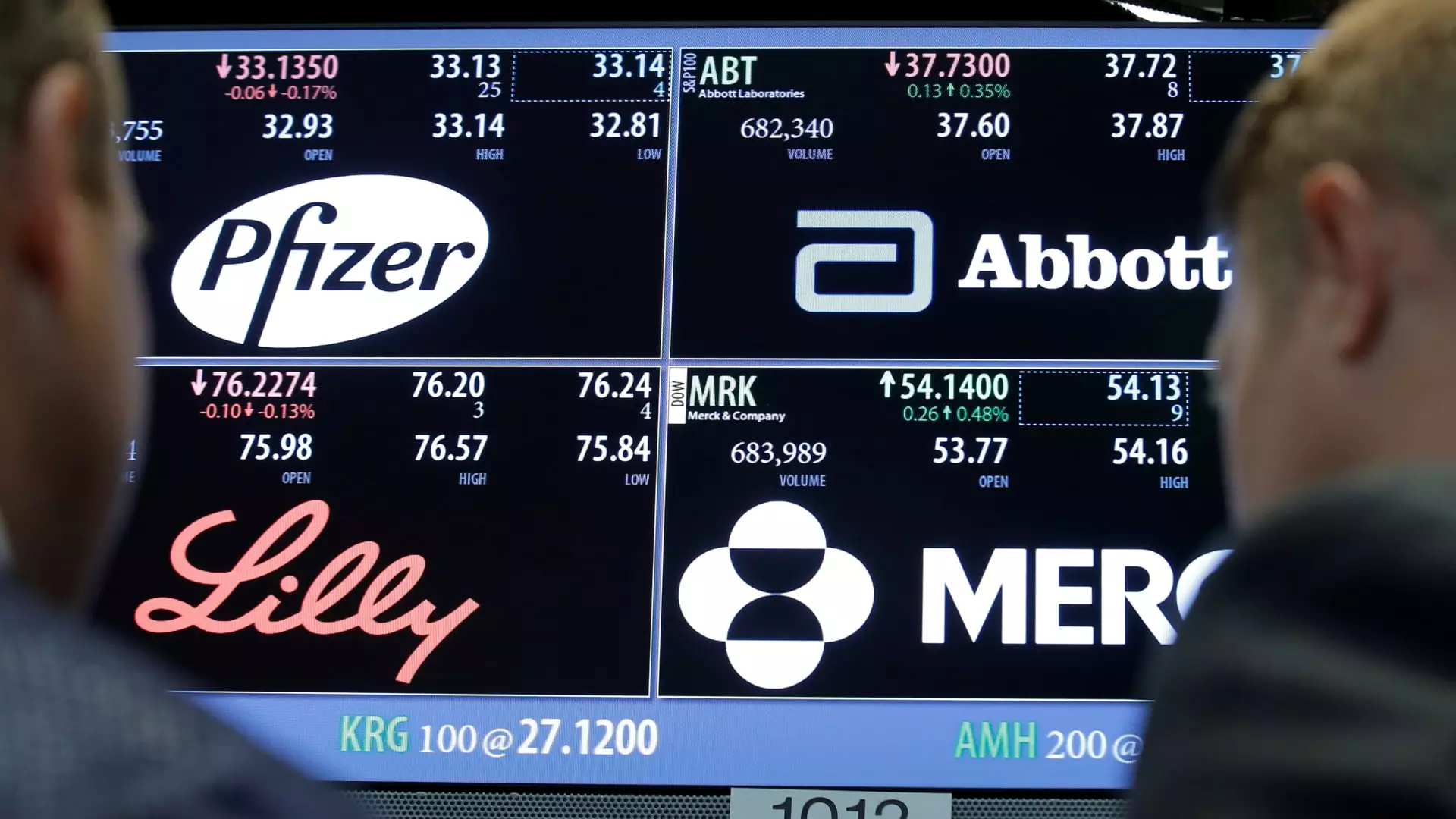

Eli Lilly shares took a hit on Wednesday, dropping 1.7% after Novo Nordisk reported disappointing earnings. The company fell short of expectations in terms of net profit for the second quarter and missed sales projections for its weight-loss drug Wegovy. Investors are now watching closely to see if Eli Lilly could face a similar fate with its GLP-1 drugs Zepbound and Mounjaro. However, it’s worth noting that Novo Nordisk’s sales miss was primarily due to higher-than-expected concessions to U.S. pharmacy benefit managers rather than a decline in demand for its products. Jim Cramer warned that Eli Lilly shares might continue to fall following the company’s upcoming quarterly results release but expressed optimism about the long-term prospects of the pharmaceutical company.

Amazon received positive news regarding its e-commerce business following CVS Health’s quarterly earnings report. CVS Health’s decision to close 900 retail drug stores by the end of the year, as part of a restructuring initiative, could potentially benefit Amazon’s platform as consumers increasingly rely on online shopping for everyday essentials. As a result, Amazon’s stock saw a 3% increase on Wednesday. This development signals a potential competitive advantage for Amazon in the e-commerce space.

As a member of the CNBC Investing Club with Jim Cramer, subscribers receive exclusive trade alerts before Jim makes any trades in his charitable trust portfolio. There is a waiting period of 45 minutes after a trade alert is sent before any action is taken, ensuring thoughtful decision-making. Additionally, if Jim discusses a stock on CNBC TV, a 72-hour waiting period is observed before executing a trade. It’s essential to understand and abide by the terms and conditions, privacy policy, and disclaimer of the Investing Club to make informed investment decisions.

While the stock market experienced a positive upswing on Wednesday, investors must remain vigilant and informed about market trends and company developments. Eli Lilly’s performance, Amazon’s e-commerce prospects, and the CNBC Investing Club’s trade alert system highlight the importance of staying up-to-date with financial news and utilizing reputable sources for investment guidance. By staying educated and proactive, investors can navigate the ever-changing landscape of the stock market with confidence.