The recent withdrawal of two significant student loan forgiveness plans by the Biden administration has generated renewed discourse surrounding the future of education financing and debt relief in the United States. These proposed regulations aimed at alleviating the financial burden on various groups of borrowers, especially those facing prolonged repayment periods or acute financial distress. Their repeal could impact millions of Americans who continue to grapple with student loan debt, further complicating an already precarious financial landscape for many.

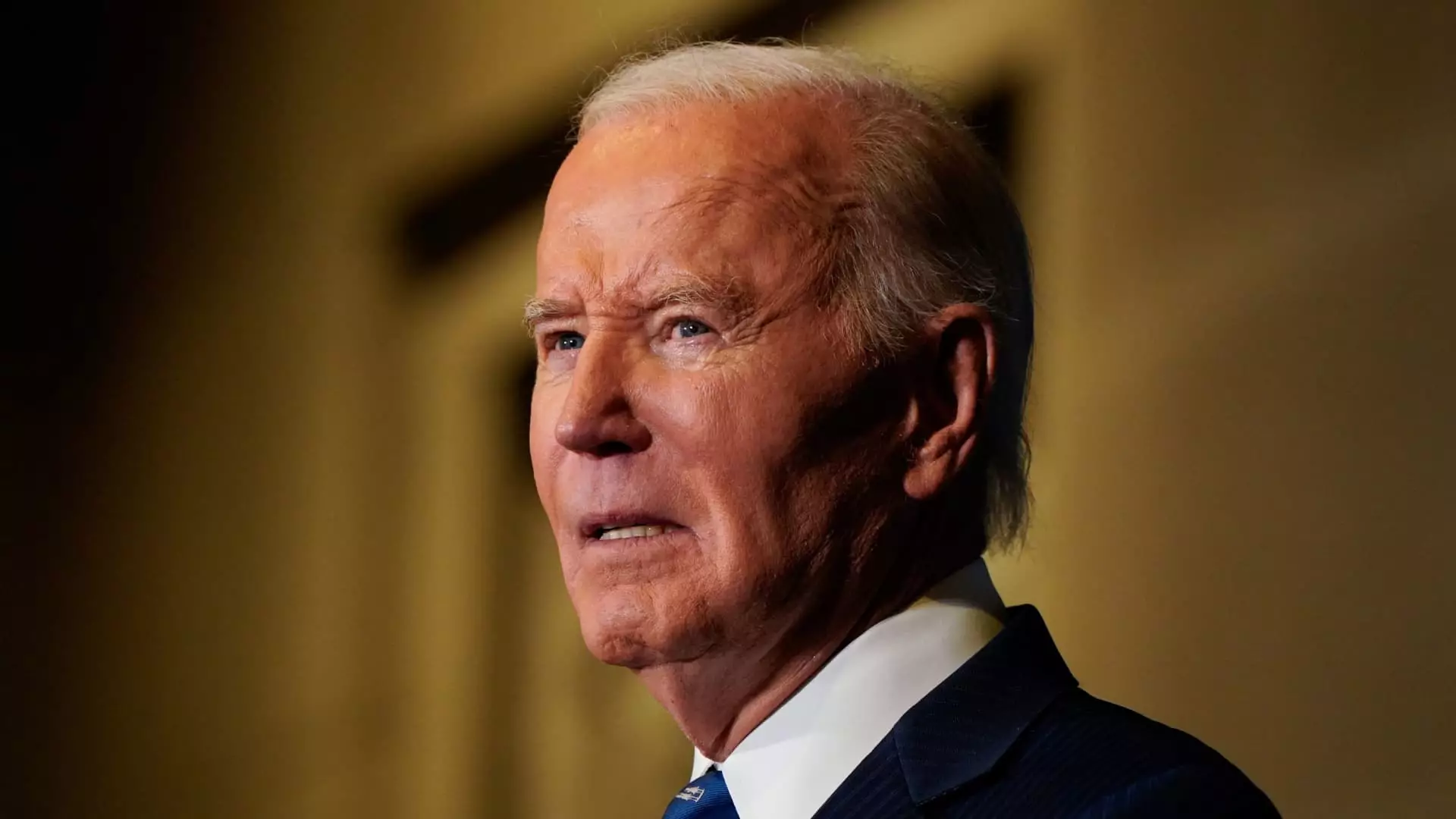

Initially, these regulations represented a hopeful initiative amidst a growing acknowledgment of the student debt crisis facing Americans. They were designed to empower the Secretary of the U.S. Department of Education to facilitate loan cancellation for a diverse range of borrowers, marking a significant shift in how student debt relief could be approached. However, just weeks before the anticipated transition of power to President-elect Donald Trump—a known opponent of student loan forgiveness—the Education Department announced its decision to withdraw these proposals. The stated reason was the operational challenges in implementing such extensive policies. The perception that limited resources should be allocated more wisely, particularly in these final weeks of the administration, only exacerbates the disenchantment felt by current student loan borrowers.

Political sentiment shapes educational financing policies in profound ways. Experts, like Mark Kantrowitz, warn that the Biden administration’s initiatives were likely to be undone in a Trump administration, reflecting a broader political landscape where education and financial reform hang in the balance of partisan ideologies. Trump’s previous characterizations of the Biden administration’s efforts as “vile” showcased the friction underlying the debate over student loan forgiveness. This ongoing tug-of-war over education financing has left borrowers and advocates in a state of uncertainty, particularly as new administrations take office and old policies face scrutiny.

The removal of the proposed forgiveness plans has been met with disappointment from consumer advocates. Figures like Persis Yu of the Student Borrower Protection Center articulated the grave implications of this decision, emphasizing that many were anticipating potential relief that could transform their economic prospects. Borrowers are not just statistics; they are individuals who hoped to be granted the wings of economic mobility. Elaine Rubin from Edvisors underscored the anxiety permeating the community regarding how the upcoming administration’s policies will affect borrowers still grappling with student debt.

While these new plans have been revoked, the Education Department continues to administer other loan forgiveness options, such as the Public Service Loan Forgiveness (PSLF) and the Teacher Loan Forgiveness programs. These established programs provide specific avenues for debt relief but may not be sufficient for the broader base of borrowers who do not fit these narrow criteria. The PSLF program, in particular, has been an essential lifeline for many working in public service and education. However, with potential changes looming in administrative priorities, many borrowers harbor valid concerns regarding the stability and longevity of such existing programs.

Looking ahead, the landscape of student loan forgiveness in the U.S. remains fraught with ambiguity. While various federal relief programs continue to exist, the recent rescission of broad forgiveness proposals highlights a significant gap between what advocates sought and what is available. Borrowers are encouraged to familiarize themselves with remaining options, as evidenced by resources like Studentaid.gov and The Institute of Student Loan Advisors, which maintain updated databases of relief programs.

The withdrawal of the Biden administration’s student loan forgiveness plans is indicative of the complex interplay between policy, politics, and personal finance. As borrower concerns mount and the political terrain shifts, the future of student loan relief will hinge not only on legal frameworks but also on the broader commitment to addressing the student debt crisis more comprehensively. The necessity for sustained advocacy in this arena has never been more pressing, as millions remain burdened by the enduring impacts of high educational costs.