In a significant move towards alleviating the financial distress of student borrowers, the Biden administration unveiled its definitive round of student loan forgiveness, amounting to over $600 million dedicated to easing debts for thousands of individuals. This latest initiative, aimed at 4,550 borrowers enrolled in the Income-Based Repayment (IBR) plan and an additional 4,100 former DeVry University students, marks a critical moment in the administration’s ongoing efforts to address the student loan crisis.

The decision to discharge debts for the DeVry University cohort stems from findings announced in February 2022, which revealed the institution’s persistent misrepresentation of job placement rates, misleading many students pursuing an education under the assumption of better employment prospects. Despite the absence of a response from DeVry regarding this latest announcement, the decision underscores a broader trend of accountability among educational institutions, especially for-profit entities.

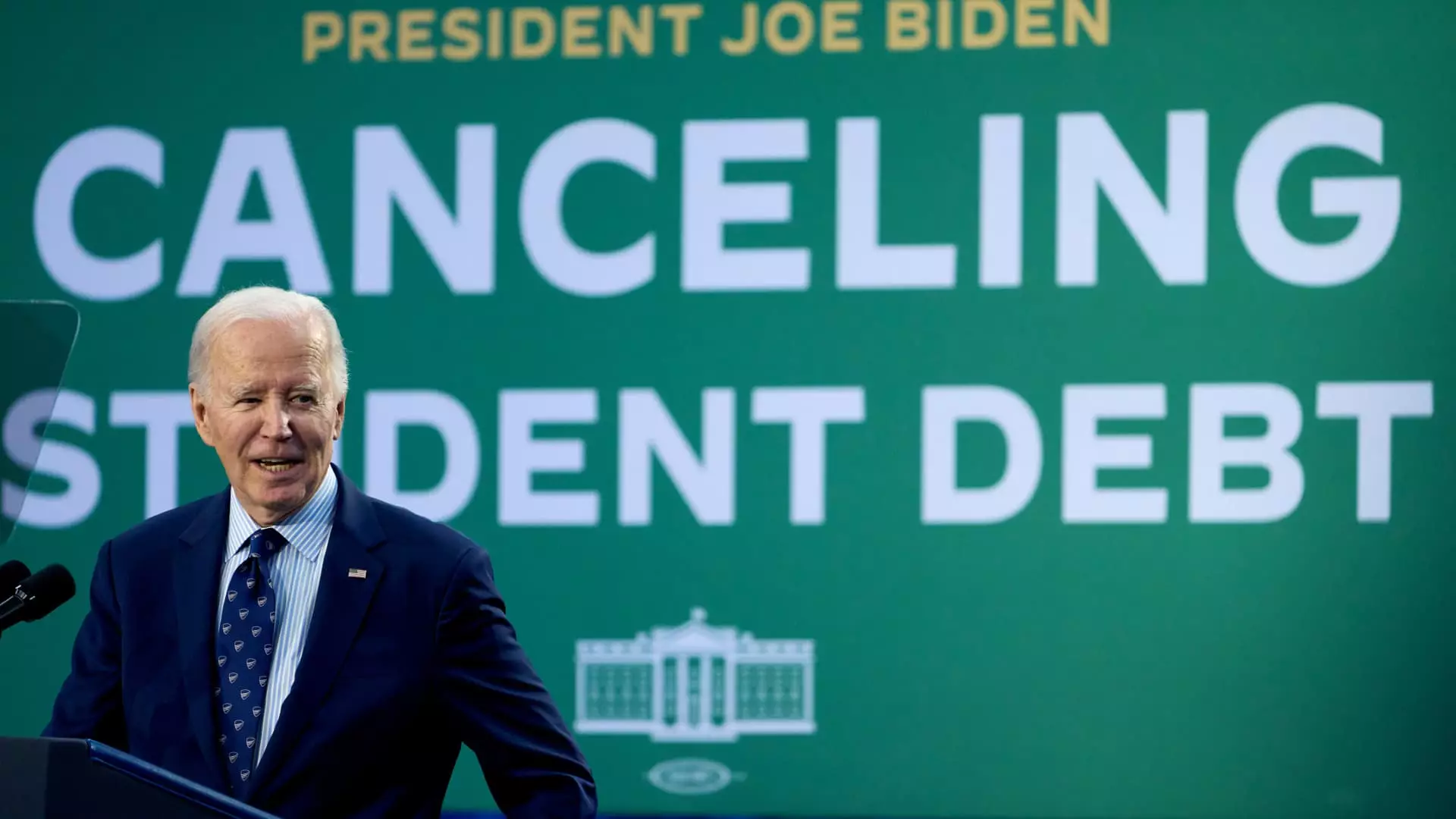

As President Joe Biden prepares to exit office, his administration stands out for having forgiven $188.8 billion in student debt, benefiting approximately 5.3 million borrowers. Mark Kantrowitz, a recognized authority in higher education financing, characterized Biden’s efforts as paving the way for unprecedented levels of student debt forgiveness compared to previous administrations. The culmination of these initiatives, as outlined in the recent pronouncement, signifies what Kantrowitz deems “the end of an era” in federal student debt policy.

Interestingly, while the Supreme Court halted a broad-scale forgiveness proposal meant to assist millions of borrowers in 2023, the administration successfully navigated other relief channels, demonstrating resilience in the face of legal setbacks. These adjustments illustrate a commitment to addressing systemic issues plaguing the student loan landscape.

U.S. Secretary of Education Miguel Cardona emphasized the administration’s dedication to repairing a historically flawed student loan framework. By rectifying existing debt relief programs, he stated, the administration aimed to deliver on the promise made four years prior to reform the broken system. Cardona’s assertion hints at a proactive stance, acknowledging the past failures that have left many borrowers without proper relief options.

Another essential component of this initiative is the adjustment to the payment count for borrowers in Income-Driven Repayment (IDR) plans. For years, numerous borrowers expressed concerns that loan servicers were remiss in accurately tracking their repayment timelines, a vital factor that determines eligibility for loan forgiveness after 20 to 25 years of payments. The recent developments ensure that borrowers can now verify their payment counts by logging into their accounts via Studentaid.gov, a significant stride toward increased transparency and efficiency in the loan management process.

The final student loan forgiveness announcement reflects both the accomplishments and challenges faced by the Biden administration in overhauling a deeply entrenched student loan system. As the years progress, the lessons learned during this period may foster a future where educational financing becomes more manageable for prospective students, aligning their aspirations with realistic financial frameworks. While the journey continues, the recent actions taken signify vital steps towards a more equitable and accountable education system.