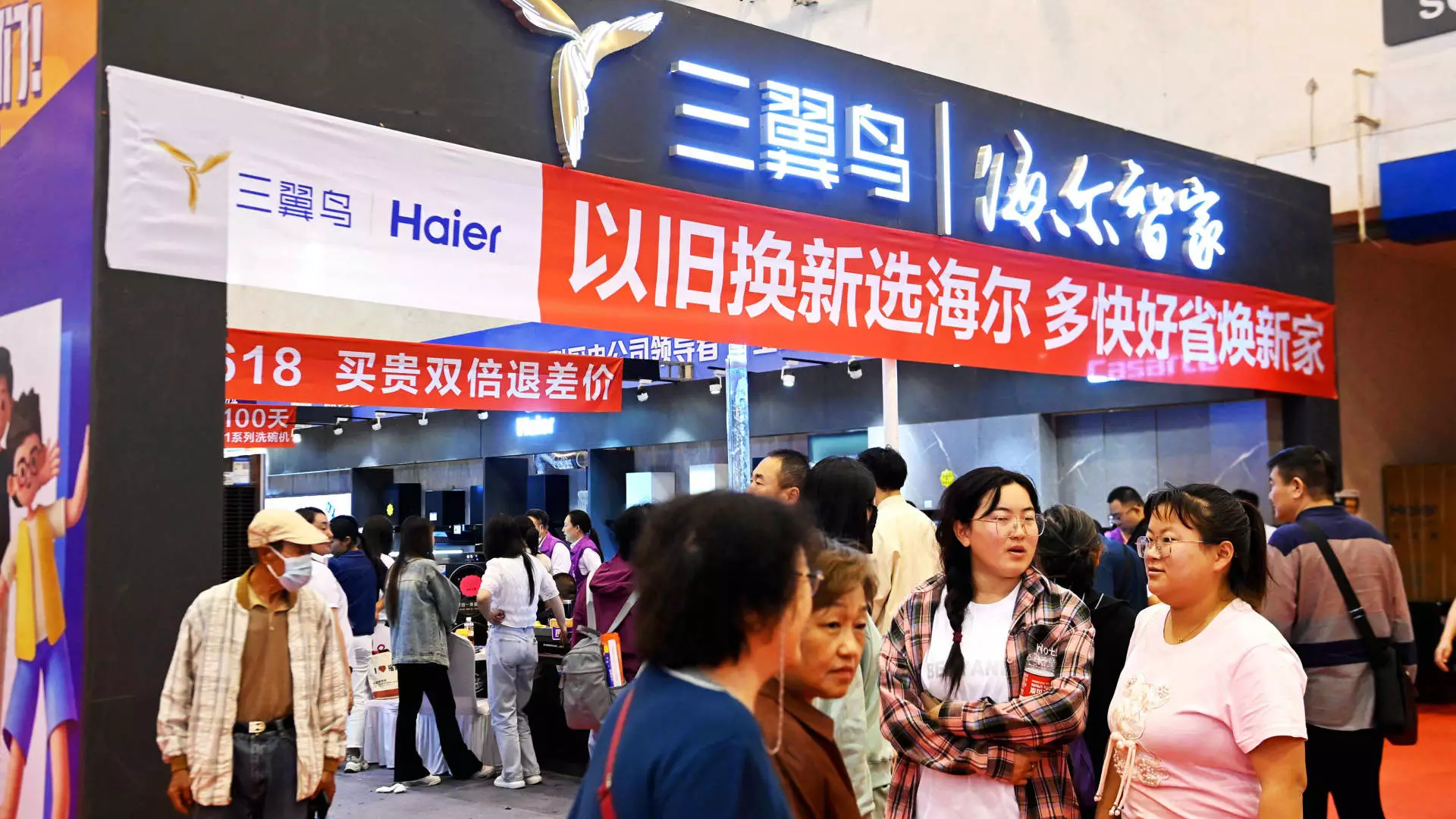

In a bold move to stoke economic vitality, China unveiled an extensive trade-in program in July 2023, earmarking a staggering 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds. This initiative aims to stimulate domestic consumption by incentivizing upgrades in consumer goods such as automobiles and home appliances, while also targeting essential equipment like elevators. Although the intentions behind the policy are commendable, various businesses and analysts indicate that tangible benefits may be slow to emerge, raising questions about its overall efficacy.

The centerpiece of the trade-in strategy involves the allocation of approximately half of the total funding towards subsidies for consumer goods. Local governments are provided the flexibility to utilize these ultra-long bonds to encourage purchases, thereby enhancing consumption. However, this initiative has an inherent limitation; consumers must possess a used item to exchange and have the financial capacity to make an additional outlay. As Jens Eskelund, president of the EU Chamber of Commerce in China, highlighted, the full potential of the policy has not been translated into on-ground incentives or consumer behavior shifts.

Furthermore, the per capita budget allocated under this program amounts to about 210 yuan ($29.50), a figure that raises skepticism about the adequacy of funds reaching everyday households. Given demographic considerations, the possibilities for significant increases in domestic consumption seem undermined by structural apprehensions among consumers still recovering from the economic impacts of the Covid-19 pandemic.

The cautious consumer sentiment in China adds another layer to this complex scenario. Recent retail sales data reflects stagnation, with June registering only a 2% increase—the slowest growth post-pandemic—while July showcased a modest uptick to 2.7%. Analysts have voiced concerns over whether the trade-in program will provide substantial support to the retail sector. Tao Wang, Chief China Economist at UBS Investment Bank, estimates that this scheme could only enhance retail sales by an equivalent of 0.3% in 2023.

On the other side of the equation, there is a spark of hope in the new energy vehicle sector, where sales surged by nearly 37% in July, contrasting with a decline in overall passenger car sales. This stark divergence points towards a market segment eager for innovation and change, possibly laying the groundwork for future consumer willingness to engage with trade-in policies.

As part of the announcements around the trade-in policy, officials indicated that a substantial number of elevators in China are overdue for upgrades, with about 800,000 exceeding their recommended operational lifespan. While foreign companies like Otis and Kone were optimistic about potential opportunities, the reality remained stark. New orders related to the trade-in initiatives have not yet materialized, leaving several companies reporting stagnant or declining sales figures in the region.

Sally Loh, president of Otis’s operations in China, expressed a clear expectation for timely and effective deployment of funds at the local government level. The ongoing ambiguity concerning the amount allocated to equipment upgrades continues to dampen expectations. Kone’s CFO Ilkka Hara echoed a similar sentiment, commending the trade-in program as a potential catalyst but recognizing that its impact would take time to manifest.

Despite the hesitance surrounding immediate results, some companies remain optimistic about the longer-term implications of the program. For instance, ATRenew, which operates stores for secondhand goods, views the trade-in initiative as a pathway to foster the secondhand market’s growth, though they note that initial impacts may be minimal. As they expand their operations, including becoming a global trade-in partner for Apple, ATRenew acknowledges emerging trends such as a significant increase in trade-in orders from platforms like JD.com.

Interestingly, growth in specific sectors, like mobile phones and laptops in Guangdong, hints at a burgeoning acceptance of secondhand transactions, suggesting potential avenues for consumer engagement under the expanded trade-in policy.

China’s trade-in policy symbolizes an ambitious effort to invigorate domestic consumption amidst economic uncertainty. However, the pathway to success is undoubtedly fraught with challenges—consumer apprehensions, the vagaries of local government execution, and the economic landscape’s complexity all play critical roles. As the country strides forward, the emphasis will need to pivot toward effective policy execution, fostering consumer confidence, and ultimately achieving measurable results that enhance public engagement with the new trade-in paradigm. Only time will tell whether this initiative will evolve from a high-level ambition into a practical solution yielding palpable economic benefits.