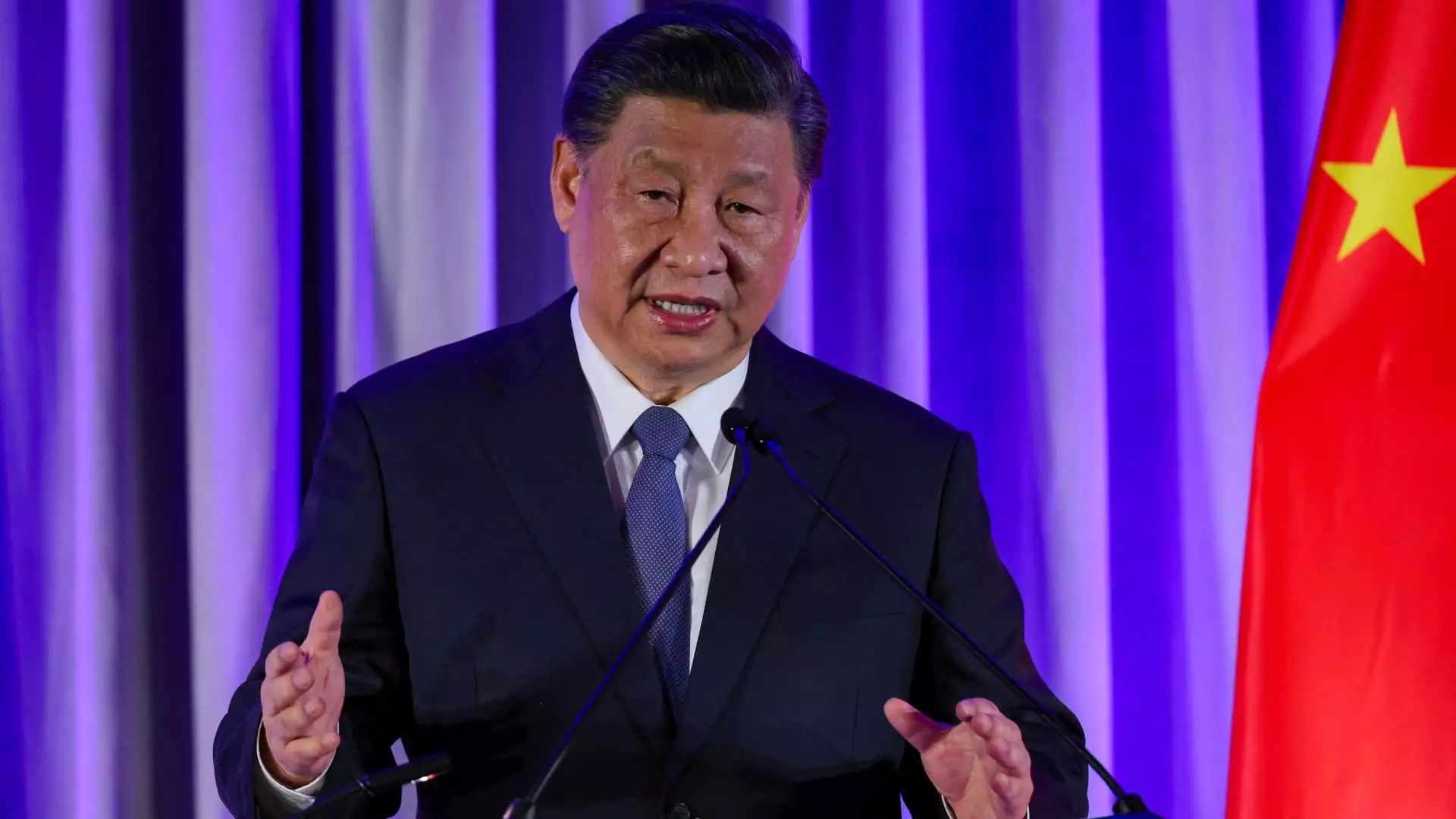

China’s leadership is undertaking a pivotal initiative to rejuvenate its beleaguered real estate sector, a crucial engine for economic growth. Following a recent high-level meeting convened by President Xi Jinping, top officials have indicated a strong commitment to reverse the ongoing decline in property markets, as shared in a state media report. The meeting underscored the necessity for the government to implement strategies aimed at halting the economic downturn, responding to public concerns, and ensuring a stable recovery in real estate.

Real estate investments have historically constituted a substantial portion of the Chinese economy, with past figures indicating that it accounted for over 25% of GDP. However, since the central government’s crackdown on excessive borrowing by real estate developers in 2020, the industry has witnessed a significant downturn, adversely impacting local governments’ revenue streams and household wealth. The present focus is on safeguarding this vital economic sector to prevent further erosion of financial stability.

A Comprehensive Approach to Economic Stability

The Politburo meeting, as reported, highlighted several key areas for consideration, including the enhancement of fiscal and monetary policies, job creation, and strategies to accommodate an aging demographic. While specifics on the timeframe and scope of potential measures were lacking, analysts have expressed cautious optimism about the proactive steps being taken.

Chief economist Zhiwei Zhang of Pinpoint Asset Management noted that the recent discussions signal a constructive move towards formulating a coherent fiscal plan, implying that while addressing economic challenges will take time, progress is being made. Following the announcement, stock markets in mainland China and Hong Kong responded positively, indicating a renewed investor confidence, particularly within property stock indices.

Current data reveals that the real estate sector is gradually stabilizing, albeit still facing significant challenges. According to Goldman Sachs, the value of new homes sold plummeted by 23.6% year over year through August, showcasing a slight improvement from the previous month’s more severe 24.3% decrease. Concurrently, average home prices displayed a modest decline of 6.8% in August, reflecting a less severe drop than the 7.6% reported in July.

Understanding the gravity of the situation, economist Yue Su from the Economist Intelligence Unit articulated that achieving bottom-out stabilization in the housing market is essential for encouraging consumer action. This perspective suggests a strategic shift in policy—far from merely inflating property prices to stimulate a wealth effect, the focus is on instilling confidence among households to make purchases and thus reinvigorate the economy.

The recent meeting outlined various initiatives intended to strengthen the real estate market, such as capping growth in housing supply, facilitating increased loan availability for priority projects, and alleviating the interest burdens on existing mortgages. The People’s Bank of China has anticipated that upcoming cuts could potentially ease the mortgage obligations by about 150 billion yuan yearly, highlighting a significant intent to bolster consumer confidence.

Despite the favorable initial reactions from the market, analysts remain cautious, emphasizing the need for broader fiscal support to genuinely stabilize and invigorate the economy. The nuanced tone from the government, shifting from aggressive recovery targets to a more balanced approach, suggests deliberation between fostering immediate growth and addressing long-term structural concerns.

Amidst grim forecasts from various financial institutions, including Goldman Sachs which downgraded growth expectations, the recent meeting reflects a shift in strategy that prioritizes stability over rapid recovery. As per the insights from economist Su, the government may now adopt a more tolerant stance for growth rates below the 5% target, indicating a realistic acknowledgment of prevailing economic conditions.

This strategic pivot has likely emerged out of necessity. The early convening of the meeting, typically scheduled for later in the year, signals a heightened awareness of the urgency to address economic trends that are faltering. As analysts anticipate more proactive initiatives in the near future, it becomes increasingly essential for China to craft a comprehensive and sustainable economic recovery roadmap that balances immediate fiscal needs with long-term transformative goals.

While the road ahead remains complex and fraught with challenges, the recent concerted efforts by the Chinese leadership represent a pivotal moment in navigating the turbulence within the real estate sector and its broader economic implications.