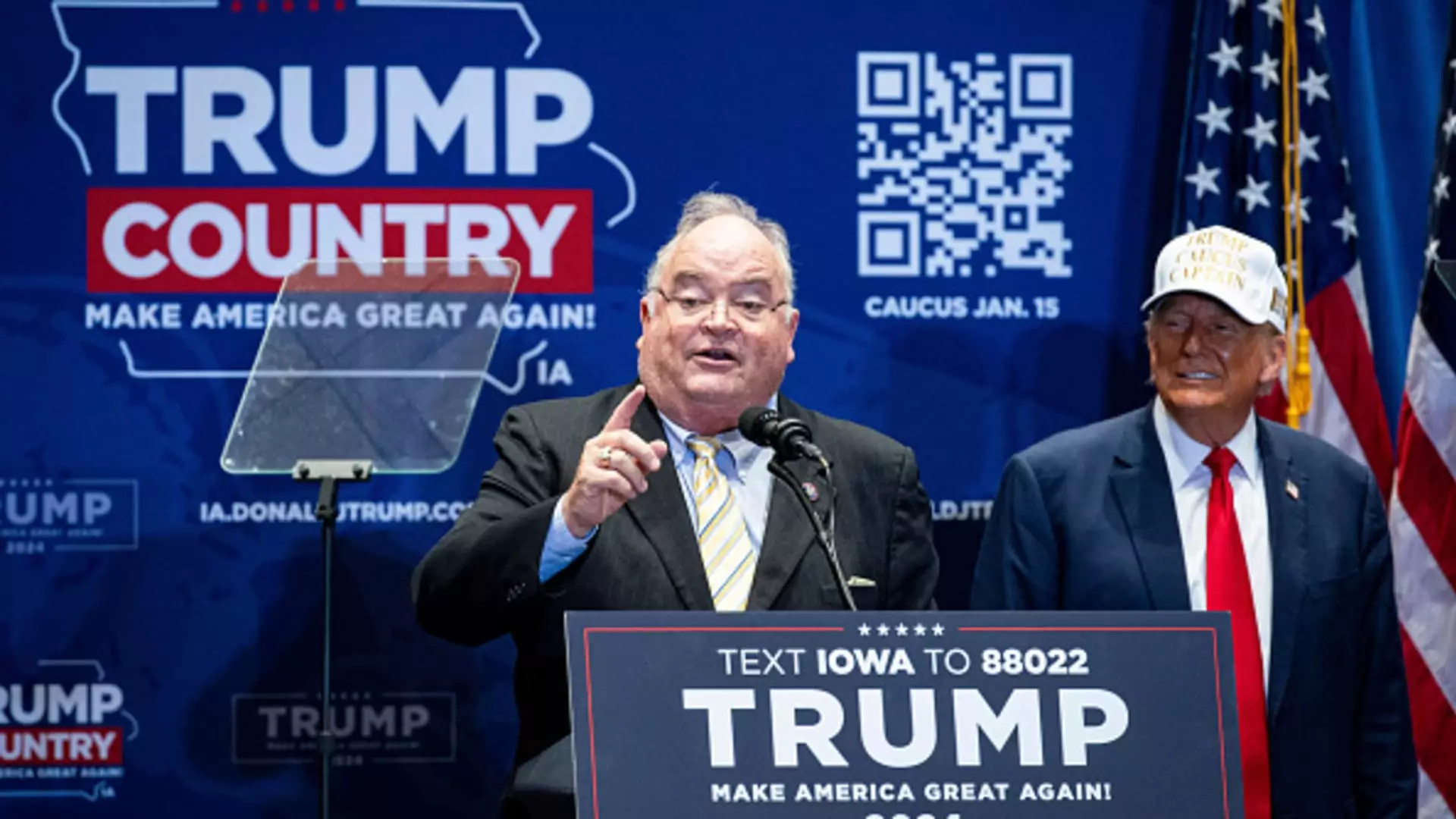

The appointment of Billy Long, a former Missouri congressman, as the prospective IRS Commissioner by President-elect Donald Trump has ignited a whirlwind of debate among policymakers and tax professionals. His nomination comes at a critical juncture as the IRS embarks on a significant overhauling process, aiming to modernize its operations considerably. With an infusion of nearly $80 billion approved by Congress for the agency’s future, the implications of Long’s potential leadership raise questions about whether such changes will continue, stall, or significantly transform under his management.

Billy Long, who served six terms in the House of Representatives, is no stranger to the complexities of governance. His previous experience as an auctioneer adds a unique backdrop to his political career, but it also raises questions about his suitability for leading the IRS—a federal agency that has faced ongoing criticism for its management and efficiency. If confirmed, Long would oversee an agency grappling with broad demands, from taxpayer services to robust enforcement of tax laws against high-profile entities. Critics argue that his lack of prior experience directly related to tax administration could hinder the agency’s ability to navigate the intricate tax landscape.

Moreover, Long’s involvement in the tax advisory field post-Congress has been a focal point of concern, particularly among Democrats who question the ethics of his activities in the employee retention tax credit space. This pandemic-era tax relief aimed to assist struggling businesses, but has since been plagued by allegations of fraudulent claims and misuse. This history brings forth valid apprehensions about Long’s commitment to honest and fair tax administration. Senate Finance Committee Chair Ron Wyden’s statement encapsulates this sentiment, suggesting that moving from the legislative branch to a significant regulatory role should warrant a higher level of scrutiny concerning conflicts of interest.

The $80 billion allocated to the IRS represents a historical investment intended to improve customer service, upgrade technology, and enhance the agency’s capacity to address tax evasion, particularly among affluent individuals and large corporations. However, Republican opposition could jeopardize this funding, as they have advocated for the revocation of resources that support aggressive tax enforcement. Long’s position may significantly influence whether such resources are protected or diminished, especially in an administration that prioritizes tax cuts and deregulation.

Supporters of Long argue that his congressional background gives him the necessary acumen to engage in discussions on Capitol Hill effectively. Mark Everson, a former IRS commissioner, noted that credibility among lawmakers would be crucial for Long to champion the agency’s independence and secure its financial future. Yet, the political landscape remains contentious, and Long’s alignment with Trump’s agenda could challenge his ability to effectively advocate for the IRS’s operational needs.

Long’s nomination is not without its challengers. Resistance from Democrats is expected not only due to Long’s controversial past but also the underlying disruptions anticipated within the IRS under their leadership. Critics are wary that Long’s influence could diminish the focus on taxpayer rights and protections and pivot towards a system more aligned with enforcement rather than compassion in fiscal management.

Further complicating the conversation is the transition from the current IRS Commissioner, Daniel Werfel, who was appointed by President Joe Biden. The politically charged atmosphere surrounding this nomination underscores the broader partisan conflicts affecting agencies like the IRS. Mark Everson’s comments reflect a tempered optimism but also a recognition that political allegiances may overshadow the agency’s technical functions.

The potential confirmation of Billy Long as IRS Commissioner brings significant uncertainty to an agency poised for transformation. While proponents underscore his legislative experience, the concerns raised about his past endeavors and the looming specter of partisan politics may complicate his transition and effectiveness. The stakes are high; with a crucial investment on the table and a pressing need for reform, the path forward for the IRS under Long’s leadership could either signal a transformative era or merely replicate the challenges of the past. Ultimately, the outcome of this nomination will greatly influence taxpayer trust and the agency’s ability to fulfill its mandate in a rapidly changing fiscal environment.