Warren Buffett, a name synonymous with investment wisdom, has once again altered his strategy regarding Apple Inc., his most significant equity investment. Following a pattern that has emerged over the past year, Buffett’s conglomerate, Berkshire Hathaway, has consistently reduced its holdings in the tech giant. As of the completion of the third quarter in September, Berkshire’s Apple share value stood at an impressive $69.9 billion. This figure reflects a notable decrease of 67.2% from the same time last year, showcasing Buffett’s decision to offload a staggering quarter of his stake, leaving roughly 300 million shares still in his portfolio.

Analyzing the Reasons Behind the Sales

The reasons behind Buffett’s continuous divestment are a topic of considerable debate among analysts and investors alike. While high valuations are often cited as a factor—hinting at a potential market correction—many believe that the decision is driven by more strategic portfolio management aims, particularly concerning the concentration of assets. Buffett’s Apple investment was once the cornerstone of his equity portfolio, even accounting for nearly 50% of its total value. Amid shifts in his investment approach, the ongoing sale raises questions about long-term confidence in the technology sector.

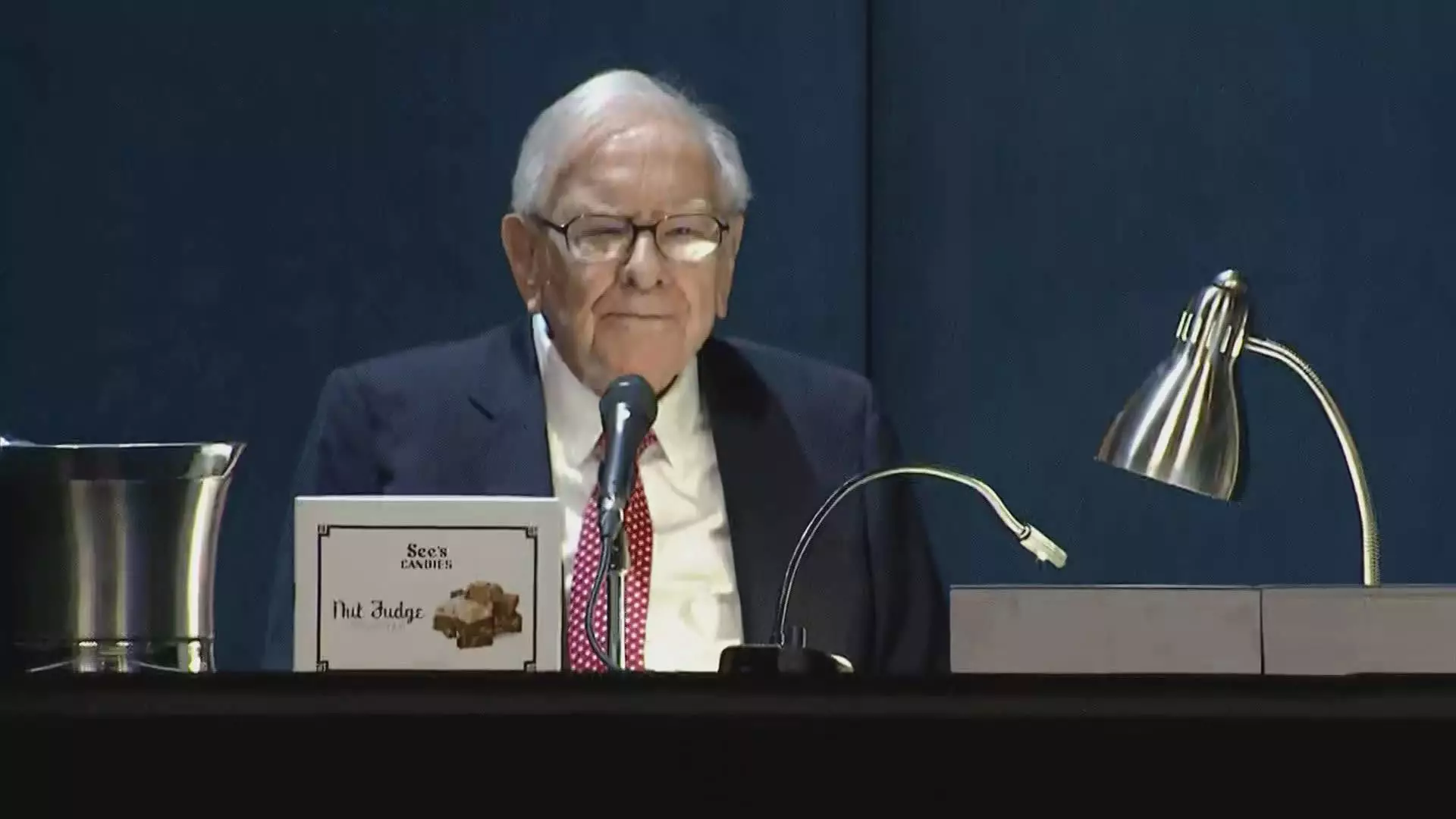

Another layer of complexity emerged during the annual Berkshire meeting in May when Buffett suggested that part of the selling could relate to tax strategies. He speculated that future tax hikes on capital gains might prompt investors to liquidate holdings sooner rather than later, particularly in light of rising fiscal deficits faced by the U.S. government. This assertion implies a multifaceted consideration behind his selling strategies that may not solely encompass market trends or valuations.

Buffett’s relationship with Apple marks a significant departure from his historical reluctance to invest in technology. Traditionally, he shied away from tech firms, claiming they fell outside his “circle of competence.” However, his foray into Apple provides a compelling narrative of change influenced by his investing partners, Ted Weschler and Todd Combs. Attracted by Apple’s unbeatable customer loyalty and innovative ecosystem, Buffett invested heavily in the company, at one stage dubbing it the second-most important business in his expansive portfolio, right after his insurance operations.

Yet, the narrative around Buffett’s investment strategy signals a potential re-evaluation of the technology sector as a whole. Buffett’s active selling could illustrate apprehension regarding excessive valuations or a tech market that may be due for a correction. Furthermore, his decisions could be interpreted as a response to shifting market dynamics as Apple’s stock, despite an annual gain of 16%, has continued to lag behind the broader S&P 500 index.

Currently, Berkshire Hathaway sits on a record cash reserve, boasting $325.2 billion at the end of the third quarter. This accumulation of cash, coupled with a cessation of buybacks, suggests a cautious stance from Buffett as he navigates a complex economic landscape. While the continued selling of Apple shares might raise eyebrows, it might also reflect a prudent approach to preserve capital and reevaluate the best opportunities for investment moving forward.

Buffett’s recent activities involving his Apple stake furnish vital insights into his investment philosophy and market perspective. By strategically scaling back his equity in what was once one of his most treasured investments, he is likely positioning himself for future opportunities, all while considering the broader implications of tax strategies and market valuations in an ever-evolving financial landscape.