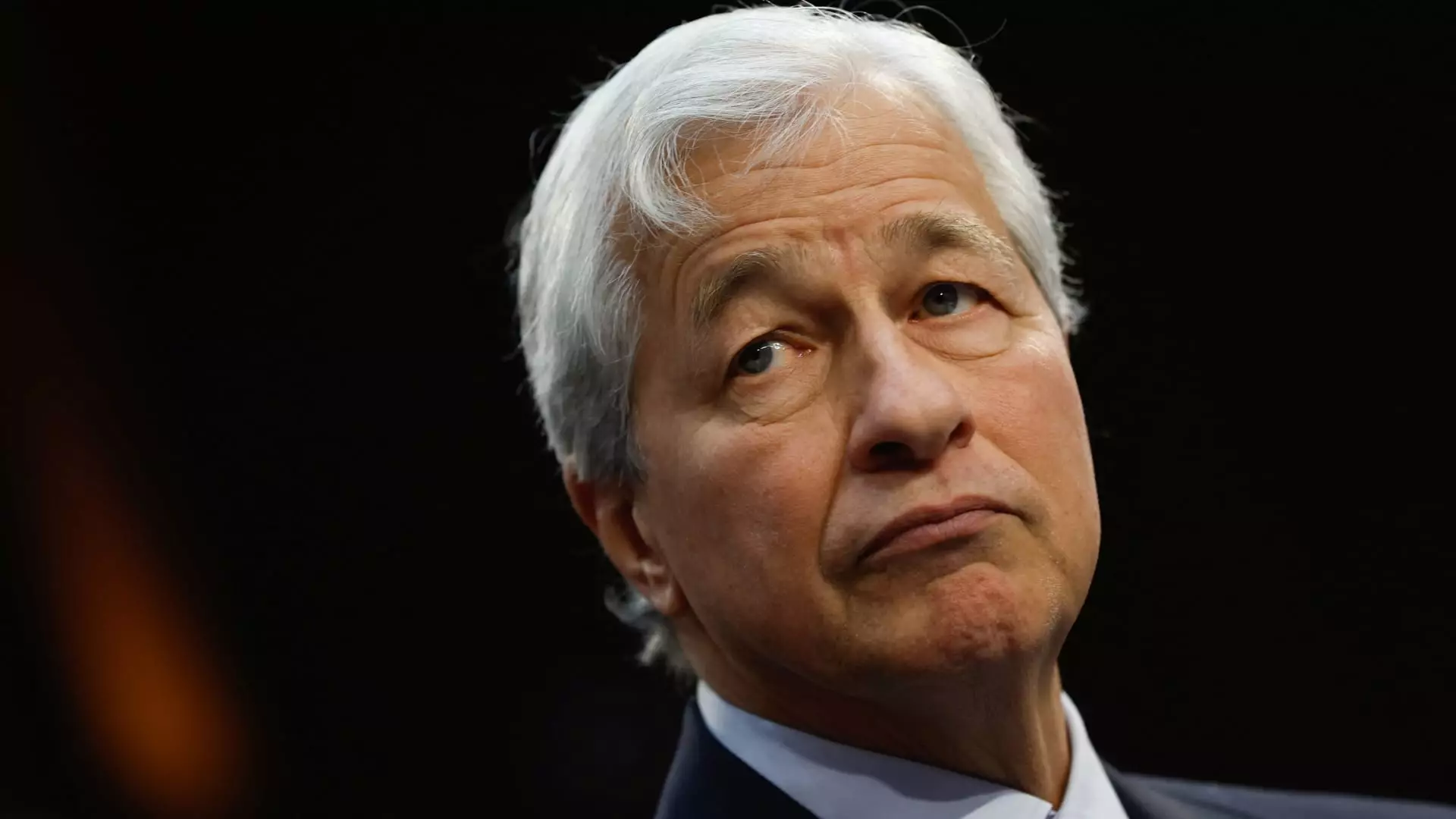

As global dynamics shift with alarming rapidity, Jamie Dimon, the CEO of JPMorgan Chase, voices a growing concern over the landscape of international affairs. His comments regarding escalating tensions—particularly in the Middle East and Eastern Europe—illuminate a pivotal moment in global geopolitics. The enduring strife between Israel and Hamas marks a catastrophic chapter that recently crossed a year since the devastating attack on October 7, 2023. The conflict has compounded complexities, leading to widespread humanitarian crises and a significant loss of life. Dimon emphasizes that these contending forces extend beyond mere territorial disputes; they pose threats that could reshape the very fabric of historical trajectories.

Dimon articulates an alarming unraveling of the international order established post-World War II. This system, which has governed relations between nations for decades, finds itself jeopardized by escalated hostilities and rising tensions between the U.S. and China. The concept of “nuclear blackmail” looms large, with countries like Iran, North Korea, and Russia demonstrating increasingly aggressive postures. These heightened risks call for a renewed commitment to robust leadership from American and Western authorities. Dimon underlines his belief that decisive action is paramount to curtail ongoing conflicts and foster stability. His concerns reflect not merely corporate interests but a deep-seated apprehension for global stability itself.

The pervasive nature of these geopolitical risks culminates in profound economic ramifications. Despite signs of resilience in the U.S. economy and a slow easing of inflation, Dimon warns of the gravity of fiscal deficits, infrastructure needs, and the remilitarization efforts that countries are undertaking. The fiscal outlook is precarious, with potential fallout influencing budgets and economic planning. This scenario suggests that even if immediate economic indicators appear stable, underlying vulnerabilities could precipitate significant challenges.

In the context of renewed military escalations, such as Iran’s missile tests against Israel, the stakes escalate. Analysts recognize Russia’s amplified defense spending as a clear signal of its commitment to the war in Ukraine, raising concerns that prolonged conflict may catalyze shifts in global alliances and trade patterns. Dimon’s perspective serves as a reminder that the interconnectedness of global economies means that domestic markets remain susceptible to international turmoil.

The commentary from Jamie Dimon presents a sobering view of a world beset by escalating tensions and the potential for conflict. His insights underscore the need for effective leadership and collaborative strategies among nations to mitigate risks. As nations grapple with the realities of geopolitical instability, it is imperative for stakeholders—both public and private—to remain vigilant and proactive. The future, influenced by these dynamic geopolitical developments, calls for strategic foresight and an unwavering commitment to peace and stability in the global arena. As events unfold, the world watches closely, aware that today’s decisions will shape the contours of tomorrow’s landscape.