In the continuously evolving landscape of the music industry, Reservoir Media has carved out a significant niche by focusing on music publishing, recorded music, and rights management, especially within the Middle Eastern market. Established in the wake of extensive privatization, the company transitioned to public status in mid-2021 through a merger with a special-purpose acquisition company (SPAC). This shift has sparked considerable interest among investors, particularly given the fundamental design of its operational model and the strategic changes proposed by activist investors. However, the company’s growth trajectory and stock performance have led to complex discussions about its future, ownership structure, and strategic direction.

Business Segments and Revenue Structure

Reservoir operates through two primary segments: Music Publishing and Recorded Music, with the former accounting for over two-thirds of its revenue. This model enables the company to generate income from three main sources: acquiring music catalogs, signing songwriters, and managing royalties. The company’s diverse catalog includes iconic artists such as Joni Mitchell and John Denver, establishing a historic and stable income stream from royalties.

Despite these strengths, Reservoir is undergoing scrutiny regarding its profitability. With year-over-year profitability metrics showing impressive growth—gross profit nearly doubling to $89.38 million—there still exists a disconnect between this performance and share price trajectory. Since going public, the company has seen a significant dip of over 20% in its stock value, pushing discussions about possible strategic revisions into the limelight. The main revenue drivers appear to stem largely from subscription streaming services, a booming sector that accounted for over half of the company’s revenue.

In recent months, activist investor Irenic Capital has emerged as a significant stakeholder, advocating for a strategic review of Reservoir Media’s operational framework. This shift in investor involvement is signaling a broader trend increasingly observed in publicly traded music companies, where the value of catalog royalties is juxtaposed with the pressures of maintaining a public-facing business model.

Irenic’s recommendations include forming a special committee to explore the viability of a potential sale, thereby prompting critical discourse about the company’s strategic intentions. Given that a significant portion of Reservoir’s assets can be likened to fixed-income vehicles, investor approaches may warrant a more conservative perspective focused on long-term stability rather than aggressive growth. However, many analysts express concern over the implications of “sell the company” activism, which could detrimentally impact long-term business strategies for short-term gains.

The financial landscape for music publishers is notably shaping the discourse around Reservoir Media. The company trades at 8-9 times its net publisher’s share (NPS), a figure significantly below its industry peers, which routinely achieve valuations in the mid-teens or higher. This discrepancy raises questions not only about Reservoir’s current worth but also about its standing in a competitive marketplace where perception and valuation are pivotal.

As streaming revenues grow—projected to rise over 11% in the coming years—the market for music royalties appears ripe for disruption. Consequently, investors may increasingly look for consolidation opportunities to maximize returns, presenting a compelling case for Reservoir to consider embarking on strategic mergers and acquisitions or ultimately explore buyout scenarios.

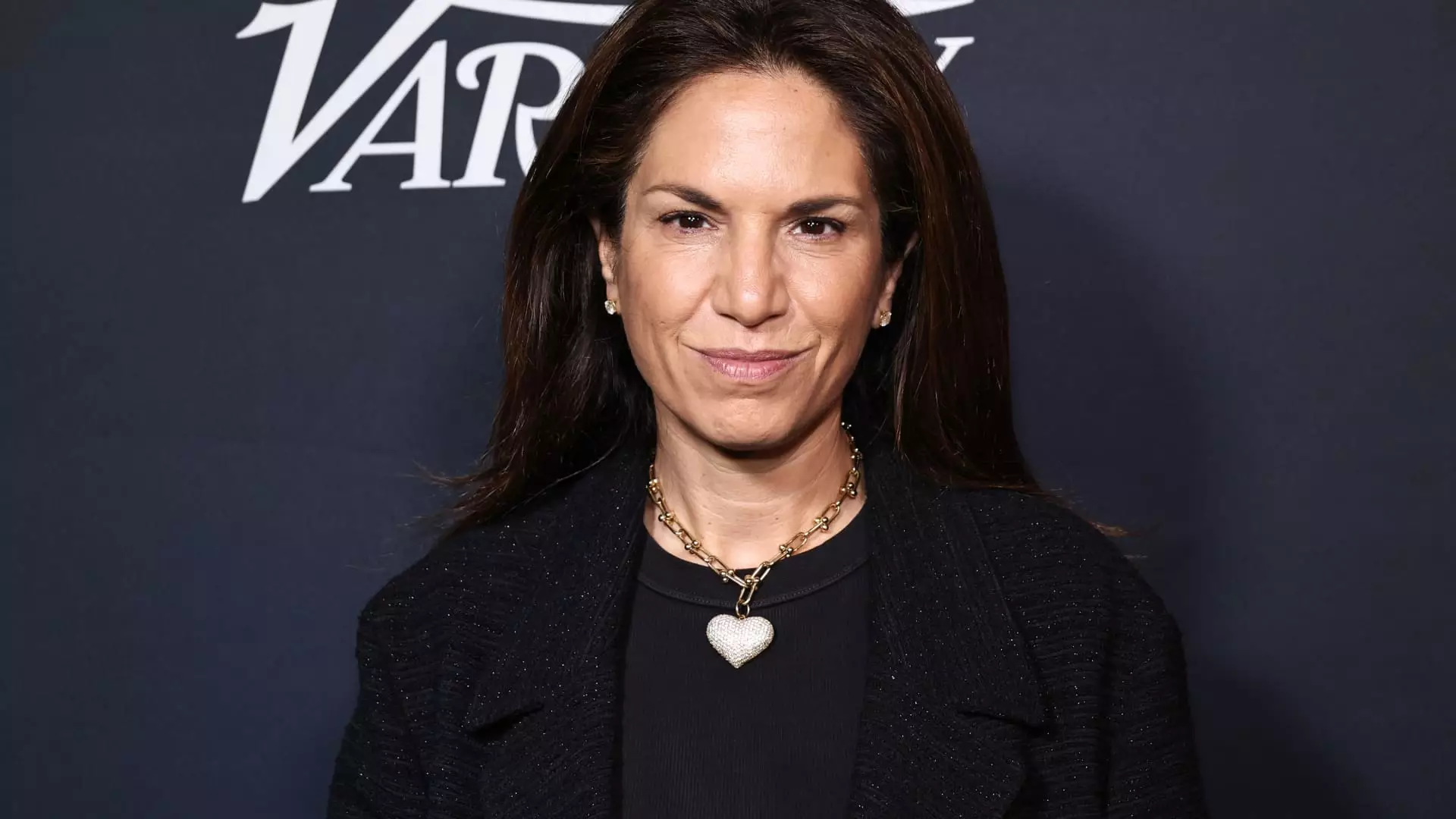

Casting a shadow over potential changes is Reservoir’s ownership framework and the influential role of the Khosrowshahi family, who control approximately 44% of shares. Leadership under CEO Golnar Khosrowshahi has been largely viewed favorably, positioning her as a central figure in any acquisition discussions. Nevertheless, her stronghold complicates external activist agendas while also solidifying confidence in internal management approaches.

Additionally, the interplay between Irenic and other stakeholders, particularly Richmond Hill Investments, suggests that any path forward will necessitate a delicate balancing act of interests among long-term investors, management, and activist entities alike. Such dynamics could lead to either constructive collaboration or conflict, with the potential to heavily shape Reservoir’s strategic direction.

Reservoir Media finds itself at a pivotal juncture. With a robust portfolio and steady revenue streams, the company is well-prepared to navigate the complexities of the modern music industry. However, the fluctuating stock performance and pressure from activist investors signify an urgent need for strategic contemplation. Whether through mergers, acquisitions, or remaining resolute in current operations will ultimately dictate the company’s trajectory. As the music landscapes shift, Reservoir’s prudent management of its assets and stakeholder relations will undeniably determine its ability to sustain growth and create long-lasting value in an ever-changing market.