Oracle Corporation witnessed a notable stock surge of approximately 6% during after-hours trading on Thursday, in response to the company’s optimistic fiscal projections announced at the Oracle CloudWorld conference in Las Vegas. The tech giant raised its revenue forecast for the fiscal year 2026 to a minimum of $66 billion, surpassing analyst expectations of $64.5 billion, as surveyed by LSEG. This ambitious estimate is a testament to Oracle’s growth strategy and increasing market position, especially in the competitive cloud computing environment.

Over the course of the past week, Oracle’s stock has shown impressive momentum, rising nearly 15% within three trading sessions. This upward trajectory positions the company for a remarkable annual performance, with shares soaring 55% year-to-date. Such growth has placed Oracle among the leading large-cap technology firms, trailing only behind Nvidia. This surge in share price is largely attributed to the positive quarterly results released earlier, which exceeded market predictions and demonstrated robust operational efficiency.

Future Growth and Strategic Partnerships

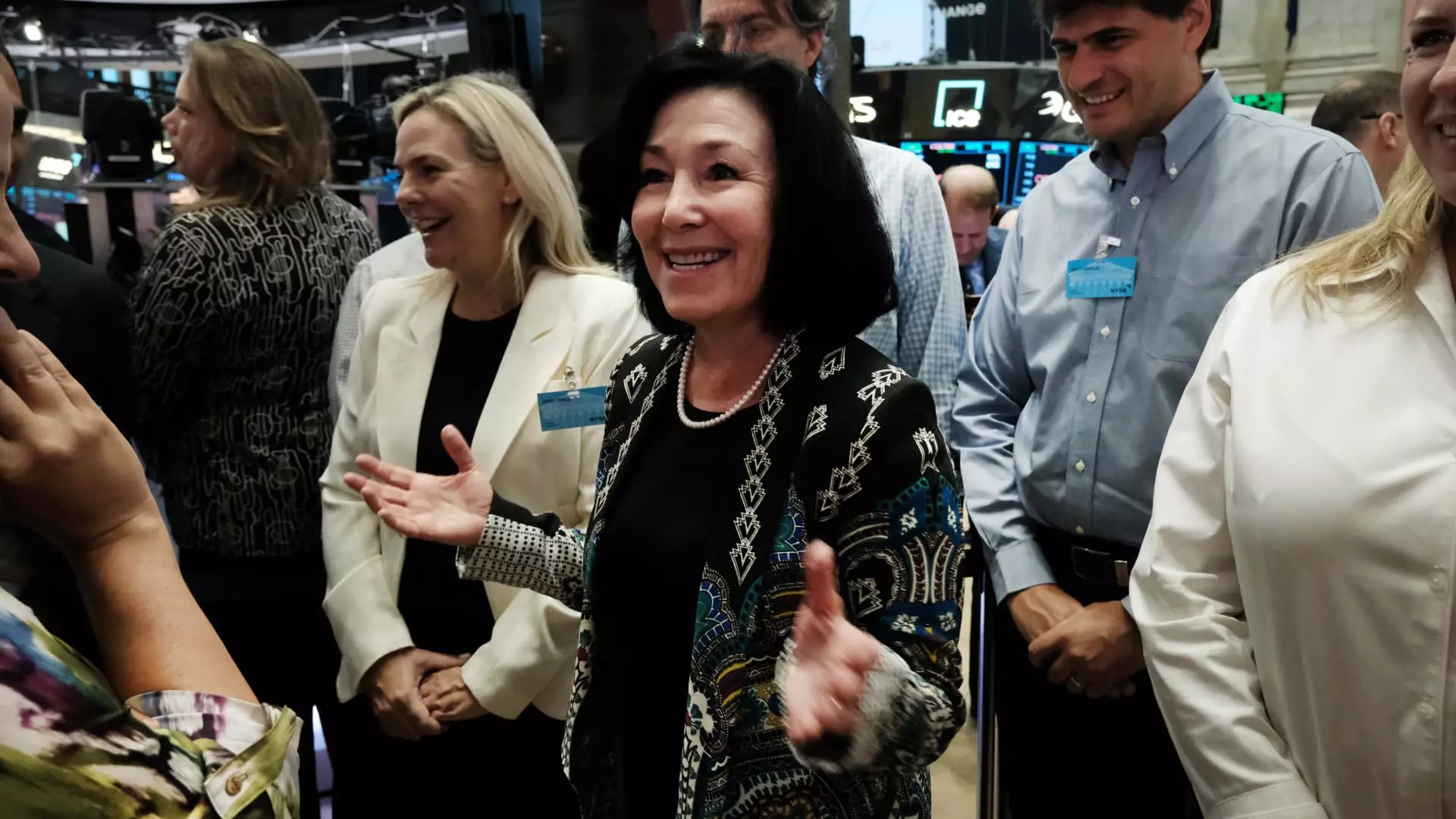

At the analyst meeting, CEO Safra Catz outlined Oracle’s longer-term vision, forecasting over $104 billion in revenue for the fiscal year 2029 and projecting a year-over-year earnings per share growth of 20%. Catz expressed confidence in these figures, highlighting strategic partnerships with major players like Amazon, Google, and Microsoft that will enable firms to leverage Oracle’s database software seamlessly through these top-tier cloud services. This collaboration is crucial in an era where businesses are increasingly migrating their operations to the cloud.

The announcement of the partnership with Amazon earlier in the week signals Oracle’s commitment to strengthening its market presence. Catz’s remarks underscore a forward-thinking approach, emphasizing that these numbers should be readily attainable given market conditions and operational strategies.

Oracle’s cloud infrastructure revenue growth—a staggering 45% in the recent quarter—outpaces competitors such as Amazon, Google, and Microsoft, indicating robust demand for its services. As companies shift workloads from traditional data centers to cloud platforms, Oracle stands to benefit significantly from this ongoing transition. Additionally, the company’s investment in artificial intelligence is increasingly relevant.

Recent announcements regarding the acquisition of a substantial number of next-generation “Blackwell” graphics processing units from Nvidia for its cloud operations further illustrate Oracle’s commitment to staying at the forefront of technology. This strategic move not only bolsters Oracle’s positioning in cloud computing but also sets the stage for advancements in AI applications, which are becoming crucial in various business sectors.

To support its ambitious revenue goals, Oracle anticipates that its capital expenditures will double during the current 2025 fiscal year. This proactive stance towards investing in infrastructure and technology reflects a strong belief in future growth trajectories. As Oracle prepares to escalate its cloud and AI initiatives, these investments are critical for sustaining competitive advantage in a rapidly evolving landscape.

Oracle’s upward revisions in revenue forecasts, aggressive capital investments, and strategic partnerships signify a phase of robust growth and opportunity within the technology sector. As the company continues to capitalize on the cloud transformation and invest in AI technologies, it is poised to leave a significant mark on the industry landscape in the coming years.