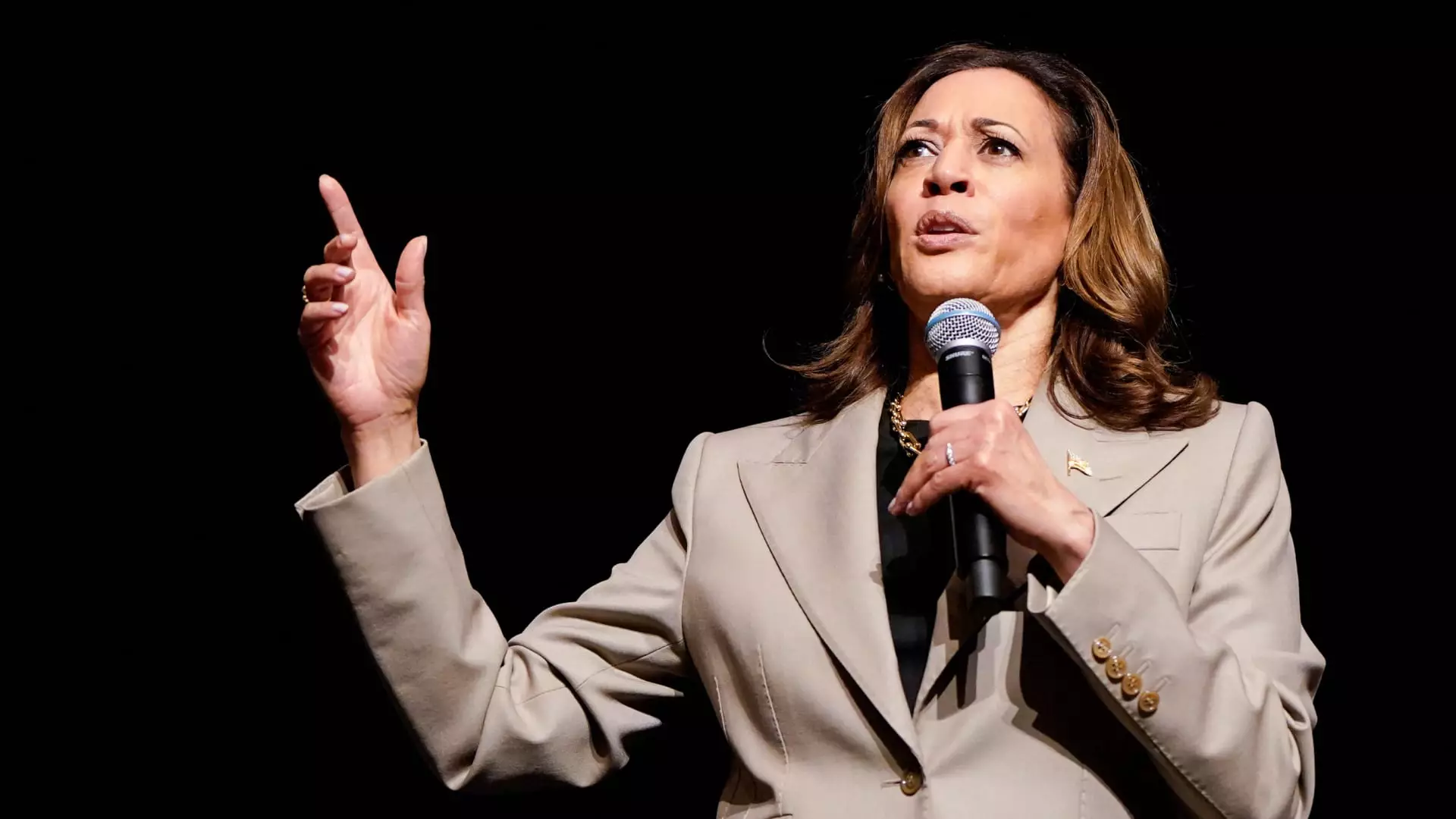

Vice President Kamala Harris recently rolled out a new economic plan that includes an expanded child tax credit worth up to $6,000 for families with newborn children. This proposal aims to build upon the higher child tax credit introduced through the American Rescue Plan in 2021, which gave families a maximum credit of up to $3,600 per child. The goal of Harris’s plan is to provide more support to middle- to lower-income families during the crucial first year of a child’s life.

Notably, Sen. JD Vance of Ohio, a prominent Republican figure, has also suggested a $5,000 child tax credit. This move has prompted speculation about potential bipartisan support for an expanded child tax credit. While Harris’s proposal aligns with President Joe Biden’s agenda, the addition of a $2,400 bonus for newborns has caught the attention of experts like Kyle Pomerleau, who sees it as a strategic response to Vance’s proposal.

The temporary increase in the maximum child tax credit under the American Rescue Plan led to a significant drop in the child poverty rate, reaching a historic low of 5.2% in 2021. This success has fueled discussions about the long-term implications of expanding the child tax credit further. However, experts like Pomerleau caution that the costs associated with such an expansion could pose challenges, especially given the existing federal budget deficit.

One of the key factors influencing the fate of the child tax credit expansion is the outcome of future elections. The design and magnitude of the credit will depend on which party controls the White House and Congress. While there is bipartisan momentum behind the idea of expanding the child tax credit, the details of any future legislation will need to address the financial implications and feasibility of such a move.

Harris’s economic plan emphasizes the importance of fiscal responsibility, calling for higher taxes on wealthy Americans and large corporations to fund initiatives like the expanded child tax credit. In the face of mounting budgetary pressures and competing priorities, the implementation of such a plan will require careful deliberation and strategic decision-making from policymakers.

Vice President Kamala Harris’s proposed child tax credit expansion has the potential to provide much-needed support to families with newborn children and contribute to reducing child poverty. However, the road ahead is filled with challenges related to costs, political dynamics, and fiscal sustainability. As the debate around the child tax credit unfolds, it will be critical for policymakers to balance the economic benefits of such a program with its long-term implications for the country’s finances.