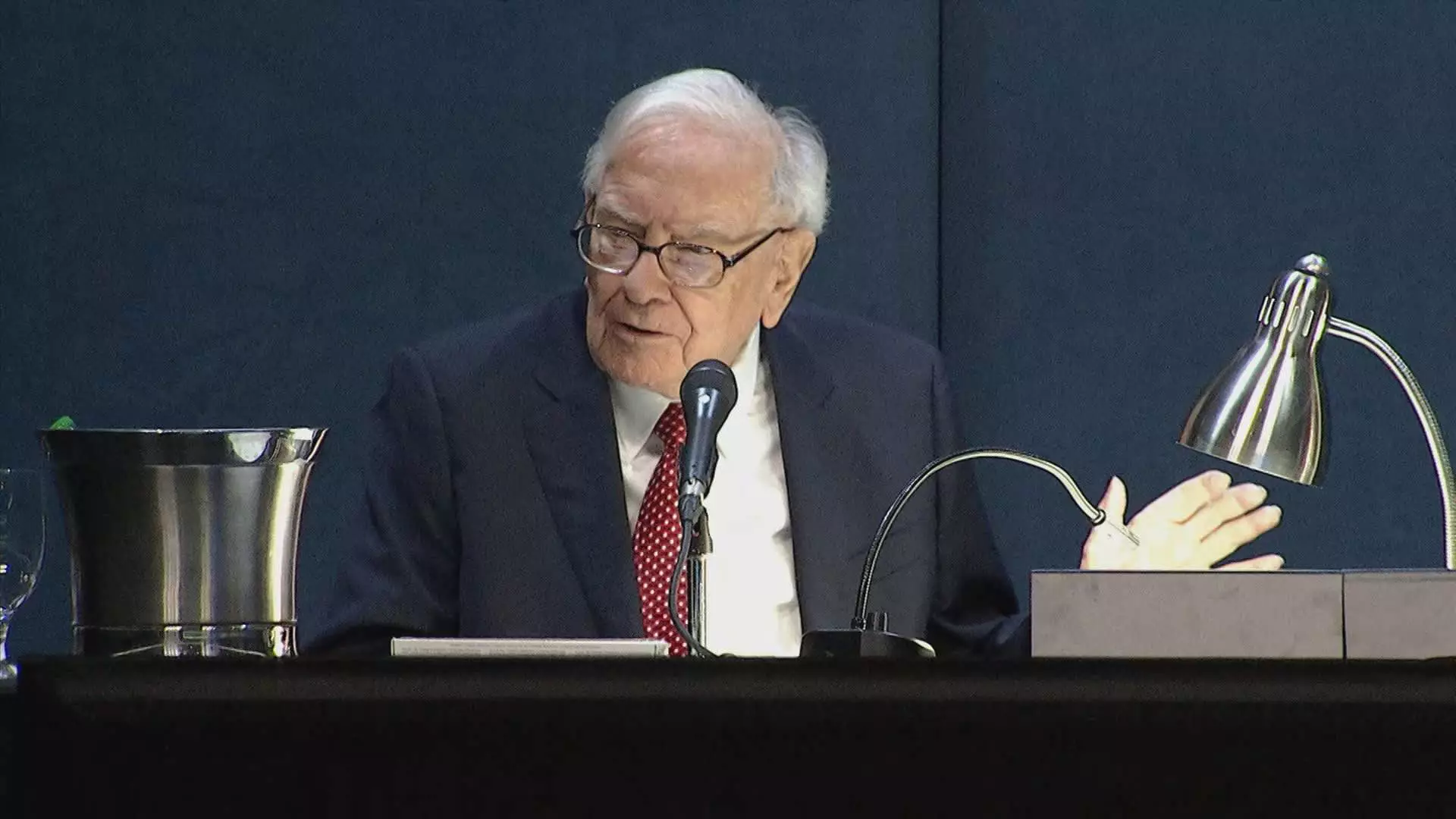

Warren Buffett, also known as the “Oracle of Omaha,” has recently caught the attention of many investors because of his equity holdings in Apple and Coca-Cola. A regulatory filing revealed that Buffett now owns the exact same number of shares in both companies – a total of 400 million shares each. This observation has sparked debates among market watchers, with some speculating whether this is a mere coincidence or a deliberate master plan on Buffett’s part.

Buffett’s relationship with Coca-Cola dates back to 1988 when he first purchased 14,172,500 shares of the company. Over the years, he has steadily increased his stake to reach 400 million shares, making it his oldest and longest stock position. Buffett’s fondness for Coca-Cola is well-documented, and he has often referred to it as a “permanent” holding in his portfolio. The round-number share count has remained constant for the past 30 years, reflecting Buffett’s long-term investment strategy.

Apple: A Consumer Products Company?

Despite being known for his value investing principles, Buffett’s investment in Apple has raised eyebrows among his followers. He views the tech giant not as a typical technology company but as a consumer products company akin to Coca-Cola. Buffett has praised Apple’s loyal customer base and even compared it to Berkshire’s cluster of insurers in terms of importance. However, Berkshire’s decision to reduce its stake in Apple by more than 49% in the second quarter came as a surprise to many. This move lowered Apple’s weighting in Berkshire’s portfolio but retained it at a round number similar to his Coca-Cola holding.

The sharp decline in Berkshire’s Apple stake led to widespread speculation about Buffett’s motives. Some attributed it to portfolio management or a broader market outlook rather than a negative assessment of Apple’s future prospects. Analysts noted that the reduction in Apple’s weighting brought it in line with Buffett’s preferred level for his long-term investments. While skeptics dismissed the identical share count as mere coincidence, Buffett’s deliberate approach to investing in companies for the long-term cannot be overlooked.

Warren Buffett’s balanced portfolio strategy blends traditional value investing with a modern approach to technology stocks. His equal holdings in Apple and Coca-Cola showcase a mix of continuity and adaptation in response to changing market dynamics. Whether intentional or accidental, the parallel between the two iconic companies in Buffett’s portfolio underscores his strategic foresight and disciplined investment philosophy. Ultimately, only time will tell how Buffett’s latest move in reshuffling his portfolio will pan out in the long run.