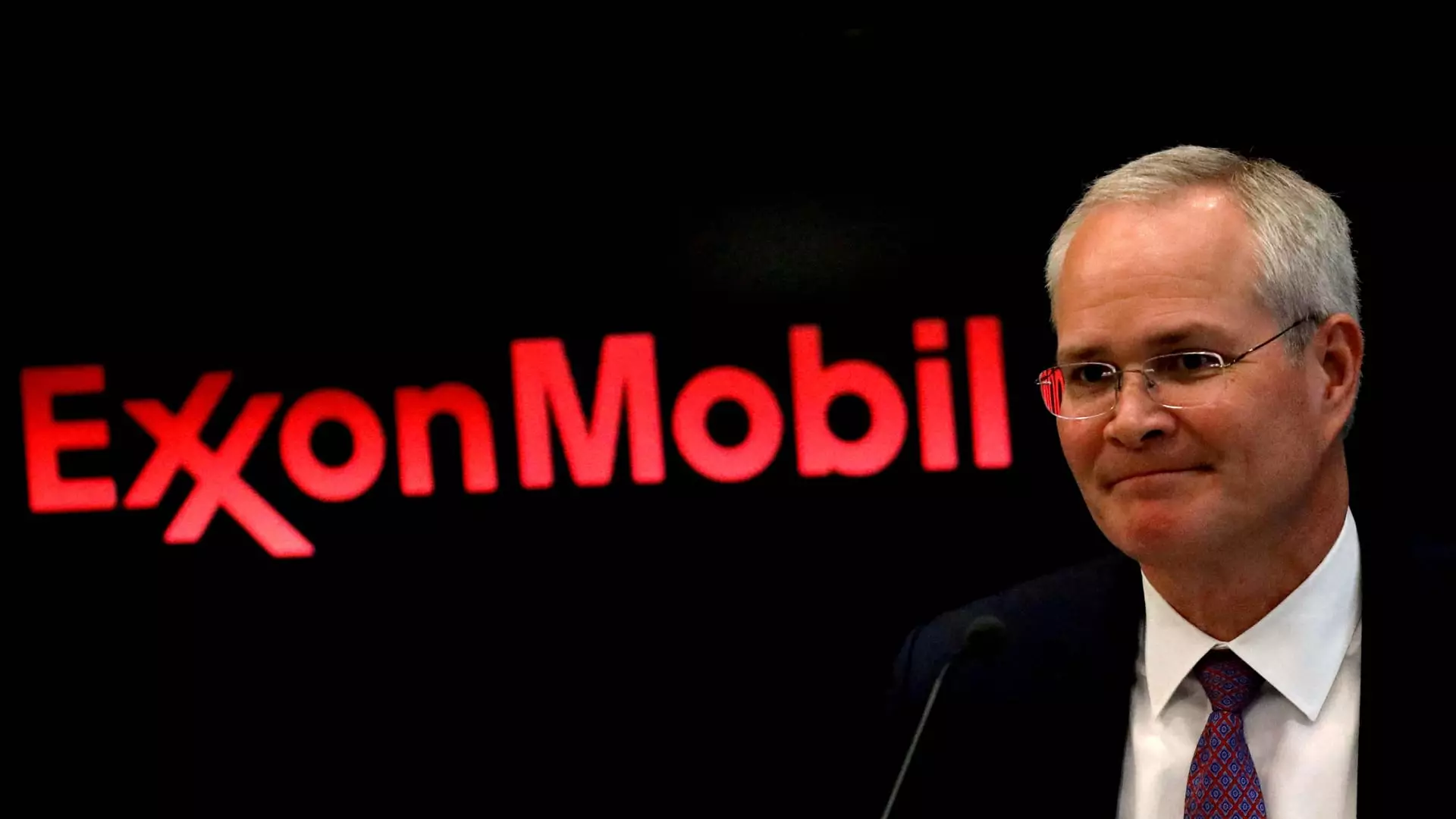

Exxon Mobil recently announced its results for the second quarter, which were the second-highest in the past decade. The company achieved record production in Guyana and the Permian Basin, contributing to its success. CEO Darren Woods stated that the oil produced in the second quarter was the highest level since the merger of Exxon and Mobil in 1999.

In terms of financial performance, Exxon reported earnings per share of $2.14, surpassing the expected $2.01. The revenue of $93.06 billion also exceeded analysts’ estimates of $90.99 billion. The company posted a net income of $9.2 billion, representing a 17% increase compared to the year-ago period. The acquisition of Pioneer Natural, which closed in May, added $500 million to Exxon’s earnings.

Despite the positive results, Exxon experienced a 9% decline in profits year to date, with earnings of $17.5 billion compared to $19.3 billion in the same period last year. This decline was attributed to lower refining margins and natural gas prices. However, production increased by 15% to 4.4 million barrels per day, driven by growth in Guyana and the Permian Basin.

Exxon’s capital and exploration expenditures totaled $7 billion in the second quarter, including costs related to the Pioneer deal. Overall spending for the year is expected to reach $28 billion. Shareholder returns amounted to $9.5 billion, with $4.3 billion allocated to dividends and $5.2 billion to share buybacks. The company’s shares have also seen an increase of nearly 17% since the beginning of 2024.

Exxon Mobil’s performance in the second quarter demonstrates its ability to achieve record production levels and exceed financial expectations. Despite facing challenges such as declining profits, the company remains committed to investing in growth opportunities and delivering returns to shareholders. As Exxon continues to navigate the evolving energy landscape, its strategic investments and operational efficiency will be key factors in driving future success.