In the last quarter, Berkshire Hathaway’s cash pile reached an all-time high of $276.9 billion, breaking the previous record of $189 billion set earlier in 2024. This increase was fueled by Warren Buffett’s decision to sell off a substantial portion of his stock holdings, including a significant chunk of Apple, one of his key investments.

Over the past seven quarters, Berkshire Hathaway has been steadily offloading its stock holdings, with Buffett selling more than $75 billion in equities in the second quarter alone. This trend continued into the third quarter, with Berkshire trimming its second-largest stake in Bank of America over 12 consecutive days. Despite these sell-offs, the conglomerate’s operating earnings saw a significant boost in the second quarter, largely due to the strong performance of auto insurer Geico.

Buffett’s Investment Strategy

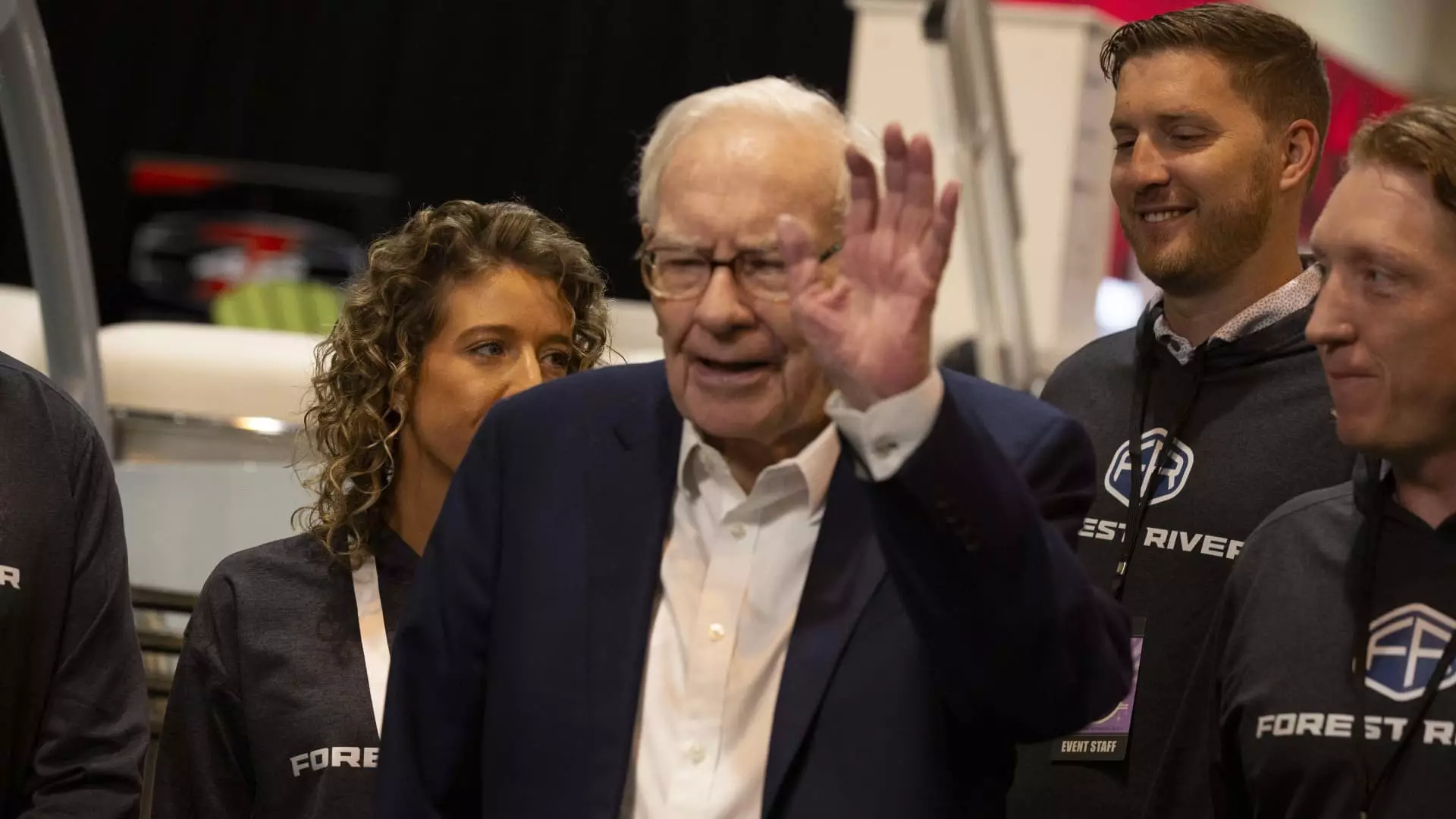

At nearly 94 years old, Warren Buffett remains cautious about deploying capital in the current market environment. While he expressed a willingness to invest, Buffett cited high prices as a deterrent, stating that he would only consider opportunities with minimal risk and high profit potential. This mentality is reflected in Berkshire’s limited stock buybacks of just $345 million in the second quarter, a sharp decline from previous quarters.

Market Uncertainties

The surge in the S&P 500 over the past two years has raised concerns about market valuations and the potential for economic downturn. Recent data, including a disappointing July jobs report, has fueled worries about a slowing economy. Additionally, investors are growing wary of inflated valuations in the technology sector, which has been a driving force behind the bull market.

Despite Berkshire Hathaway’s overall cash position, some of its subsidiaries have shown mixed performance. Geico, Buffett’s “favorite child,” reported a significant increase in underwriting earnings in the second quarter, while BNSF Railway maintained steady profits. However, Berkshire Hathaway Energy’s utility business faced earnings decline, attributed to ongoing concerns about potential wildfire liabilities.

Berkshire Hathaway’s cash pile has reached unprecedented levels, driven by strategic sell-offs and cautious investment decisions. Warren Buffett’s conservative approach to deploying capital reflects the current market uncertainties and inflated valuations. While some of Berkshire’s subsidiaries continue to perform well, challenges persist in navigating an unpredictable economic landscape. As the conglomerate adapts to changing market conditions, the future trajectory of its cash pile and investment strategy remains a topic of interest for investors and analysts alike.