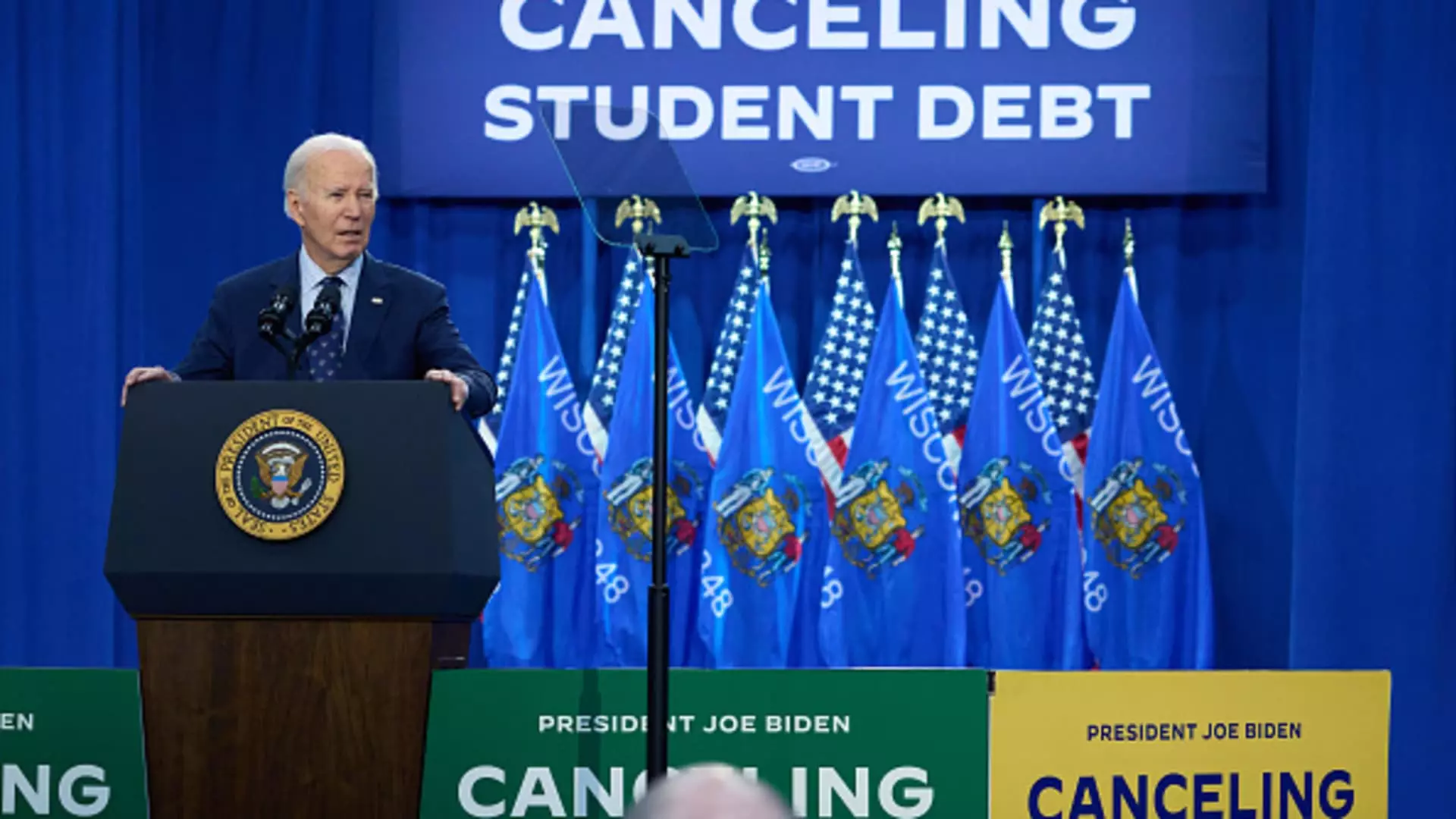

The Biden administration is once again making an attempt to forgive the student debt of millions of Americans, following a previous unsuccessful effort that was struck down by the Supreme Court. The U.S. Department of Education is set to reach out to borrowers who may qualify for this large-scale loan forgiveness in the upcoming days. The goal is to provide relief by the fall, potentially just weeks before the 2024 presidential election. This move is being hailed as another step in the administration’s commitment to addressing the failures of the current student loan system.

Borrowers who do not wish to participate in the debt forgiveness program have until August 30 to opt out with their loan servicer, according to the Department of Education. Those who are likely to be eligible for either partial or full debt cancellation are individuals who currently owe more than their initial loan amount and borrowers who have been making payments on their loans for an extended period of time.

Following the Supreme Court’s decision to block President Biden’s initial executive action for student loan forgiveness, a new approach is being taken. Rather than using executive powers, the administration is now focusing on regulatory processes through the Education Department. Experts believe that this shift should improve the chances of the debt forgiveness initiative surviving potential legal challenges in the future. The White House is determined to find a way to provide relief for borrowers burdened by student loan debt.

By taking a different strategy and actively involving borrowers in the process, the Biden administration is showing a renewed commitment to addressing the student loan crisis in the country. As the situation continues to evolve, it is crucial for borrowers to stay informed about the updates and changes in the student debt forgiveness programs. The impact of these decisions will greatly affect millions of Americans who are struggling to manage their student loan obligations. Stay tuned for further developments on this issue.