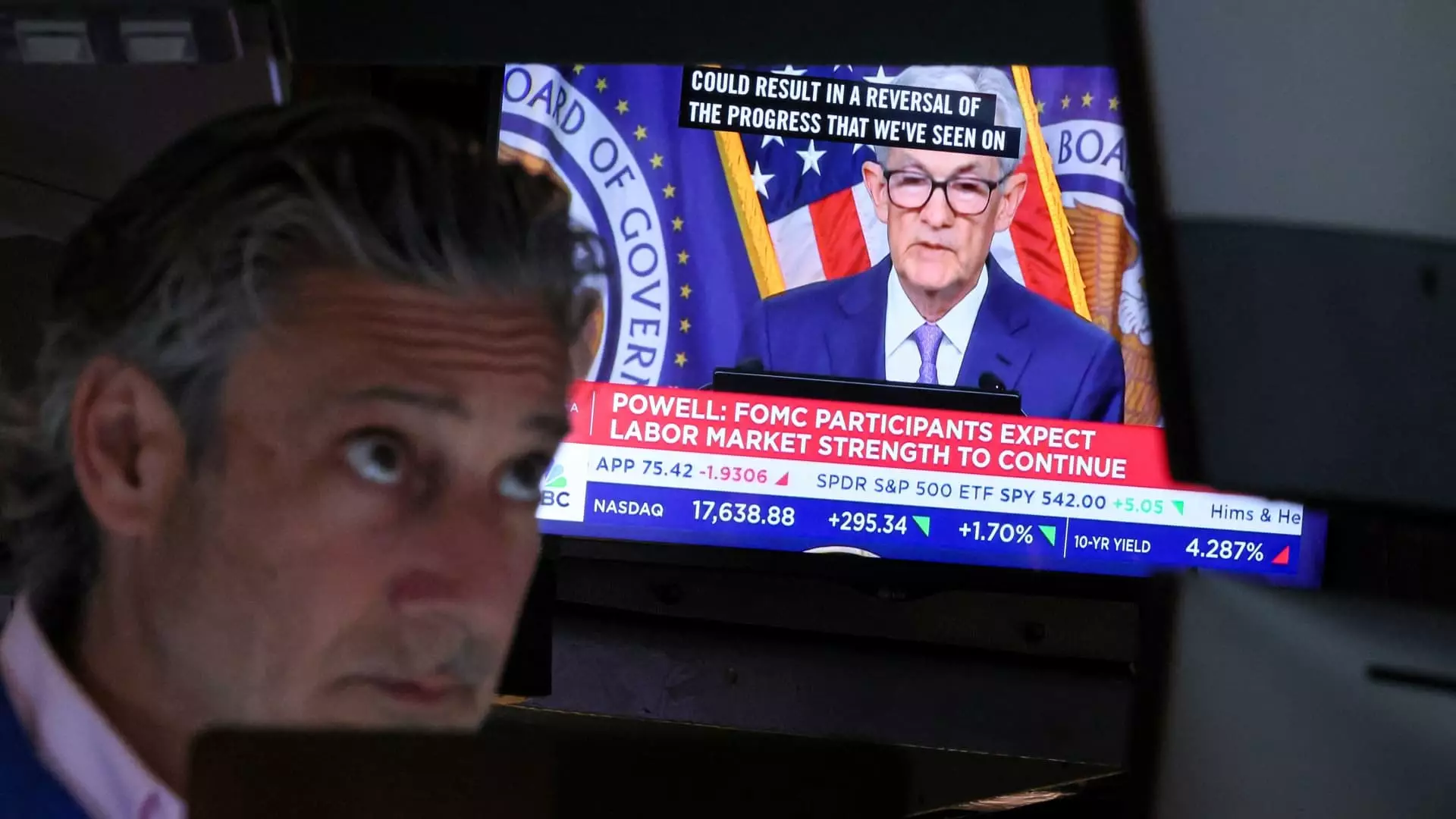

The recent optimism surrounding the Federal Reserve’s potential decision to lower interest rates has had a significant impact on the stock market. With the likelihood of a rate cut by September standing at 100%, traders have been pushing stocks to new highs, as seen with the Dow Jones Industrial Average and the S&P 500 reaching all-time highs. The Nasdaq Composite has also experienced a surge, further highlighting the bullish sentiment in the market.

Amidst the overbought market conditions, the CNBC Investing Club has taken action to capitalize on the current market trends. By offloading shares of companies like TJX Companies and making sales of Meta Platforms and Palo Alto Networks, significant gains have been realized. Additionally, the club has identified opportunities during the tech pullback and strategically initiated positions in Advanced Micro Devices, a move that aligns with the broader market theme of diversifying away from Big Tech.

One of the key trends observed in the stock market recently is the rotation towards sectors outside of Big Tech. This shift in investor sentiment has been evident in the performance of small-cap U.S. stocks, as represented by the Russell 2000, which saw a significant jump compared to the tech-heavy Nasdaq. Mega-cap stocks like Amazon, Alphabet, Meta, and Microsoft have experienced losses, while companies with heavy ties to China, such as Wynn Resorts, Starbucks, and Estee Lauder, have also struggled. This market rotation has resulted in 12 out of the portfolio’s 34 stocks being in the red.

Top-Performing Stocks and Driving Factors

Despite the overall market dynamics, certain stocks have stood out as top performers. Companies like Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover have seen notable gains in their stock prices. These gains have been attributed to various factors, ranging from improving sales for Ford Motor and anticipated interest rate cuts benefiting Stanley Black & Decker, to positive industry recommendations for Apple and Dover’s positioning in sectors poised to benefit from rate cuts.

As a subscriber to the CNBC Investing Club with Jim Cramer, members receive trade alerts before any trades are made, allowing for timely decision-making based on expert insights. Jim Cramer’s careful approach of waiting 45 minutes after sending a trade alert before executing a trade ensures that members have the opportunity to react to the information shared. Additionally, the club’s adherence to specific guidelines and terms ensures transparency and accountability in all investment decisions.

The current state of the stock market reflects a mix of optimism, caution, and strategic positioning. With evolving market trends, investor sentiment, and potential policy changes, it is crucial for investors to stay informed, adapt their strategies, and leverage expert insights to navigate the dynamic landscape of the stock market. By closely monitoring market developments and aligning investment decisions with key trends, investors can optimize their portfolios and capitalize on emerging opportunities in the market.