The financial world is no stranger to the kind of turmoil we’ve witnessed recently, particularly with the U.S.-China trade war escalating to unprecedented heights. Each weekday, market-watchers tune into CNBC’s Investing Club with Jim Cramer, where insights into the latest market movements are dished out like a buffet of stock tips. After a week filled with dizzying peaks and valleys, it’s evident that market volatility is no simple beast. The seeming agreements followed by retaliatory tariffs raise serious questions about the stability of economic forecasting and the overall sentiment in investment circles.

Just this past Friday, stocks experienced a sudden rally, effectively catching many seasoned traders off-guard and instilling a temporary sense of hope as comments from the White House suggested potential diplomatic resolutions. However, these fleeting moments of optimism are not built on a stable foundation. Hours earlier, China had escalated tariffs on U.S. goods to 125% from 84% in reaction to Trump’s aggressive duties, amplifying the volatility that has characterized every trading session for some time. The S&P 500 may have enjoyed a significant daily rebound earlier in the week, but such swift changes in direction point to a deeper instability in market confidence, fueled by uncertainty surrounding tariffs and trade relations.

Financial Reporting: A Double-Edged Sword

Earnings reports have a singular power in influencing market trends, both positively and negatively. This week, Wells Fargo and BlackRock saw their stocks fluctuate like a pendulum in response to first-quarter earnings announcements. While Wells Fargo’s results disappointed and led to an immediate drop in share prices, BlackRock’s solid performance offered a brief respite for its investors. Yet, does the market’s fluctuating half-reactions to earnings signal a larger issue—namely, that the foundations of these companies are increasingly susceptible to external pressures?

What’s particularly startling is the fact that neither the Wells Fargo nor BlackRock outcomes truly shifted the fundamental outlook for the portfolio held by the Investing Club. When have we reached a point where an underwhelming performance by a major bank hardly undermines its valuation? There’s a sense of desensitization developing among investors—a numbness towards financial disclosures that could once cause ripples across the board. Instead, traders appear to focus on broader market movements rather than individual stock stories. In a world of algorithmic trading and instant news cycles, the core principles of finance seem eclipsed.

Chipmakers Thrive Amidst Chaos

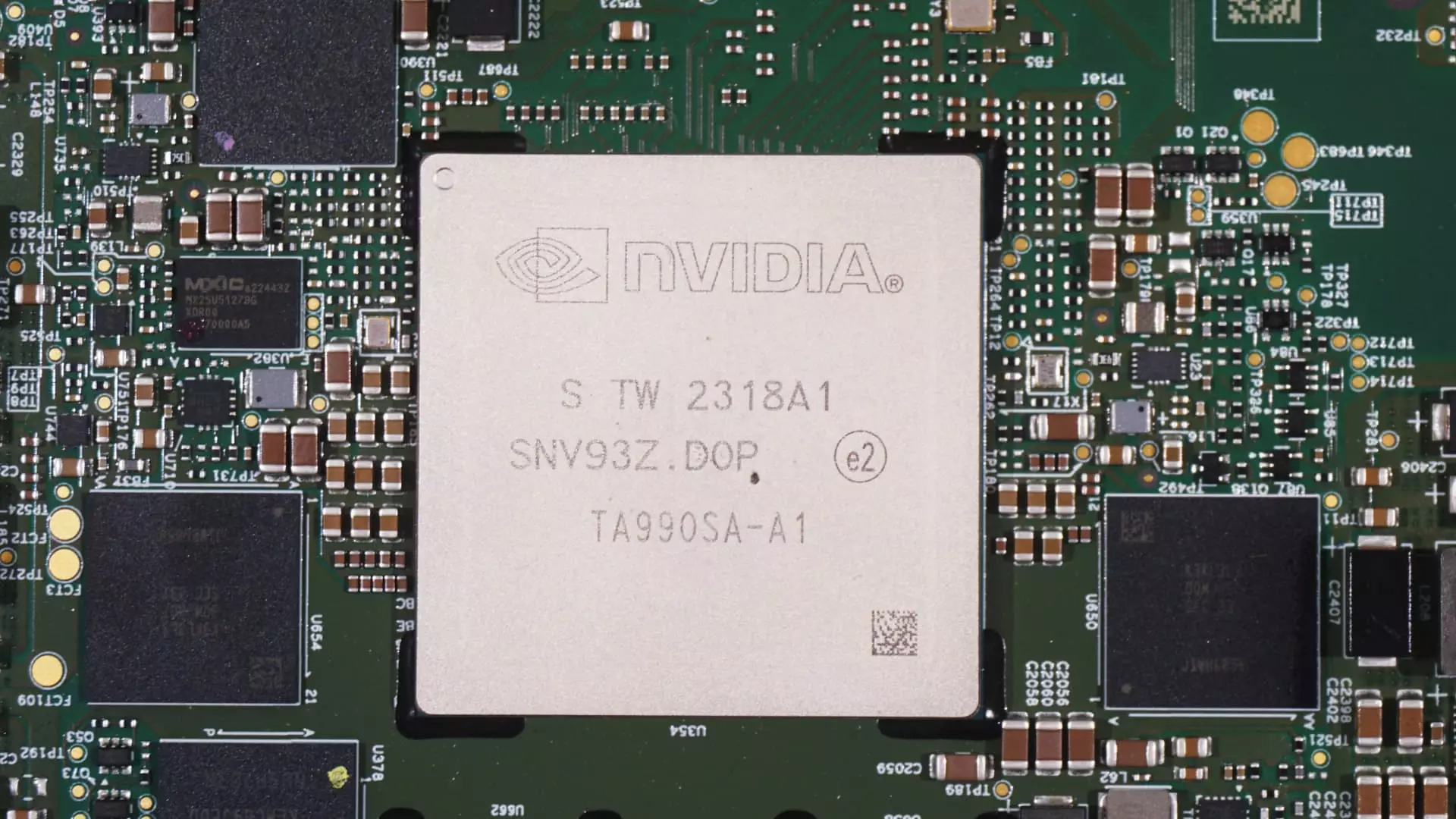

In this volatile environment, one unexpected item stands out: the outperformance of chipmakers like Broadcom and Nvidia. They are thriving amidst the chaos, witnessing stock prices soar as the likelihood of recovery looms on the horizon. Having taken severe hits during the initial sell-off instigated by Trump’s tariff announcements, their rebound raises critical questions about the resiliency of tech stocks against geopolitical currents. Broadcom’s impressive 22% increase and Nvidia’s 17% gain within the same week suggest we might need to reevaluate our understanding of risk and reward in tech investments.

It’s also worth noting the refreshing dynamic in how these companies are responding to external challenges. For instance, the narrative that China will base chip tariffs on manufacturing location rather than shipping point significantly eases market fears. Moreover, Broadcom’s bold announcement of a $10 billion stock buyback program signals a desire for stabilization amidst external volatility. Investors are increasingly looking for signals of strength, and these moves are being perceived as bullish, reinforcing a crucial tenet in investing—companies that return value to their shareholders can cultivate resilience in chaotic markets.

Looking Ahead: An Uncertain Future

Looking towards future reports, the earnings season will undoubtedly continue to shape investor sentiment. Major companies like Goldman Sachs and Abbott Labs are poised to release their financial updates, providing yet another point of intrigue as investors are keen to analyze the impact of ongoing geopolitical uncertainties on earnings. With economic data from the Bureau of Labor Statistics and the Census Bureau also scheduled for release, the plethora of information may further complicate the market mood.

As discussions around tariffs and trade constraints continue to evolve, investors must brace themselves for more sharp swings. The system feels reactive and frayed, as if one unexpected headline could shift the market significantly. This rollercoaster of erratic market behavior gives rise to concerns about naive optimism among traders—inaction or excessive caution seems like logical strategies unless the underlying trade tensions are resolved, leaving many to ponder whether any bullish trends can be trusted in such treacherous waters.

Amid these turbulent times, it’s critical for investors to remain vigilant and discerning rather than fall into herd mentality traps, which can lead to grave misjudgments—especially when the stakes are so high as they currently are.