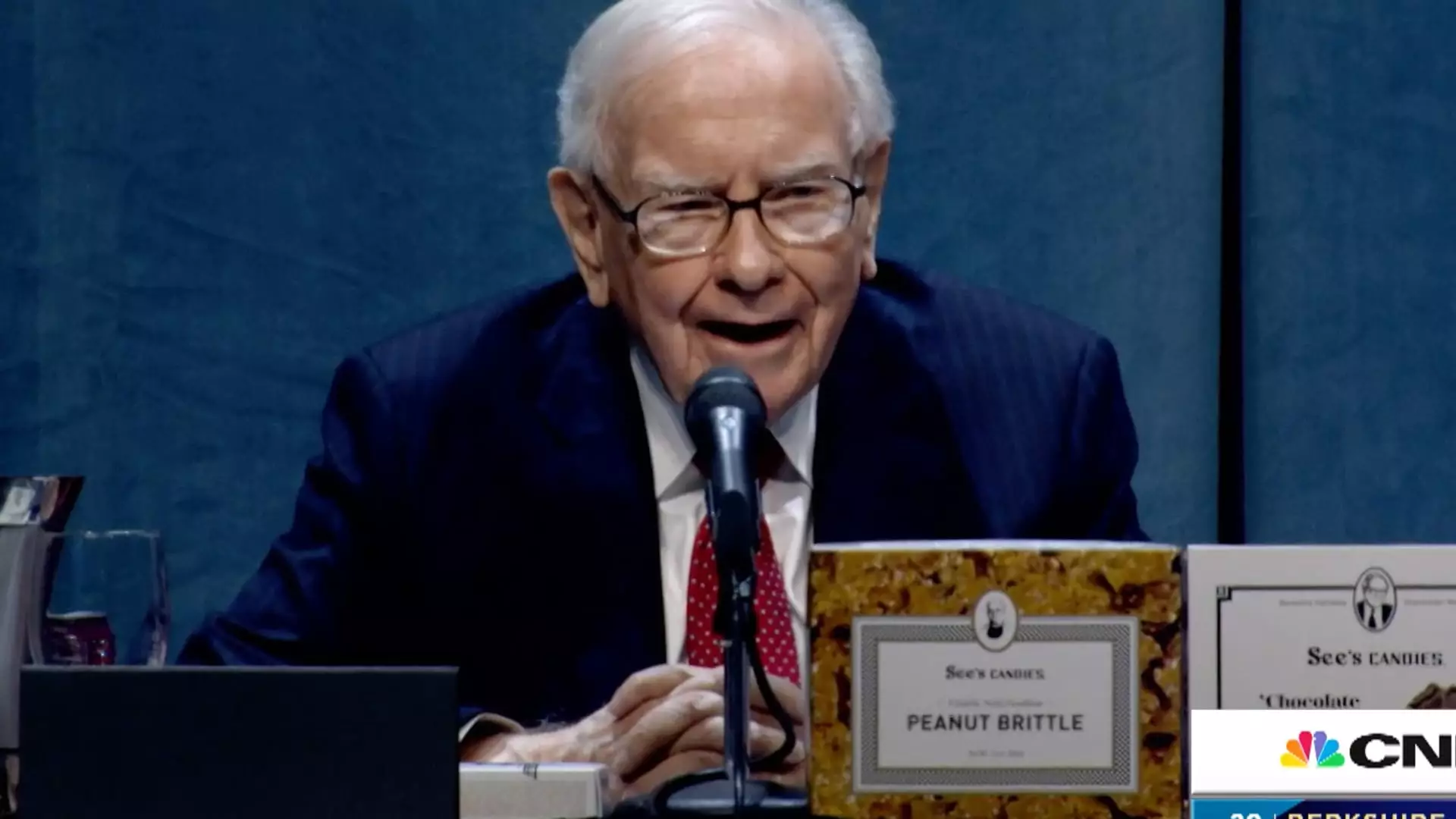

Warren Buffett, one of the most respected investors in the world, recently addressed the topic of tariffs imposed by President Donald Trump, offering a rare glimpse into his views on economic policy. During an interview with CBS News, Buffett referred to tariffs as potentially damaging actions, likening them to a form of economic warfare. His assertion that “tariffs are actually… an act of war, to some degree,” underscores the grave implications he sees in imposing such duties. This analogy emphasizes the seriousness with which Buffett regards trade barriers, suggesting they can significantly disrupt market dynamics.

Buffett’s comments highlight the burden that tariffs impose not only on businesses but ultimately on consumers. He candidly remarked that such duties act as a form of taxation on goods, stating, “The Tooth Fairy doesn’t pay ’em!” This whimsical phrasing serves to illustrate a fundamental principle: the costs associated with tariffs do not simply vanish; they must be absorbed by either the producer or, more likely, the end consumer. In a time when inflation concerns loom large, his statement carries significant weight as it suggests that higher tariffs could exacerbate price increases, placing further strain on American households.

Buffett’s comments come at a time when the global economic landscape is fraught with uncertainties. The differentiation between the effects of tariffs on domestic markets versus their global repercussions is crucial. As Trump announced a series of high tariffs on imports from Mexico, Canada, and China, the possibility of retaliatory measures from these countries became increasingly probable. The resultant trade wars could lead to further economic instability, an outcome that Buffett foresaw during past trade conflicts. His earlier warnings regarding aggressive trade strategies have proven prescient, as global markets react to disruptive policies.

However, in his recent remarks, Buffett chose to refrain from directly commenting on the current state of the economy. His reluctance to engage in speculation might indicate a cautious approach in the face of ongoing market volatility. Over the past year, Buffett has liquidated significant stock holdings and amassed a substantial cash reserve, suggesting a defensive posture that some interpret as a bearish stance on future market conditions. This strategic maneuvering raises questions: Is Buffett bracing for an economic downturn, or is he positioning his conglomerate, Berkshire Hathaway, for a smoother transition to future leadership?

The broader implications of Buffett’s insights extend to the general market sentiment. As the S&P 500 struggles to gain significant traction, up only about 1% for the year, concerns about economic slowdown and unpredictable policy changes are at the forefront of investors’ minds. Increasing volatility signals a potential shift in market dynamics, compelling investors to reconsider their strategies in light of the changing economic landscape.

Ultimately, Buffett’s reflections serve as a critical reminder of the interconnectedness of trade policies, consumer behavior, and economic health. As the situation evolves, his unique perspective as a seasoned investor will be closely watched, offering guidance not only for long-term strategies but also for immediate reactions to the tumultuous political and economic climate. In a world increasingly defined by trade rivalries and financial uncertainty, the insights of figures like Buffett become more vital than ever.