Nvidia’s recent earnings report for the fiscal fourth quarter of 2024 has generated significant interest, both from investors and the tech community. The company’s financial performance not only exceeded Wall Street’s expectations but also offered optimistic guidance for future growth driven by artificial intelligence (AI). This article will delve into the nuances of Nvidia’s earnings, its strategic positioning in the AI landscape, and the potential hurdles the company may face in maintaining its meteoric rise.

Revenue Insights: Exceeding Expectations

Nvidia recorded a revenue of $39.33 billion in the fourth quarter, surpassing estimates of $38.05 billion. This figure reflects a tremendous year-on-year increase and highlights the company’s stronghold in the GPU market, particularly within the AI sector. The earnings per share (EPS) also exceeded forecasts, coming in at 89 cents compared to an anticipated 84 cents. This performance aligns well with Nvidia’s trajectory over the past fiscal year, where total revenue climbed 114% to an impressive $130.5 billion.

The prediction for Q1 2025 revenue stands at approximately $43 billion, with Chief Financial Officer Colette Kress indicating a robust year-on-year growth figure of about 65%. However, this is a deceleration compared to the staggering 262% growth seen in the previous year, illuminating a potential shift in the company’s previously unprecedented rapid growth rate.

A significant driver of Nvidia’s recent revenue surge is its dominance in the AI chip market. With the rise of data centers utilizing advanced GPUs, Nvidia has positioned itself as a leader in providing the necessary hardware to support AI applications. The company noted a remarkable 93% year-on-year increase in data center revenue, amounting to $35.6 billion in the fourth quarter. This remarkable performance establishes data centers as a crucial pillar of Nvidia’s operations, now accounting for 91% of the company’s total sales.

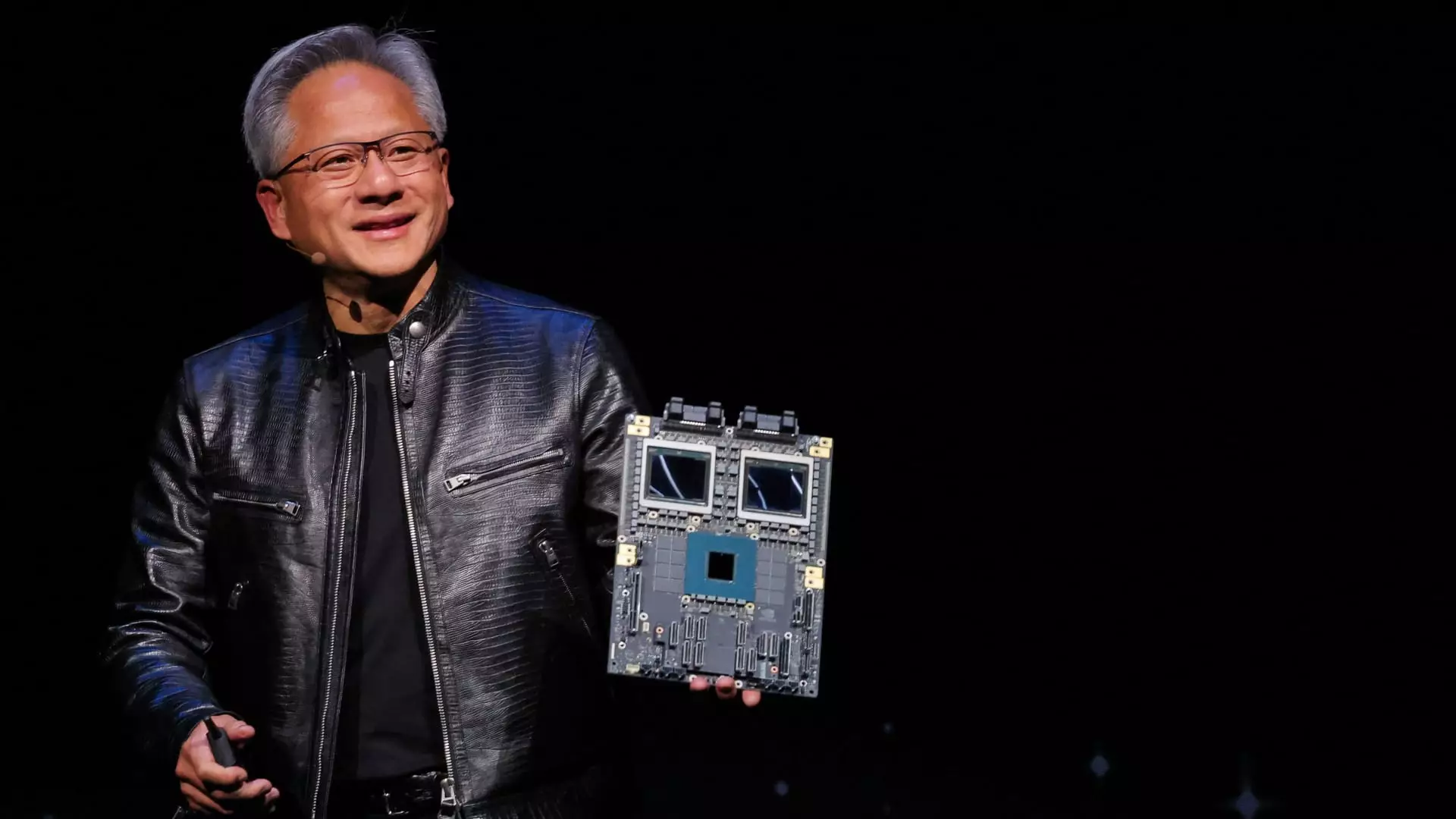

The introduction of Nvidia’s next-generation AI chip, Blackwell, has further solidified this positioning. Kress reported an “amazing” demand for Blackwell, which achieved $11 billion in revenue during its initial quarter. This product is expected to facilitate the transition from the training phase of AI development to the more resource-intensive inference phase, thus broadening the market for Nvidia’s products.

Challenges on the Horizon

Despite these impressive figures, Nvidia faces several hurdles. The potential slowdown in growth, increasingly visible in its year-on-year comparisons, raises questions about its ability to maintain its pace in an evolving tech landscape. Moreover, while the data center business remains a strong growth area, there are concerns regarding the competitive landscape. The emergence of custom chips developed by tech giants like Amazon, Microsoft, and Google poses a threat. Nvidia’s CEO Jensen Huang addressed these concerns by asserting that the design and deployment of chips are not synonymous; however, competition will inevitably pressure the company to innovate continually.

Additionally, the gaming segment, historically an essential part of Nvidia’s business, reported sales of $2.5 billion—below the projected $3.04 billion. This decline underscores the need for Nvidia to bolster its presence in sectors beyond AI and data centers, as lagging growth in gaming could affect overall profitability.

To counterbalance the challenges and capitalize on emerging opportunities, Nvidia is focusing on innovation across various product lines, including automotive and robotics. With $570 million in automotive sales, while still a minor fraction of its overall revenue, the sector saw a commendable growth of 103% year-over-year. This suggests that Nvidia is actively seeking to diversify its revenue streams and mitigate risks associated with reliance on the data center market.

Furthermore, investments in share repurchases, amounting to $33.7 billion in fiscal 2025, indicate a commitment to enhancing shareholder value even amidst fluctuating market conditions. This strategic maneuvering reflects an intent not only to bolster stock performance but also to reinforce investor confidence in the company’s long-term vision.

Nvidia’s fourth-quarter earnings reveal a complex yet hopeful narrative for the company. While it continues to excel in the AI space with robust revenue and promising product launches like Blackwell, challenges loom on the horizon, particularly as growth rates begin to stabilize. To sustain its position as a market leader, Nvidia must continue to innovate, diversify its offerings, and strategically navigate the competitive landscape. The coming quarters will be pivotal as the company seeks to balance its historical growth trajectory with the realities of a rapidly evolving industry.