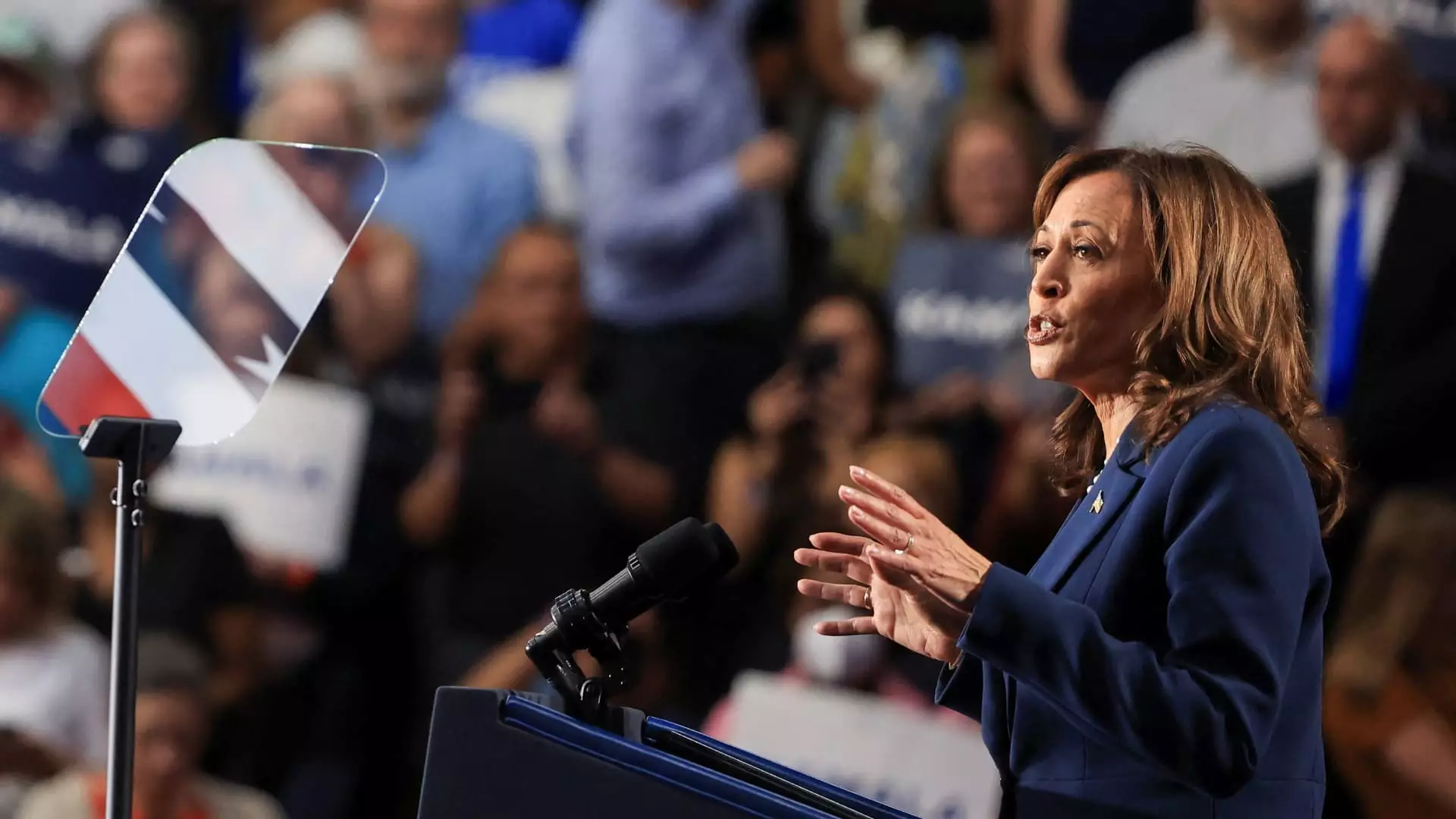

In a significant political address delivered in West Allis, Wisconsin, Vice President Kamala Harris articulated a pivotal objective of her anticipated presidential campaign: revitalizing the middle class. During her speech, she emphasized that a robust middle class is synonymous with a strong America, echoing a sentiment that has been a recurrent theme in her political career. As she steps into the forefront of the Democratic Party’s race for the presidency, Harris appears to be channeling her previous legislative efforts into a renewed vision for economic equity.

This emphasis on the middle class comes at a time of increasing economic disparity, where the incomes of many working-class citizens have stagnated or even diminished amid rising inflation. Economic experts are raising alarms over the urgent need to address the wealth gap—an issue that Harris is keenly aware of and eager to tackle.

Among her earlier legislative proposals is the LIFT (Livable Incomes for Families Today) Act, which sought to provide significant tax relief to lower and middle-income workers by offering annual tax credits up to $6,000 for couples. This initiative was designed to alleviate economic pressures and is now seen as a potentially vital tool for addressing the financial challenges faced by renters—a demographic that has been struggling amidst soaring housing costs.

Francesco D’Acunto, a finance professor, suggests that the LIFT Act could serve as a more effective relief measure compared to President Biden’s recent proposal to cap rent increases at 5%. While intended to stabilize rent prices, the cap could have unintended consequences, such as incentivizing landlords to withdraw from the rental market. Thus, the LIFT Act not only proposes a direct financial aid strategy for renters but also avoids the market distortions that rent controls might trigger.

Despite the promising nature of the LIFT Act, it is essential to note the broader economic landscape that Harris will have to navigate. The cost of living has escalated dramatically, thereby eroding the financial positions of many American families. Former White House advisor Tomas Philipson pointed out that with stagnant real incomes, dissatisfaction with the current handling of the economy has surged. Furthermore, the rise of artificial intelligence adds layers of uncertainty regarding job security, compelling a need for more robust social safety nets.

Laura Veldkamp, an economics professor, stressed the urgency of addressing these economic insecurities—particularly for those worried about losing their jobs to automation. A tax credit like LIFT might be one of the ways to offer some respite, providing a safety cushion for those whose livelihoods are threatened.

However, the road to implementing such an ambitious proposal is fraught with obstacles. The Tax Policy Center previously delineated the financial strain that would accompany the LIFT Act, estimating substantial costs. To fund this initiative, Harris suggested repealing portions of the Tax Cuts and Jobs Act that primarily benefit higher-income taxpayers. Nevertheless, in today’s climate, with unyielding concerns about the federal budget deficit, convincing legislators to back such sweeping reforms may prove challenging.

Moreover, the expiration of significant tax cuts established under the previous administration adds another layer of complexity to Harris’ plans. With Congress’s focus potentially shifting toward other urgent priorities, like the enhancement of the child tax credit, it remains uncertain whether Harris would advocate for the revival of the LIFT Act.

The child tax credit represents another avenue worth exploring. Enhanced during the pandemic as part of the American Rescue Plan, this tax relief measure succeeded in drastically reducing child poverty. As the landscape continues to evolve, addressing the needs of families with children may become a compelling focus for Harris, particularly given the positive evidence surrounding its impact on child poverty rates.

Yet, even as the child tax credit receives attention and support from lawmakers, the critical question remains—will these efforts supersede the LIFT Act in Harris’ agenda? As political realities dictate priorities, navigating the complexities of tax policy will be essential in her campaign strategy.

Vice President Kamala Harris’ call to strengthen the middle class symbolizes not merely a campaign promise but an acknowledgment of the pressing socio-economic challenges many Americans face today. While her proposals, such as the LIFT Act, highlight a visionary approach to economic empowerment, they must contend with fiscal realities and varying political priorities.

As the landscape evolves and the dynamics of the Democratic race take shape, Harris will need to grapple with these challenges while remaining committed to her original pledge to uplift the middle class. Whether through direct tax relief, support programs, or policy initiatives focused on child poverty, the success of her presidency may ultimately hinge on the feasibility and public support of these critical proposals.