In recent years, the U.S. stock market has seen a significant shift towards concentration, with just a handful of companies dominating the market. According to a recent analysis by Morgan Stanley, the top 10 stocks in the S&P 500 accounted for 27% of the index at the end of 2023, nearly double the 14% share a decade earlier. This rapid increase in concentration is the most significant since 1950, raising concerns among some experts about the risks it poses to investors. By June 24, the top 10 stocks made up 37% of the index, with the “Magnificent Seven” – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – making up about 31% of the index.

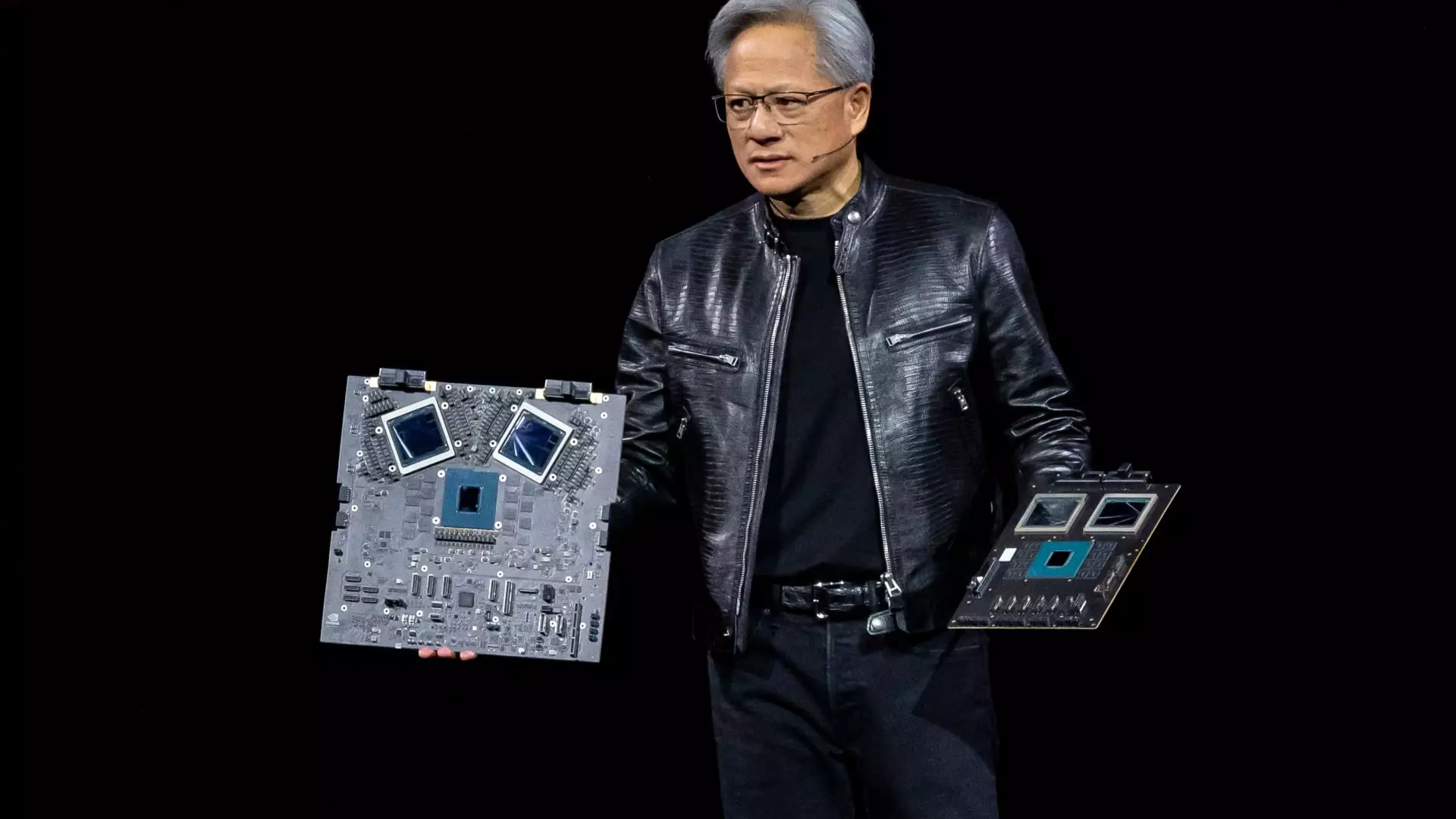

The concentration of the stock market, particularly among the largest U.S. companies, has sparked fears about the potential risks to investors’ portfolios. For example, the Magnificent Seven stocks accounted for over half of the S&P 500’s gain in 2023, indicating the significant influence these companies have on the market. A downturn in one or more of these companies could have a substantial impact on investor funds, as seen when Nvidia lost over $500 billion in market value during a recent sell-off in June. This concentration raises questions about the lack of diversification in investors’ portfolios, with some experts warning that the current market environment may be riskier than perceived.

Despite the sharp increase in stock concentration, some market experts believe that the concerns may be overblown. Historically, the level of concentration in the U.S. stock market is not unprecedented, with the top 10 stocks making up a similar percentage of the market in previous decades. Furthermore, data from a Morgan Stanley analysis shows that the U.S. market was the fourth-most-diversified among the world’s largest stock markets at the end of 2023. Additionally, experts point out that present-day market leaders have strong profits to support their valuations, unlike during the dot-com bubble of the late 1990s and early 2000s.

Diversification is key to mitigating the risks associated with stock market concentration. A well-diversified equity portfolio should include stocks of large, middle-sized, and small U.S. companies, as well as foreign companies and possibly real estate. One simple approach for the average investor is to invest in a target-date fund, which automatically adjusts asset allocation based on the investor’s age. These funds provide a diversified investment strategy that can help reduce exposure to individual stock risks and market fluctuations.

While the concentration in the U.S. stock market has raised concerns about potential risks to investors, historical data and market expert perspectives suggest that the situation may not be as dire as it appears. Diversification remains a critical strategy for investors looking to navigate the current market environment and protect their portfolios from the impact of stock concentration. By carefully assessing their investment options and considering a diversified approach, investors can better position themselves to withstand market fluctuations and achieve their financial goals.