As we step into the holiday season, it’s not just festive cheer that fills the air; it’s also a time for speculation regarding the future of media and entertainment. With a blend of optimism and skepticism, anonymous executives from some of the industry’s most powerful companies have shared their predictions for 2025. This article contextualizes these insights, contrasting them with past forecasts, and unearths the evolving landscape of entertainment.

The Legacy of Past Predictions

Looking back at the predictions made for 2024, it’s evident that the accuracy of industry forecasts can vary greatly. While there were some notable successes—like the collaboration between Max and Disney—there were also significant misses. For instance, the anticipated collaboration among major streaming platforms did not materialize, showcasing the unpredictable nature of the industry. Crucially, the previous year served as a reminder that even experienced executives can misjudge the trajectory of major corporations like Paramount Global, which faced complexities in its merger endeavors. This reflection prompts us to approach the 2025 predictions with a blend of hope and cautious optimism.

One of the most striking trends forecasted for 2025 is the separation of major companies from their traditional linear assets. For example, Warner Bros. Discovery appears set to split its linear television components from its digital assets, indicating that the urgency for businesses to adapt to changing market conditions is growing. Parallel to this, Comcast is anticipated to undergo a similar transformation, leading to the creation of two new subsidiaries. This trend illustrates a broader industry movement away from entrenched models toward more flexible structures, which may better respond to evolving consumer demands.

Furthermore, Comcast’s rumored interest in merging with other cable giants raises eyebrows. After previously abandoning such a bid, the possibility of revisiting this path in a new regulatory landscape underscores the shifting political dynamics that could shape future deals.

Another looming theme in 2025 concerns acquisitions and consolidations. Speculation surrounds Fox’s ambitions, particularly its perceived interest in reclaiming influence through significant purchases such as HBO and Turner Networks. The return of a formidable player like Fox into the arena may disrupt existing power balances, particularly if it seeks to regain prominence. This mirrors a broader theme within the industry, where legacies of past corporate giants are attempting resurgence amid increasing competition.

Moreover, the forecasted market activity involving Paramount Global and Lionsgate gives insights into how alliances could forge new pathways. The anticipated mergers and acquisitions hint at a consolidation strategy that some might view as a necessary evolution in a fragmented industry. However, this excitement must be tempered with the skepticism expressed by certain executives who believe consolidation may not remedy the fundamental shifts causing disruptions.

The Quest for Content: A New Era of Streaming Consolidation?

As streaming services continue to proliferate, the challenge of content aggregation looms larger. There’s buzz about a possible joint venture between Paramount Global, NBCUniversal, and Warner Bros. Discovery, which could result in a bundled streaming service. This relates back to previous predictions where combined offerings were deemed essential in an era dominated by cord-cutting. A shift from a solo platform model to a collaborative bundle could redefine how consumers engage with content, providing them greater value for their subscriptions.

However, if the planned Venu joint venture falters amid legal challenges, the emergence of a flagship ESPN streaming service may signal a departure from conventional collaboration strategies, dictating a new phase for how sports content is consumed. This could lead companies to innovate in their delivery methods and product offerings as they cater to an increasingly diversifying audience.

Leadership Changes and Operational Strategy Adjustments

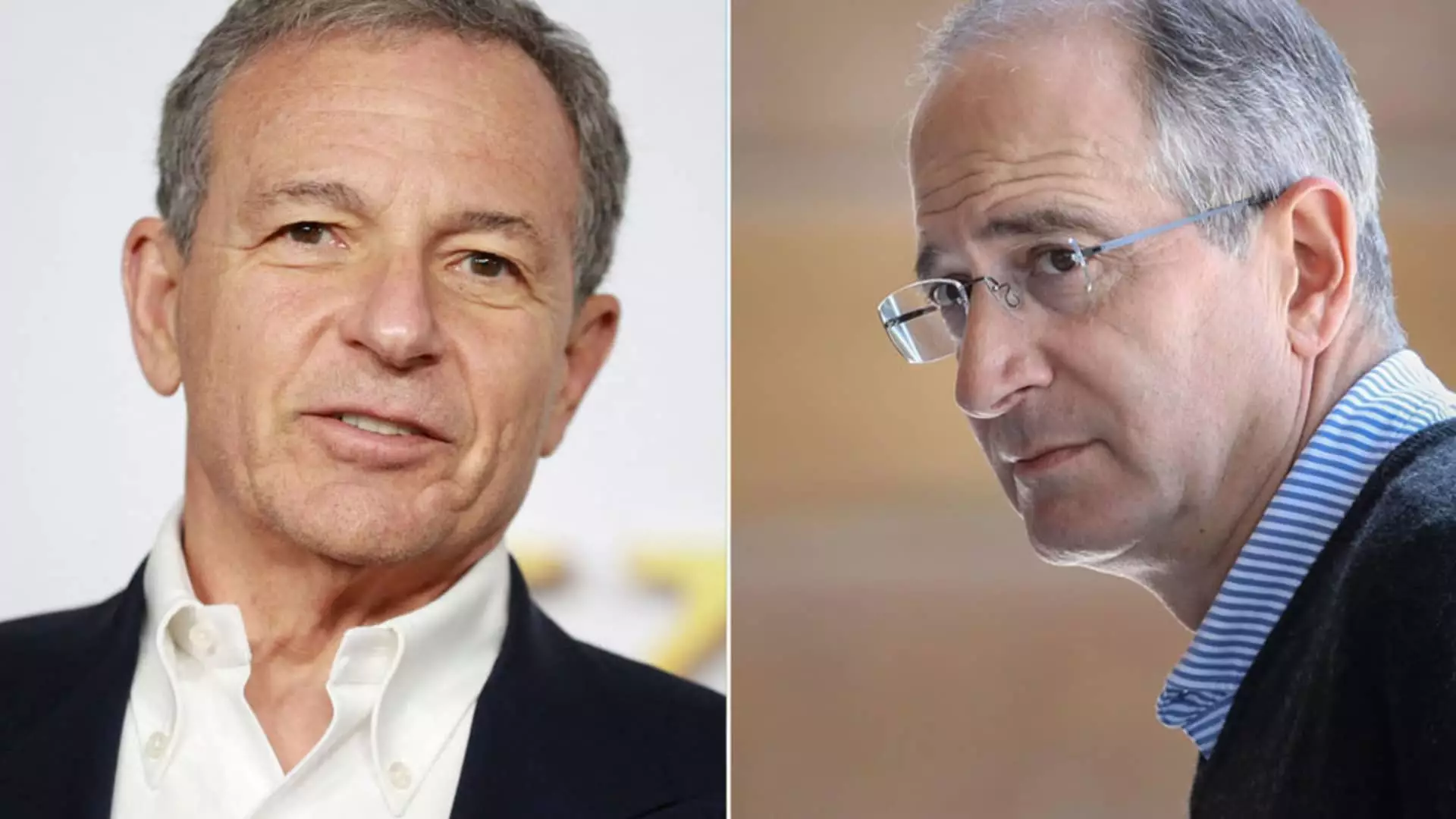

On the leadership front, the looming question regarding the future of Disney’s management continues to capture attention. With Bob Iger’s term extending only to 2026, the momentum builds regarding the potential successors to lead the company, such as Dana Walden. This transitional phase in leadership could have consequential implications for Disney’s strategic direction, particularly as it navigates the complex integration of its various channels and franchises.

Amid these uncertainties, the potential for new leadership could usher in fresh ideas, particularly in a flagship franchise like Star Wars that has seen its share of criticism and acclaim. Rejuvenating creative strategies may be the key to reinvigorating interest and engagement among fans.

The predictions for 2025 present a landscape filled with possibilities while also highlighting the numerous challenges that media and entertainment companies face. As executives speculate on mergers, acquisitions, and leadership changes, one key takeaway is the ever-evolving nature of the industry. The forecasts suggest that 2025 may very well serve as a pivotal year, one where traditional paradigms are questioned, and new opportunities could materialize. However, as history has shown, the road ahead may not be as straightforward as it appears, and navigating it will require astute strategy and adaptability. As the clock ticks down to 2025, the anticipation of what lies ahead continues to build.