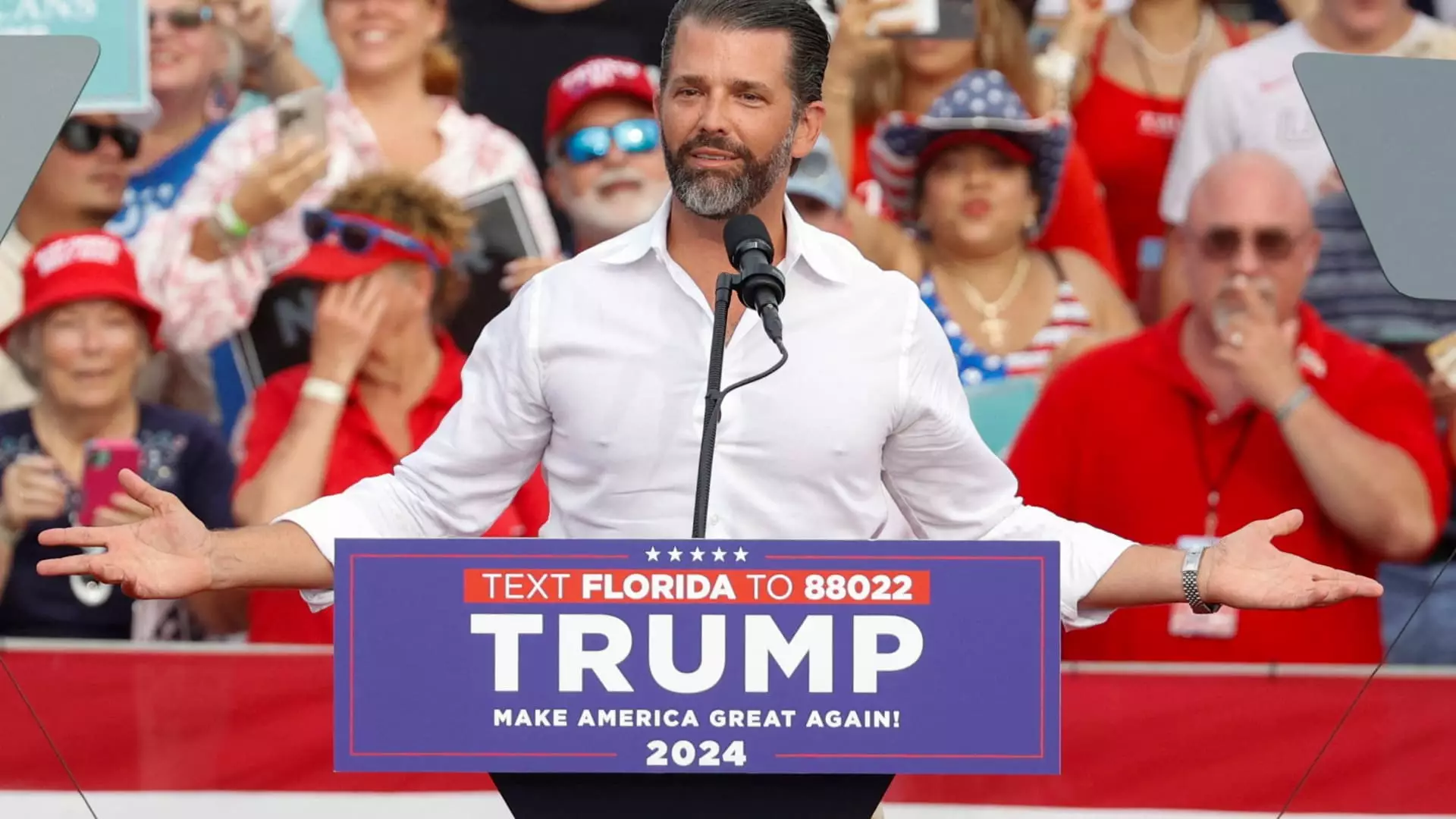

The recent announcement of Donald Trump Jr. joining the board of PSQ Holdings has stirred significant turbulence within financial markets, prompting an astounding surge in the company’s stock price. Within hours, shares of PublicSquare, a commerce and payments platform, soared by as much as 185%—a striking reflection of how investor sentiment can be swayed by high-profile associations in the business landscape. Such reactions underline the volatile nature of microcap stocks, especially when intertwined with prominent political figures who can sway public opinion and investor confidence.

PSQ Holdings, which operates PublicSquare, positions itself as a commerce and payments entity emphasizing traditional American values—life, family, and liberty. These principles not only serve as the company’s marketing mantra but also cultivate a niche among like-minded investors seeking to forge what they deem a “cancel-proof” economy. As of Monday’s closing, the company was only valued at $72 million, categorizing it firmly within the microcap stock arena. This classification inherently carries risks and opportunities, amplifying fluctuations resulting from news events—whether good or bad.

Michael Seifert, the CEO of PublicSquare, articulated the value Trump Jr. brings as a board member, highlighting his background in business and strategic experience. These remarks seem to be aimed at courting a specific investor demographic attracted by the Trump brand, which has cultivated a sense of allegiance among a significant segment of the American populace. The insights from Trump Jr. regarding the marketplace’s competitive positioning indicate aspirations to capitalize on the growing demand for services that align with conservative values. This leads to a broader question: can a company effectively exist on principles centered around a segment of political ideology without alienating broader consumer bases?

Financial Performance and Future Prospects

While the fervor surrounding Trump Jr.’s involvement may excite existing shareholders, the financial realities of PSQ Holdings remain concerning. With reported net revenues of $6.5 million contrasted against operating losses exceeding $14 million in the last quarter, it prompts skepticism on whether the current surge in stock price is sustainable or merely a short-term phenomenon created by the publicity. The company faces the challenge of converting investor enthusiasm into tangible profitability, an essential aspect for long-term success.

The stakes are elevated when considering how Trump Jr.’s move coincides with his recent appointments at other companies, such as Unusual Machines and venture capital firm 1789 Capital. Investors appear to be rushing into these opportunities driven by an affinity for his brand and the political narratives surrounding it, reinforcing the potential for speculative bubbles. Kelly Loeffler, another prominent figure associated with PSQ, emphasizes the network effect generated within these markets, suggesting that political connections can indeed influence stock valuations significantly.

While the rapid price increase following Trump Jr.’s appointment may present a moment of optimism for PSQ Holdings, the underlying financial conditions and market dynamics could temper expectations. Investors are advised to assess these developments critically, considering both the narrative and the numbers that drive genuine corporate performance.