As Nvidia prepares to unveil its fiscal third-quarter earnings, expectations are running high among investors and analysts alike. Scheduled for release Wednesday post-market, the results are projected to demonstrate substantial revenue figures, with consensus estimates from LSEG forecasting $33.16 billion in sales and an adjusted earnings per share (EPS) of 75 cents. However, while the figures themselves are undoubtedly significant, it is the guidance and outlook Nvidia provides for the upcoming quarters that will hold the real weight in terms of investor sentiment and market positioning.

The chipmaker’s performance comes at a pivotal time, as the artificial intelligence sector experiences its ongoing expansion into the third year of its boom. Investors are eager to understand if Nvidia can maintain its aggressive growth pace with expectations for fast revenue escalation continuing to rise. Analysts predict Nvidia will project earnings of 82 cents per share on revenues of $37.08 billion in the forthcoming quarter. This reflects confidence that Nvidia will not just manage to keep pace but potentially outdistance its competitors in the fast-evolving tech landscape.

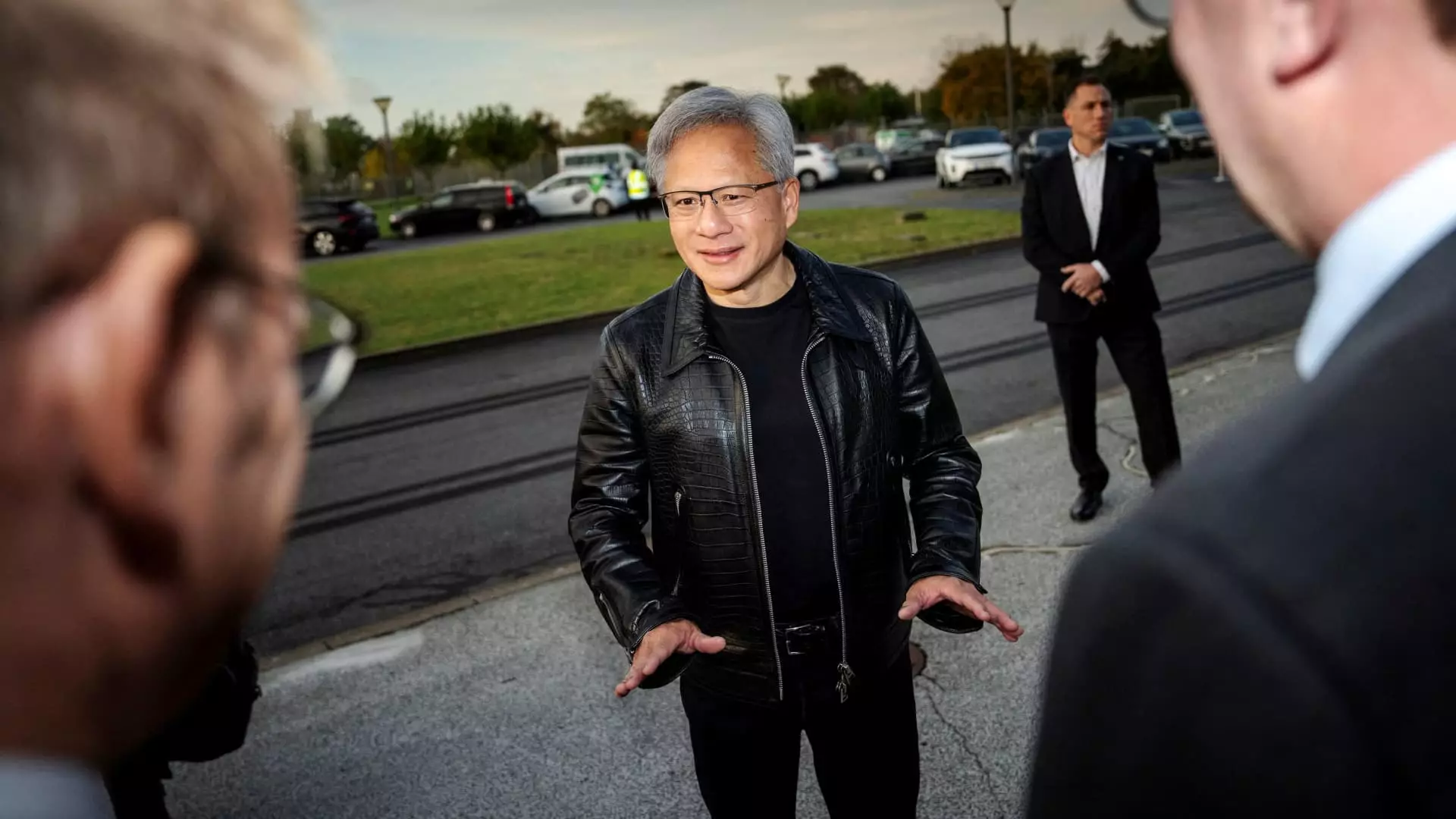

A significant portion of Nvidia’s anticipated growth hinges on its next-generation AI chip, Blackwell, which is currently being shipped to major technology players such as Microsoft, Google, and Oracle. The implications of Blackwell’s performance cannot be understated, as it is expected to be a driving force behind Nvidia’s broader ambitions in the data center market. Investors will be all ears during the conference call, particularly for any commentary from CEO Jensen Huang regarding demand for Blackwell and its reception among customers. Concerns have also been raised about potential overheating issues linked to systems running on Blackwell chips, which could impact investor confidence if not addressed adequately.

Notably, Nvidia’s stock has exhibited remarkable resilience and performance, having nearly tripled since the beginning of 2024. This surge reflects a broader optimism in the market about the company’s innovation and ability to capitalize on the artificial intelligence boom. Despite reporting a staggering 122% growth in revenue during the last quarter, this figure represents a slowing trend compared to the dramatic 262% and 265% growth recorded in earlier quarters this year. This deceleration raises questions about Nvidia’s capacity to sustain explosive growth as IT markets mature and competition intensifies.

Looking forward, the next set of earnings results will reveal critical insights into Nvidia’s strategy and market positioning during a dynamic period for the tech industry. As investors brace for the company’s announcements, the emphasis will likely be placed not merely on past performance but on future capacities, particularly concerning the continuation of its dominance in AI chip production. Nvidia’s ability to address both growth potential and technical challenges surrounding its new products will be crucial in determining its path forward in what remains a highly competitive field.