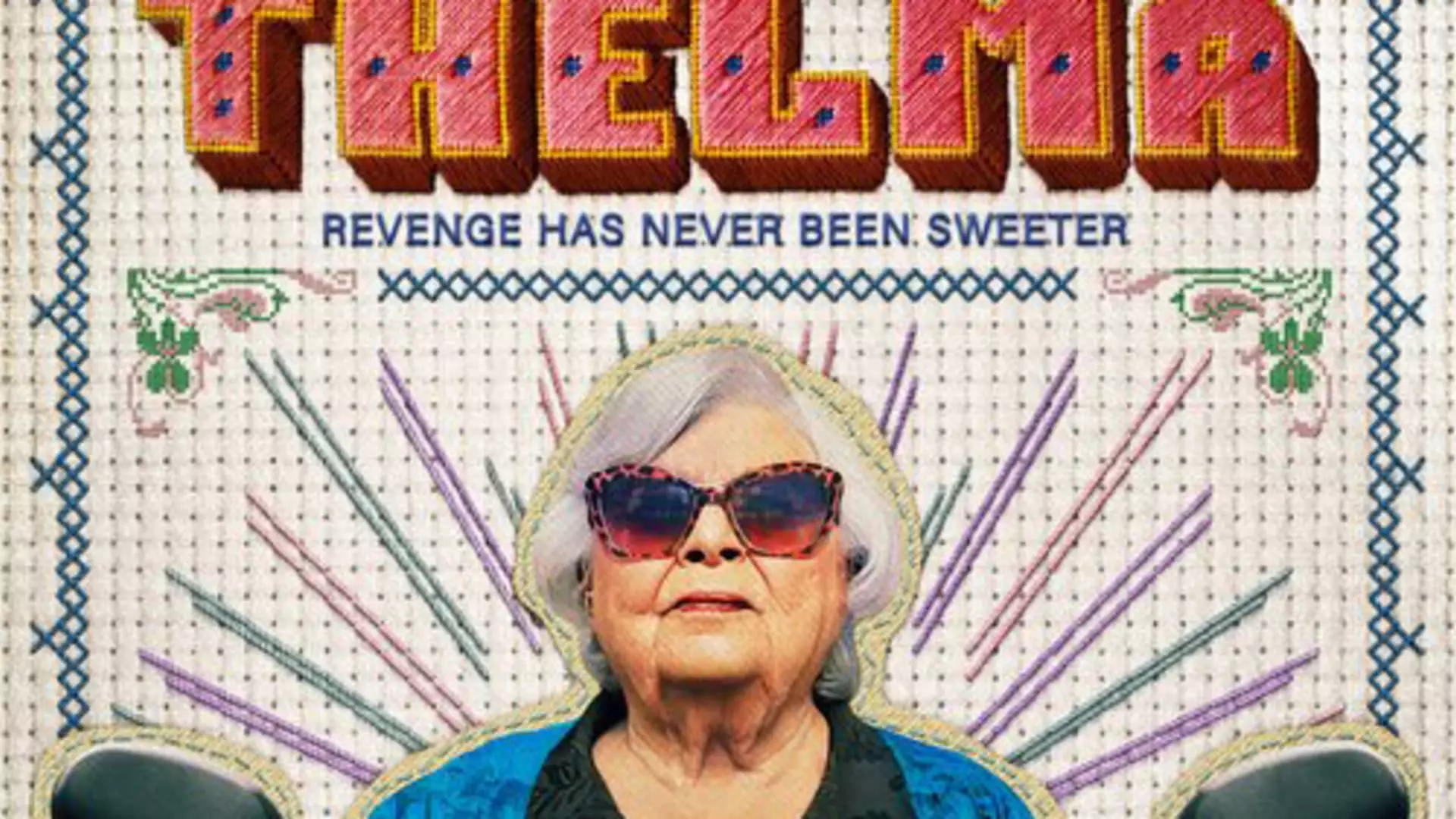

In the movie “Thelma,” a 93-year-old grandmother falls victim to a scam call from someone pretending to be her grandson in distress. While this story was dramatized for Hollywood, the threat of such scams is real and pervasive. Last year, imposter fraud resulted in losses of nearly $2.7 billion, according to the U.S. Federal Trade Commission. These scams, also known as grandparents’ scams or family emergency scams, prey on the emotions and vulnerability of their targets, often leading to significant financial losses.

Older adults like the real Thelma, who inspired the movie, are particularly vulnerable to these types of scams. As individuals age, they may experience a decline in cognitive flexibility, making it harder for them to make quick decisions and discern the legitimacy of a situation. Scammers exploit this by using fear and urgency to pressure victims into acting quickly. However, it’s not just older adults who are at risk. Younger individuals who spend more time online are also increasingly falling victim to scams, underscoring the importance of awareness and proactive measures to protect oneself and loved ones.

Advancements in technology, particularly generative AI, have made it easier for scammers to create realistic fake voices and manipulate audio snippets from social media platforms. This enables them to craft convincing distress calls that prompt victims to send money quickly. Scammers often target individuals by impersonating someone close to them, such as a family member or friend, to elicit a strong emotional response. As deep fakes become more prevalent, it’s crucial for individuals to be vigilant and skeptical of unexpected requests for financial assistance.

Establishing an aging plan in advance can help prepare for potential scams and financial exploitation. By discussing these matters with family members and appointing a financial surrogate, individuals can safeguard their assets and autonomy as they age. Basic security practices like freezing credit, enabling multifactor authentication, and purchasing identity theft insurance can also serve as effective deterrents against scammers. These measures create barriers that protect personal information and reduce the risk of falling victim to fraudulent schemes.

Raising awareness about the prevalence of imposter fraud and educating loved ones about common scam tactics can help prevent financial losses and emotional distress. Initiating conversations about the risk of scams, especially with older adults, can be challenging but essential in ensuring their safety and security. By approaching these discussions with empathy and understanding, individuals can empower their loved ones to recognize and respond to potential threats effectively.

The rise of imposter fraud poses a significant threat to individuals of all ages, emphasizing the need for proactive measures and increased vigilance. By staying informed, implementing security practices, and engaging in open dialogue with family members, individuals can protect themselves and their loved ones from falling victim to scams. Remember, being critical of the situation and taking steps to mitigate risk are essential in safeguarding against financial exploitation and preserving personal well-being.